DR 6596 040723 COLORADO DEPARTMENT of REVENUE Form

Understanding the Colorado DR 6596 Form

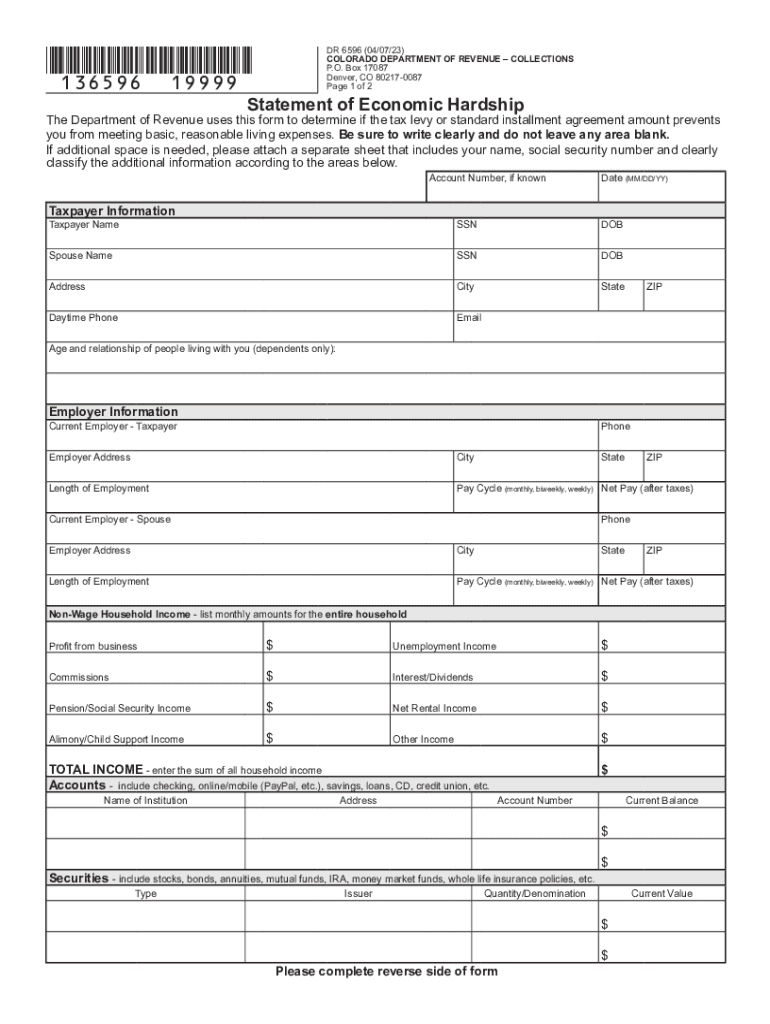

The Colorado DR 6596 form, also known as the Colorado Statement of Income and Expenses, is a document used by individuals and businesses to report their income and expenses for tax purposes. This form is particularly relevant for those who need to provide a detailed account of their financial situation to the Colorado Department of Revenue. It is essential for accurate tax reporting and compliance with state regulations.

Steps to Complete the Colorado DR 6596 Form

Completing the Colorado DR 6596 form involves several key steps:

- Gather necessary documentation: Collect all relevant financial records, including income statements, expense receipts, and any other supporting documents.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number, along with detailed income and expense figures.

- Review for accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the form: Follow the submission guidelines for your specific situation, whether online or by mail.

Legal Use of the Colorado DR 6596 Form

The Colorado DR 6596 form serves a legal purpose in tax reporting and compliance. It is used to substantiate claims made on tax returns and is often required by the Colorado Department of Revenue during audits. Accurate completion of this form is crucial to avoid potential legal issues, including penalties for misreporting income or expenses.

Key Elements of the Colorado DR 6596 Form

Understanding the key elements of the DR 6596 form is vital for effective completion:

- Personal Information: Includes fields for your name, address, and identification numbers.

- Income Reporting: Sections to detail various sources of income, such as wages, self-employment earnings, and investment income.

- Expense Reporting: Areas to itemize deductible expenses, which can significantly impact your taxable income.

- Signature Section: A place for you to sign and date the form, affirming the accuracy of the information provided.

Filing Deadlines for the Colorado DR 6596 Form

It is important to be aware of the filing deadlines associated with the Colorado DR 6596 form. Typically, the form must be submitted by the tax filing deadline, which is generally April 15 for individual taxpayers. However, extensions may be available, allowing additional time to file if necessary. Always check for any updates or changes to deadlines that may apply to your situation.

Form Submission Methods for the Colorado DR 6596

The Colorado DR 6596 form can be submitted through various methods:

- Online Submission: Many taxpayers prefer to file electronically through the Colorado Department of Revenue's online portal.

- Mail Submission: You can print the completed form and mail it to the designated address provided by the Department of Revenue.

- In-Person Submission: Some individuals may choose to deliver the form in person at local Department of Revenue offices.

Quick guide on how to complete dr 6596 040723 colorado department of revenue

Accomplish DR 6596 040723 COLORADO DEPARTMENT OF REVENUE effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals alike. It provides an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without hindrance. Manage DR 6596 040723 COLORADO DEPARTMENT OF REVENUE on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The most effective method to edit and electronically sign DR 6596 040723 COLORADO DEPARTMENT OF REVENUE with ease

- Obtain DR 6596 040723 COLORADO DEPARTMENT OF REVENUE and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign DR 6596 040723 COLORADO DEPARTMENT OF REVENUE and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 6596 040723 colorado department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mp 13 in relation to airSlate SignNow?

The term 'mp 13' refers to a specific feature set within the airSlate SignNow platform that enhances document management and electronic signing. It is designed to streamline workflows, making the signing process faster and more efficient for users. By leveraging mp 13, businesses can optimize their document handling and enhance productivity.

-

How does mp 13 improve the eSignature process?

mp 13 enhances the eSignature process by providing users with advanced automation features that reduce the time it takes to send and sign documents. This functionality ensures that signatures are collected quickly and securely, paving the way for smoother transactions. With mp 13, you also benefit from comprehensive tracking and verification capabilities.

-

What are the pricing options for airSlate SignNow featuring mp 13?

airSlate SignNow offers competitive pricing options for its services featuring mp 13, ensuring accessibility for businesses of all sizes. Pricing varies based on the features included, with flexibility for users to select plans that best fit their needs. Prospective customers can explore monthly or yearly subscription models to find the best deal.

-

What features are included with the mp 13 package?

The mp 13 package includes a range of features, such as customizable templates, advanced analytics, document merging, and multi-party signing. These tools are designed to enhance the user experience and streamline the entire document signing process. With mp 13, users can take full advantage of the robust capabilities that airSlate SignNow offers.

-

How can mp 13 benefit my business?

By implementing mp 13, your business can achieve greater efficiency and signNow time savings in document management. This feature set promotes smoother workflows and improved collaboration across teams, leading to faster decision-making processes. Ultimately, mp 13 helps companies reduce operational costs associated with traditional document handling.

-

Does mp 13 integrate with other applications?

Yes, mp 13 is designed to easily integrate with various applications that businesses already use, such as Google Drive, Salesforce, and Microsoft Office. This ensures that you can continue working in your preferred environments while leveraging the benefits of airSlate SignNow's powerful features. Seamless integration enhances the overall productivity of your team.

-

Is training available for users of mp 13?

airSlate SignNow provides comprehensive training resources for users of the mp 13 features, including tutorials, webinars, and customer support. These resources help users quickly adopt the platform and maximize its potential. Additionally, the user-friendly interface makes it easy for even non-technical users to navigate and become proficient.

Get more for DR 6596 040723 COLORADO DEPARTMENT OF REVENUE

- Kbc sfs form

- Hse retirement form

- Asb superannuation master trust withdrawal request form

- Rnzna brochure royal new zealand naval association inc rnzna org form

- Jim aitken rental application p1 form

- Entry report form fill online printable fillable blank

- Notice to landlord of rented premises residential form

- State of california health and welfare agency department form

Find out other DR 6596 040723 COLORADO DEPARTMENT OF REVENUE

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online