Income Tax FormsIndividuals & Families

Understanding the 2023 DR 0104AD Form

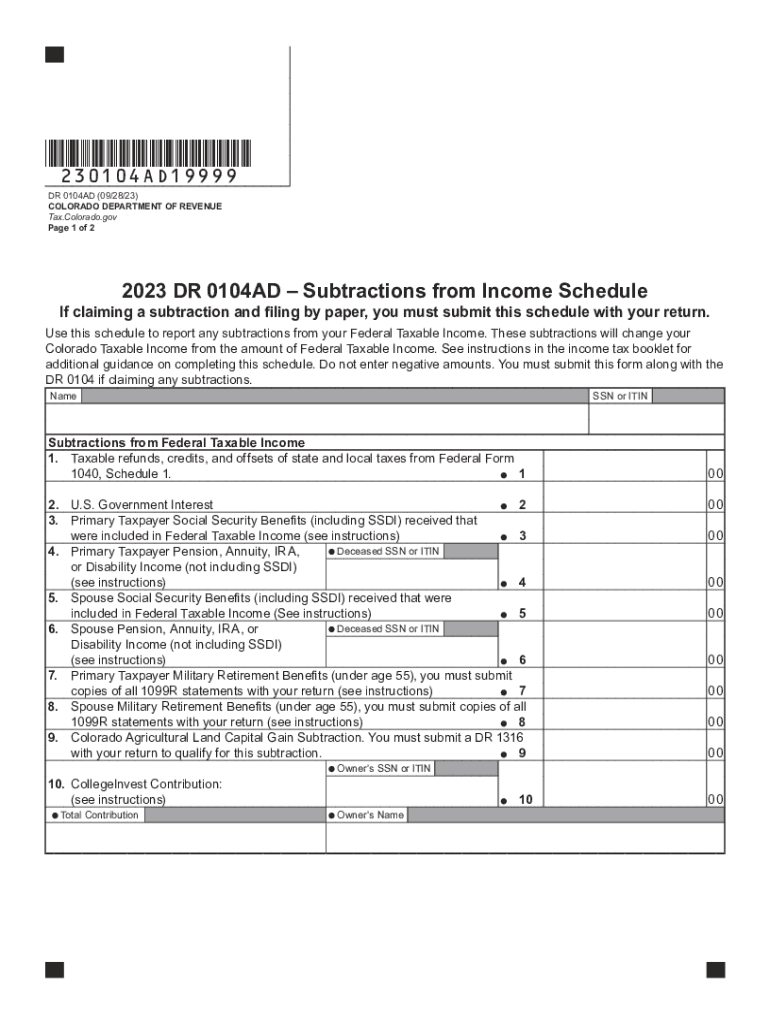

The 2023 DR 0104AD form is a crucial document for Colorado taxpayers. It is specifically designed for individuals and families to report their income and claim various subtractions from their taxable income. This form is essential for ensuring compliance with state tax regulations and maximizing potential tax benefits.

This form includes sections for reporting income, deductions, and credits, which can significantly affect the overall tax liability. Understanding the components of the DR 0104AD is vital for accurate reporting and ensuring that all eligible subtractions are claimed.

Steps to Complete the 2023 DR 0104AD Form

Completing the 2023 DR 0104AD form involves several key steps. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Identify and claim any applicable subtractions specific to Colorado, such as those for retirement income or educational expenses.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission.

Ensure that all calculations are double-checked to avoid errors that could lead to penalties or delays in processing.

Required Documents for the 2023 DR 0104AD Form

To successfully complete the 2023 DR 0104AD form, certain documents are necessary. These documents provide the information required to accurately report income and claim deductions. Key documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for any claimed subtractions, such as receipts for educational expenses or retirement contributions.

Having these documents ready will streamline the completion process and help ensure that all relevant information is included.

Filing Deadlines for the 2023 DR 0104AD Form

It is important to be aware of the filing deadlines for the 2023 DR 0104AD form to avoid penalties. Generally, the deadline for submitting this form aligns with the federal tax filing deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any potential extensions they may wish to apply for, ensuring they file any necessary paperwork before the original deadline.

Legal Use of the 2023 DR 0104AD Form

The 2023 DR 0104AD form is legally mandated for Colorado residents who are required to file a state income tax return. It is essential to use this form correctly to comply with state tax laws. Failing to file the form or providing inaccurate information can result in penalties, interest on unpaid taxes, and potential audits. Understanding the legal implications of this form underscores the importance of accuracy and compliance in the filing process.

Examples of Using the 2023 DR 0104AD Form

Taxpayers may encounter various scenarios when using the 2023 DR 0104AD form. For instance, a self-employed individual may use this form to report income from their business while claiming deductions for business-related expenses. Similarly, a retiree may utilize the form to report pension income and claim subtractions for retirement savings. Each taxpayer's situation is unique, and understanding how to apply the form to different contexts is vital for accurate reporting and tax compliance.

Quick guide on how to complete income tax formsindividuals ampamp families

Easily Prepare Income Tax FormsIndividuals & Families on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Handle Income Tax FormsIndividuals & Families on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

Effortlessly Modify and Electronically Sign Income Tax FormsIndividuals & Families

- Locate Income Tax FormsIndividuals & Families and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details with features specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about misplaced documents, exhaustive form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Income Tax FormsIndividuals & Families and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax formsindividuals ampamp families

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 dr 0104ad form and how can airSlate SignNow help?

The 2023 dr 0104ad form is a crucial document for tax purposes, and airSlate SignNow provides an efficient way to eSign and manage this form. Our platform simplifies the process, allowing users to fill out, sign, and send the 2023 dr 0104ad securely online. This not only saves time but also ensures that your documents are organized and accessible.

-

What features does airSlate SignNow offer for handling the 2023 dr 0104ad?

airSlate SignNow offers numerous features specifically designed for managing documents like the 2023 dr 0104ad. These include customizable templates, automated workflows, and real-time tracking of document status. Additionally, you can access powerful integrations that enhance your productivity when working with tax documents.

-

Is airSlate SignNow cost-effective for eSigning the 2023 dr 0104ad?

Yes, airSlate SignNow provides a cost-effective solution for eSigning the 2023 dr 0104ad. We offer competitive pricing plans tailored to meet the needs of individuals and businesses alike, ensuring you get the best value for your investment. Our transparent pricing structure means no hidden fees, allowing you to manage costs effectively.

-

Can I integrate airSlate SignNow with other software for the 2023 dr 0104ad?

Absolutely! airSlate SignNow supports seamless integrations with various software applications, making it easy to manage your 2023 dr 0104ad form alongside other tools. Whether you use CRM systems or project management software, our platform ensures that your workflows remain streamlined and efficient.

-

How does airSlate SignNow enhance the security of the 2023 dr 0104ad document?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the 2023 dr 0104ad. Our platform employs advanced encryption techniques to protect your data, ensuring that all documents are stored and transmitted securely. Additionally, we comply with industry standards and regulations to provide peace of mind.

-

What are the benefits of using airSlate SignNow for the 2023 dr 0104ad?

Using airSlate SignNow for the 2023 dr 0104ad provides several benefits, including increased efficiency, reduced turnaround time, and improved document tracking. Our user-friendly interface allows you to complete the signing process in just a few clicks, freeing up valuable time for other tasks. Plus, your documents remain easily accessible whenever you need them.

-

How can I get started with airSlate SignNow for the 2023 dr 0104ad?

Getting started with airSlate SignNow for the 2023 dr 0104ad is quick and easy. Simply sign up for an account on our website, and you can start uploading and eSigning your documents right away. We also provide helpful resources and customer support to guide you through the process.

Get more for Income Tax FormsIndividuals & Families

- Limbs for life lfl component request form

- Medical medical certificate form 9 doc

- Forestry inspection form developed lot tahoe donner

- Firefighter evaluation form 469619879

- Ctso chaperone consent form

- Www healthy arkansas govimagesuploadscollaborative practice agreement arkansas form

- Registration form ntma sawaphoenix

- Client intake form l massage therapy burkeorg

Find out other Income Tax FormsIndividuals & Families

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed