DR 0112EP Corporate Estimated Income Tax If You Are Using a Screen Reader or Other Assistive Technology, Please Note that Colora Form

Understanding the DR 0112EP Corporate Estimated Income Tax

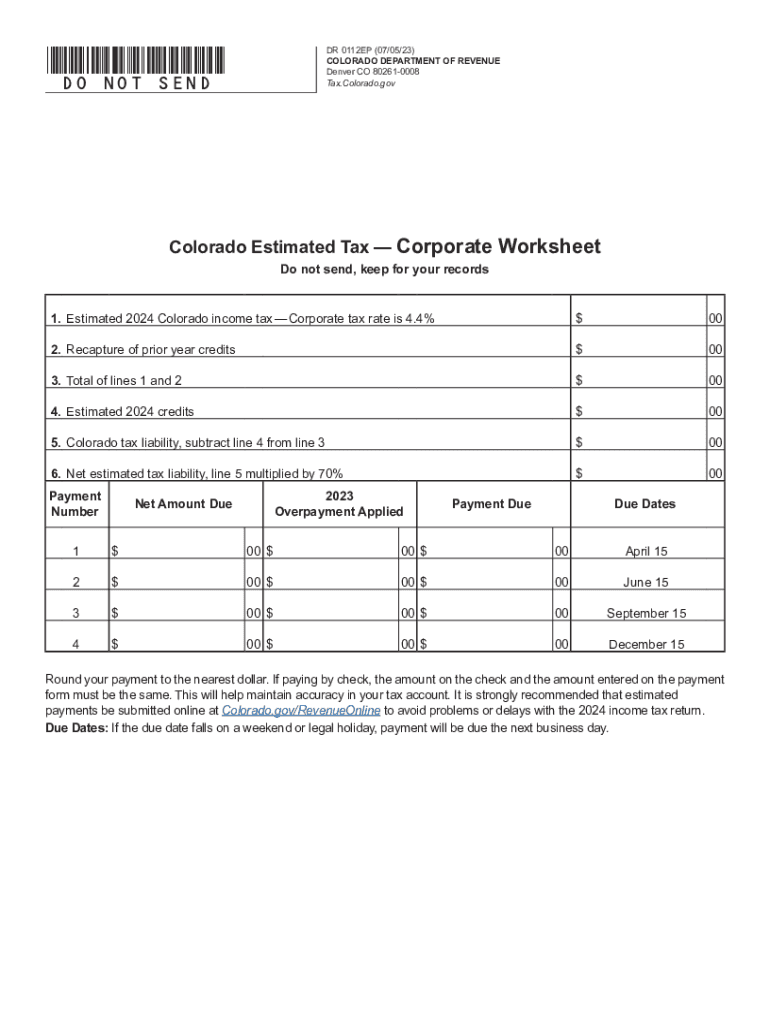

The DR 0112EP form is utilized by corporations in Colorado to report estimated income tax. This form is essential for businesses that expect to owe more than one thousand dollars in income tax for the year. By submitting this form, corporations can calculate and remit their estimated tax payments in a timely manner, ensuring compliance with state tax regulations.

Steps to Complete the DR 0112EP Corporate Estimated Income Tax

Completing the DR 0112EP involves several key steps:

- Gather financial information, including projected income, deductions, and credits.

- Calculate the estimated tax liability based on the projected income.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form by the designated deadlines to avoid penalties.

Filing Deadlines for the DR 0112EP

Corporations must adhere to specific deadlines when filing the DR 0112EP. Typically, the estimated tax payments are due quarterly. The deadlines are:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: December 15

Required Documents for Filing the DR 0112EP

To file the DR 0112EP, corporations should prepare the following documents:

- Previous year’s tax return for reference.

- Current financial statements to estimate income.

- Records of any deductions or credits applicable.

Penalties for Non-Compliance with DR 0112EP

Failure to file the DR 0112EP or make timely payments can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall liability.

Eligibility Criteria for Using the DR 0112EP

To be eligible to use the DR 0112EP, a corporation must meet certain criteria:

- Must be registered as a corporation in Colorado.

- Expected tax liability must exceed one thousand dollars for the year.

Quick guide on how to complete dr 0112ep corporate estimated income tax if you are using a screen reader or other assistive technology please note that

Complete DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your papers swiftly without holdups. Manage DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora with ease

- Obtain DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or conceal confidential information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0112ep corporate estimated income tax if you are using a screen reader or other assistive technology please note that

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 0112ep and how does it relate to airSlate SignNow?

The term 0112ep refers to a specific module within the airSlate SignNow platform that streamlines document signing processes. By leveraging its features, businesses can enhance their productivity and ensure a seamless e-signature experience.

-

How much does it cost to use airSlate SignNow and the 0112ep module?

Pricing for airSlate SignNow varies based on the selected plan. Typically, affordable monthly or annual subscriptions provide access to the 0112ep features, making it a cost-effective solution for businesses looking to enhance their document workflows.

-

What features does the 0112ep module offer?

The 0112ep module includes advanced features like customizable templates, automated workflows, and secure cloud storage. These functionalities empower users to manage documents efficiently and increase overall efficacy in business operations.

-

How can airSlate SignNow, specifically the 0112ep module, benefit my business?

Using the 0112ep module of airSlate SignNow can signNowly improve your business's document handling processes. It allows for quick e-signatures, saving time and reducing paperwork, while also enhancing compliance and security in document management.

-

Does airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow, including the 0112ep module, supports integration with various third-party applications such as CRM and file management systems. This connectivity enables streamlined workflows and enhances collaboration across platforms.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security. The 0112ep module utilizes advanced encryption and complies with regulations like GDPR, ensuring that sensitive documents are secure and protecting user data from unauthorized access.

-

Can I try airSlate SignNow and the 0112ep features before purchasing?

Yes, airSlate SignNow offers a free trial period that allows users to explore the capabilities of the 0112ep module. This trial provides an excellent opportunity to experience its features and evaluate how it fits your business needs.

Get more for DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora

- Affidavit for correctional tothis is a legal docu form

- Alternating acetaminophen and ibuprofen for pain in children form

- Mhs dental dental screening consent form

- Form 113 1044949

- Www doi govemergencyoffice of emergency managementu s department of the interior form

- Optical longisland comservicesdigital retinaldigital retinal photography in farmingdalefarmingdale form

- Lions of north dakota sight 4 kidz eye screening form

- Declaration of residence form 554151073

Find out other DR 0112EP Corporate Estimated Income Tax If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colora

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online