Forms by Tax TypeDepartment of Revenue Taxation

Understanding the DR0104CR Form

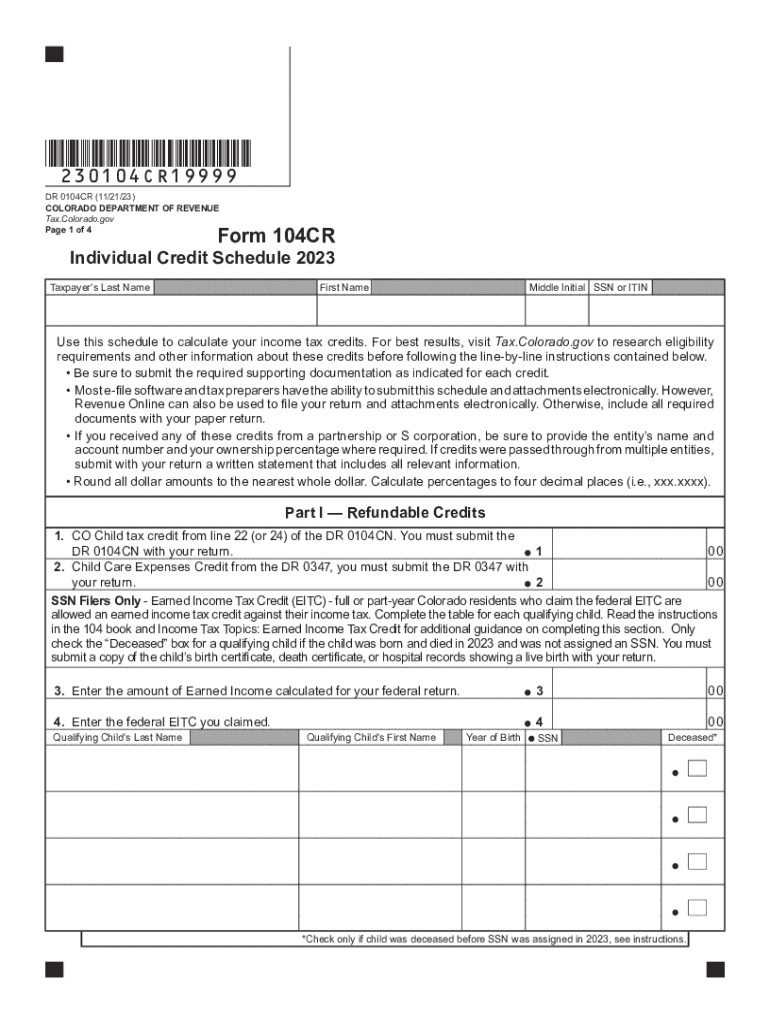

The DR0104CR form, also known as the Colorado 104CR, is a crucial document used for claiming a tax refund in Colorado. This form is specifically designed for individuals who have overpaid their state income taxes and wish to receive a refund. It is essential for taxpayers to understand the purpose of this form to ensure they can accurately request their refunds. The form includes sections for personal information, income details, and the calculation of the refund amount.

Steps to Complete the DR0104CR Form

Completing the DR0104CR form involves several key steps:

- Gather necessary documents, including your W-2s, 1099s, and any other income statements.

- Fill out your personal information at the top of the form, ensuring accuracy to avoid delays.

- Report your total income and any adjustments as required by the form.

- Calculate your total tax liability and any payments made throughout the year.

- Determine the amount of your refund by subtracting your total tax liability from your total payments.

- Sign and date the form before submission.

Required Documents for the DR0104CR Form

To successfully complete the DR0104CR form, you will need to provide specific documents. These include:

- Your W-2 forms from all employers.

- Any 1099 forms that report additional income.

- Documentation of any tax credits or deductions you plan to claim.

- Previous year’s tax return, if applicable, for reference.

Form Submission Methods

The DR0104CR form can be submitted through various methods, providing flexibility for taxpayers. You can choose to:

- File online through the Colorado Department of Revenue's website.

- Mail a printed copy of the form to the appropriate address listed on the form.

- Submit in person at a local Department of Revenue office.

Filing Deadlines for the DR0104CR Form

It is important to be aware of the filing deadlines associated with the DR0104CR form to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year for which you are claiming a refund. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Penalties for Non-Compliance

Failure to file the DR0104CR form on time or inaccuracies in the information provided can lead to penalties. These may include:

- Interest on any unpaid taxes owed.

- Late filing fees, which can accumulate over time.

- Potential audits or further scrutiny from the Colorado Department of Revenue.

Eligibility Criteria for the DR0104CR Form

To be eligible to file the DR0104CR form, taxpayers must meet certain criteria. Generally, you must:

- Be a resident of Colorado for the tax year in question.

- Have overpaid your state income taxes during that tax year.

- Provide accurate income and tax information as required by the form.

Quick guide on how to complete forms by tax typedepartment of revenue taxation

Effortlessly Create Forms By Tax TypeDepartment Of Revenue Taxation on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Manage Forms By Tax TypeDepartment Of Revenue Taxation on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven task today.

How to Edit and Electronically Sign Forms By Tax TypeDepartment Of Revenue Taxation with Ease

- Locate Forms By Tax TypeDepartment Of Revenue Taxation and click on Access Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Signature tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Finish button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Forms By Tax TypeDepartment Of Revenue Taxation and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forms by tax typedepartment of revenue taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dr0104cr form, and why is it important?

The dr0104cr form is a crucial document used for tax purposes, specifically for claiming a credit in certain states. Understanding this form is essential for accurately filing your taxes and ensuring you receive any applicable credits. Utilizing airSlate SignNow can streamline the process of completing and eSigning your dr0104cr form, making tax season less stressful.

-

How can I create a dr0104cr form using airSlate SignNow?

Creating a dr0104cr form on airSlate SignNow is simple and intuitive. Our platform offers templates and easy-to-use tools that allow you to complete the form quickly. Once you're finished, you can eSign the document and send it securely to the relevant parties.

-

Is there a cost associated with using airSlate SignNow for the dr0104cr form?

airSlate SignNow offers competitive pricing plans to help businesses manage documents like the dr0104cr form. Our pricing is designed to be cost-effective, ensuring you only pay for the features you need. Consider our monthly or annual subscriptions to get the best value.

-

What features does airSlate SignNow offer for managing the dr0104cr form?

airSlate SignNow provides a variety of features for managing the dr0104cr form, including easy editing, collaborative tools, and secure eSigning. You can also track the status of your document in real-time, ensuring that you’re always updated on its progress. These features enhance your overall document management experience.

-

Can I integrate airSlate SignNow with other applications for handling the dr0104cr form?

Yes, airSlate SignNow allows seamless integration with various applications, making it easier to manage the dr0104cr form alongside your other business tools. Integrating with your CRM, cloud storage, or other essential software can enhance your workflow and efficiency. Check our integration options for more details.

-

What are the benefits of using airSlate SignNow for the dr0104cr form?

Using airSlate SignNow for the dr0104cr form offers numerous benefits, including increased efficiency, reduced errors, and a streamlined signing process. eSigning saves time and enhances security, ensuring that your sensitive information remains protected. Additionally, our platform supports compliance with various legal standards.

-

How secure is the dr0104cr form when using airSlate SignNow?

The security of your dr0104cr form is our top priority at airSlate SignNow. We employ advanced encryption technologies and multi-factor authentication to safeguard your documents and data. Your information will remain confidential and secure throughout the signing and management process.

Get more for Forms By Tax TypeDepartment Of Revenue Taxation

- Sky high waiver 44763497 form

- The cfi provider enrollment application new hampshire healthy form

- Jag form 741 5620683

- Tot t ball registration form bondurant iowa

- Student club constitution form

- Louisiana iep form 571907938

- Station loss statement form

- Nevada humane society animal adoption application nevadahumanesociety form

Find out other Forms By Tax TypeDepartment Of Revenue Taxation

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter