Arizona Form A1 R

What is the Arizona Form A1 R

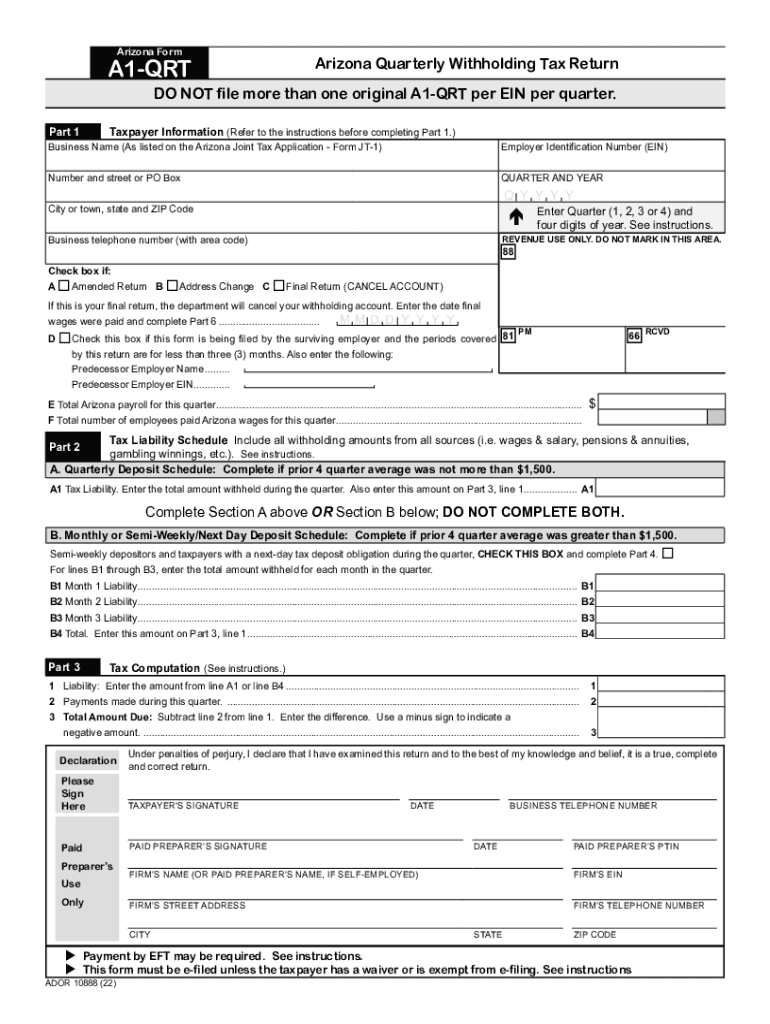

The Arizona Form A1 R is the official document used for reporting and remitting quarterly withholding taxes in the state of Arizona. This form is essential for employers who withhold state income tax from employee wages. The A1 R form allows businesses to report the amount of tax withheld during the quarter and ensures compliance with state tax regulations. Understanding the purpose of this form is crucial for maintaining accurate financial records and fulfilling legal obligations.

Steps to complete the Arizona Form A1 R

Completing the Arizona Form A1 R involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and the amount of state tax withheld.

- Fill out the form accurately, ensuring all sections are completed. Pay special attention to the calculation of taxes withheld.

- Review the form for any errors or omissions to prevent delays in processing.

- Submit the completed form by the designated filing deadline, which is typically the last day of the month following the end of the quarter.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Arizona Form A1 R. The form is due quarterly, with deadlines typically set for:

- First Quarter (January - March): Due April 30

- Second Quarter (April - June): Due July 31

- Third Quarter (July - September): Due October 31

- Fourth Quarter (October - December): Due January 31 of the following year

Missing these deadlines may result in penalties or interest charges, so timely submission is essential.

Form Submission Methods

The Arizona Form A1 R can be submitted through various methods to accommodate different preferences:

- Online: Employers can file the form electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Arizona Department of Revenue.

- In-Person: Businesses may also choose to deliver the form in person at designated tax offices.

Penalties for Non-Compliance

Failure to file the Arizona Form A1 R on time or underreporting the amount of tax withheld can lead to significant penalties. The Arizona Department of Revenue may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. It is crucial for employers to remain compliant to avoid these consequences.

Key elements of the Arizona Form A1 R

The Arizona Form A1 R includes several key elements that must be accurately reported:

- Employer Information: Including the business name, address, and EIN.

- Wages Paid: Total wages paid to employees during the quarter.

- Tax Withheld: The total amount of state income tax withheld from employee wages.

- Signature: The form must be signed by an authorized representative of the business, certifying the accuracy of the information provided.

Quick guide on how to complete arizona form a1 r

Complete Arizona Form A1 R seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely archive it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your paperwork swiftly without any holdups. Handle Arizona Form A1 R on any operating system with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and electronically sign Arizona Form A1 R with ease

- Locate Arizona Form A1 R and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure private information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced papers, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Arizona Form A1 R and guarantee clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form a1 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Arizona quarterly withholding tax return?

An Arizona quarterly withholding tax return is a tax form that employers in Arizona must submit to report the income tax withheld from their employees' wages. This form helps ensure compliance with state tax regulations and allows the state to track tax revenues. Filing these returns accurately and on time is crucial for avoiding penalties.

-

How can airSlate SignNow help with Arizona quarterly withholding tax returns?

airSlate SignNow simplifies the process of completing and submitting Arizona quarterly withholding tax returns by allowing users to eSign documents securely and efficiently. With its user-friendly interface, you can easily fill out tax forms and collaborate with team members. This reduces the chances of errors and ensures timely submissions.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as customizable templates, document sharing, and secure eSigning, which are essential for managing Arizona quarterly withholding tax returns. These tools enhance productivity and help businesses streamline their tax preparation processes. Additionally, the platform offers audit trails for better compliance tracking.

-

Is airSlate SignNow cost-effective for small businesses handling tax returns?

Yes, airSlate SignNow offers a cost-effective solution for small businesses managing Arizona quarterly withholding tax returns. With flexible pricing plans, businesses can choose an option that suits their budget without compromising on essential features. This allows small business owners to handle important paperwork efficiently while keeping costs low.

-

What integrations does airSlate SignNow support for tax processing?

airSlate SignNow supports various integrations with popular accounting software, which can be beneficial for handling Arizona quarterly withholding tax returns. These integrations facilitate seamless data transfer and help maintain accurate financial records. By connecting with your existing tools, airSlate SignNow enhances your overall tax compliance workflow.

-

How does eSigning improve the tax return filing process?

eSigning improves the tax return filing process by allowing users to sign documents electronically, eliminating the need for printing and physical signatures. This speeds up the submission of Arizona quarterly withholding tax returns and reduces the environmental impact. Additionally, eSigned documents are legally binding, ensuring compliance with state regulations.

-

What are the benefits of using airSlate SignNow for tax documents?

The benefits of using airSlate SignNow for tax documents include enhanced security, improved document tracking, and user-friendly navigation. These advantages make it easier for businesses to manage their Arizona quarterly withholding tax returns efficiently. Furthermore, the platform reduces turnaround times, allowing for quicker processing of tax forms.

Get more for Arizona Form A1 R

- T 207t rev 11 16 04 english translation of a foreign registration certificate form

- Financial responsibility form noorani medical center

- New vendor setup form 44256343

- Application for enhanced contra facility www20 hdb gov form

- Notice of intent to foreclose letter template form

- Humana health risk assessment form

- Dyskinesia identification form

- Authorization to treat a minor everett clinic form

Find out other Arizona Form A1 R

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors