Book 21 If You Are Using a Screen Reader or Other Assistive Technology, Please Note that Colorado Department of Revenue Forms an

Understanding the Colorado Severance Tax

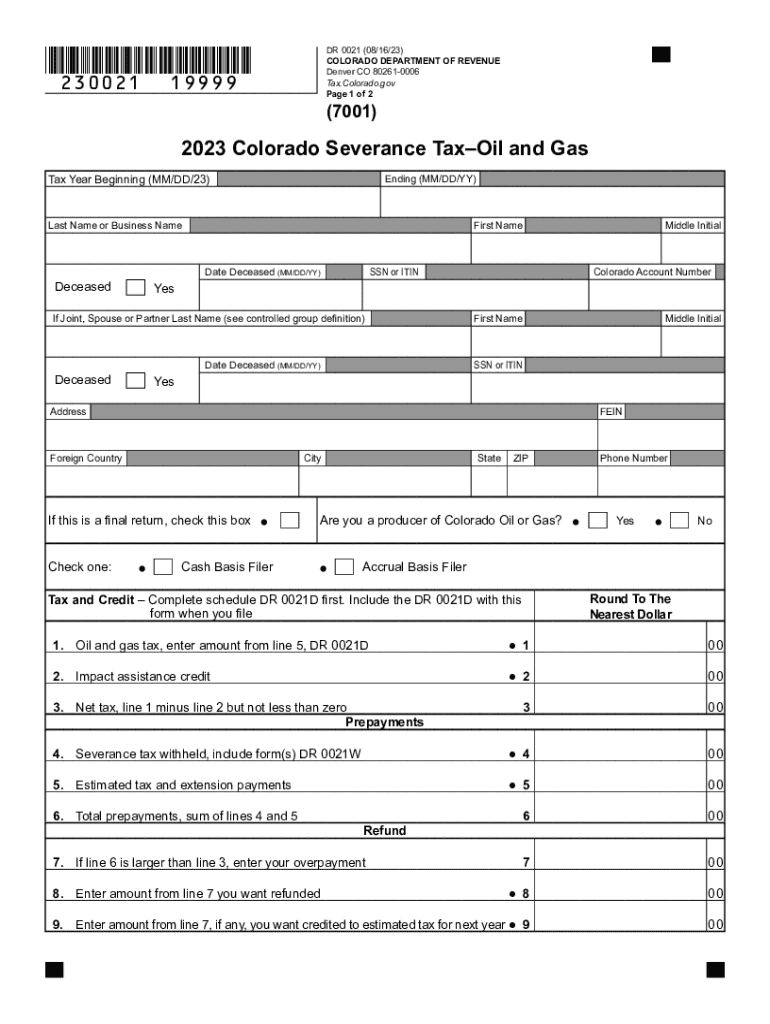

The Colorado severance tax is imposed on the extraction of natural resources, such as oil and gas. This tax is calculated based on the amount of resources extracted and is applicable to various entities involved in the production process. It is essential for businesses to be aware of the specific rates and regulations that govern this tax to ensure compliance and accurate reporting.

Filing Deadlines for Severance Tax Returns

Filing deadlines for severance tax returns in Colorado are crucial for businesses to avoid penalties. Generally, severance tax returns are due quarterly, with specific dates set by the Colorado Department of Revenue. It is important for taxpayers to stay informed about these deadlines to ensure timely submissions and maintain good standing with state tax authorities.

Required Documents for Filing Severance Tax

When filing severance tax returns, businesses must prepare several documents. These typically include production reports, sales records, and any relevant financial statements that detail the extraction and sale of resources. Ensuring that all required documentation is accurate and complete is vital for a successful filing process.

Penalties for Non-Compliance with Severance Tax Regulations

Failure to comply with severance tax regulations can result in significant penalties for businesses. These penalties may include fines, interest on unpaid taxes, and potential legal repercussions. Understanding the importance of compliance can help businesses avoid these costly consequences and maintain their operational integrity.

Eligibility Criteria for Severance Tax Exemptions

Certain exemptions may apply to businesses regarding the Colorado severance tax. Eligibility criteria can vary based on the type of resource extracted and the specific circumstances of the operation. It is essential for businesses to review these criteria thoroughly to determine if they qualify for any exemptions, which can significantly impact their tax liability.

Steps to Complete the Severance Tax Return

Completing the severance tax return involves several key steps. First, businesses must gather all necessary documentation, including production and sales data. Next, they need to accurately calculate the tax owed based on the resources extracted. Finally, the completed return must be submitted by the designated deadline, ensuring that all information is correct to avoid penalties.

Form Submission Methods for Severance Tax Returns

Businesses have several options for submitting their severance tax returns in Colorado. These methods include online filing through the state’s tax portal, mailing paper forms, or submitting them in person at designated locations. Each method has its advantages, and businesses should choose the one that best fits their operational needs and preferences.

Quick guide on how to complete book 21 if you are using a screen reader or other assistive technology please note that colorado department of revenue forms

Complete Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An effortlessly on any device

Digital document management has become increasingly common among organizations and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can find the needed form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An without hassle

- Find Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the book 21 if you are using a screen reader or other assistive technology please note that colorado department of revenue forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is severance and how is it managed with airSlate SignNow?

Severance refers to the compensation provided to employees upon termination. With airSlate SignNow, businesses can efficiently manage severance agreements by using our intuitive eSignature platform to send, sign, and store these critical documents securely.

-

How does airSlate SignNow ensure the security of severance agreements?

airSlate SignNow prioritizes the security of your severance agreements through advanced encryption and secure cloud storage. This guarantees that sensitive employee information and contractual terms are protected against unauthorized access.

-

Is airSlate SignNow a cost-effective solution for managing severance documents?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes looking to manage severance documents. By streamlining the signing process, organizations can reduce administrative costs associated with manual document management.

-

Can I integrate airSlate SignNow with other HR tools for severance documentation?

Absolutely! airSlate SignNow provides seamless integrations with various HR tools, enabling you to manage severance documentation effortlessly within your existing workflow and enhancing overall operational efficiency.

-

What features does airSlate SignNow offer for processing severance documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking, which simplify the process of sending and signing severance documents. These features ensure that you can manage severance efficiently and effectively.

-

How quickly can I send severance agreements using airSlate SignNow?

With airSlate SignNow, you can send severance agreements instantly with just a few clicks. Our user-friendly interface allows for quick document preparation and swift delivery, reducing the time it takes to finalize severance transactions.

-

What are the benefits of using airSlate SignNow for severance agreements?

Using airSlate SignNow for severance agreements speeds up the signing process, increases compliance, and reduces the risk of errors. Additionally, the platform’s audit trail feature provides transparency and accountability throughout the severance process.

Get more for Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An

- Revised 32021facility nameincident report forms

- Oncology massage intake form firsthealth firsthealth

- Physicians reach out pro is a care ring program that provides primary and specialist form

- Are property tax cuts coming to slo county homeowners form

- City of port direct deposit agreement form

- Information form 36827371

- Mandatory krcher full service maintenance agreement form

- Address change form dre doc

Find out other Book 21 If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado Department Of Revenue Forms An

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free