Form 501 Annual Information Return Summary of Reports Enclosed Herewith

Overview of the Form 501 Annual Information Return

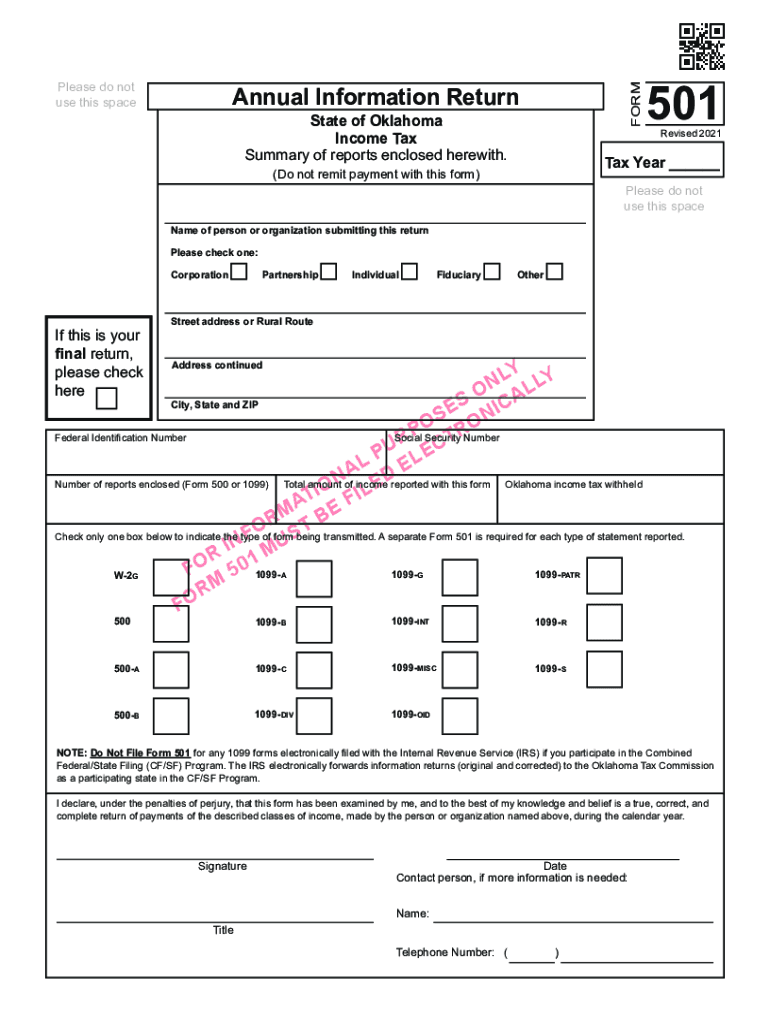

The Form 501 Annual Information Return is a crucial document for businesses operating in Oklahoma. This form serves as a summary of reports that must be enclosed and submitted to the Oklahoma Tax Commission. It is primarily used to report various types of income and tax information to ensure compliance with state tax laws. Understanding the purpose and requirements of this form is essential for accurate tax filing and maintaining good standing with tax authorities.

Steps to Complete the Form 501 Annual Information Return

Completing the Oklahoma Form 501 involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements, expense reports, and previous tax filings.

- Fill out the form accurately, providing details about your business entity, income sources, and any deductions or credits applicable.

- Ensure that all reports that accompany the form are complete and accurate, as these will be reviewed by the Oklahoma Tax Commission.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 501 Annual Information Return. Typically, the form must be submitted by the last day of the fourth month following the end of your business's fiscal year. For most businesses operating on a calendar year, this means the due date is April 15. Failure to file by this deadline may result in penalties or interest charges.

Required Documents for Submission

When preparing to submit the Form 501, it is important to have the following documents ready:

- Complete income statements for the reporting period.

- Expense reports that detail all deductions claimed.

- Any additional forms or schedules required by the Oklahoma Tax Commission.

Having these documents organized can streamline the filing process and help prevent delays or issues with your submission.

Submission Methods for Form 501

The Form 501 can be submitted through various methods to accommodate different preferences:

- Online: Many businesses opt for electronic filing through the Oklahoma Tax Commission's website, which can expedite processing times.

- Mail: You can also print the completed form and send it via postal service to the appropriate address provided by the Oklahoma Tax Commission.

- In-Person: Submitting the form in person at a local tax office is another option for those who prefer direct interaction.

Penalties for Non-Compliance

Failing to file the Form 501 on time or providing inaccurate information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential to adhere to all filing requirements and deadlines to avoid these consequences and maintain compliance with Oklahoma tax laws.

Quick guide on how to complete form 501 annual information return summary of reports enclosed herewith

Accomplish Form 501 Annual Information Return Summary Of Reports Enclosed Herewith seamlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form 501 Annual Information Return Summary Of Reports Enclosed Herewith on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign Form 501 Annual Information Return Summary Of Reports Enclosed Herewith with ease

- Locate Form 501 Annual Information Return Summary Of Reports Enclosed Herewith and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark essential sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or missing files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 501 Annual Information Return Summary Of Reports Enclosed Herewith to ensure clear communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 501 annual information return summary of reports enclosed herewith

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 501 information?

Form 501 information refers to the details required to complete the Form 501, which is an essential document for various business applications. This form typically includes data such as business identification and specific requests for funding or approvals. Understanding Form 501 information is crucial for ensuring compliance and leveraging available resources effectively.

-

How can airSlate SignNow help with Form 501 information?

airSlate SignNow streamlines the process of filling out and submitting Form 501 information by allowing users to create, share, and eSign documents seamlessly. Our platform ensures that all necessary data is accurately captured and securely stored. By using airSlate SignNow, you can save time and reduce the risk of errors in important submissions.

-

Is there a cost associated with using airSlate SignNow for Form 501 information?

Yes, there is a cost associated with using airSlate SignNow, but we offer flexible pricing plans that cater to different business sizes and needs. Our plans are designed to provide you with a cost-effective solution that meets your requirements for managing Form 501 information. You can choose a plan that suits your budget and ensures you have all the features required for successful document management.

-

What features does airSlate SignNow provide for managing Form 501 information?

airSlate SignNow offers a variety of features tailored for managing Form 501 information effectively. Some key features include customizable templates, automated workflows, and secure eSigning capabilities. These features help streamline your document processes and ensure you can easily handle all aspects of Form 501 information collection and submission.

-

Can I integrate airSlate SignNow with other applications for Form 501 information management?

Yes, airSlate SignNow offers integration with various applications to enhance your Form 501 information management experience. You can connect with platforms like Google Drive, Dropbox, and major CRMs to streamline workflows and ensure data consistency. This integration capability allows you to centralize your Form 501 information and work more efficiently.

-

What are the benefits of using airSlate SignNow for Form 501 information?

Using airSlate SignNow for Form 501 information provides numerous benefits, including increased efficiency and reduced turnaround time for document processing. Additionally, the platform enhances collaboration by allowing multiple users to access and edit documents simultaneously. This ultimately leads to a more organized and effective approach to managing essential forms like Form 501.

-

Is airSlate SignNow secure for handling sensitive Form 501 information?

Absolutely! airSlate SignNow prioritizes the security of your Form 501 information through advanced encryption and compliance with industry standards. Our platform ensures that all your documents are stored securely and are only accessible by authorized users. You can have peace of mind knowing that your important data is protected.

Get more for Form 501 Annual Information Return Summary Of Reports Enclosed Herewith

- Protective oversight form

- Jackie gurbey day care director cohoescommunitycenter form

- Mvp direct deposit form

- Edd supplementary certificate form

- Gpc 03a ama ras form marin emergency medical services ems marinhhs

- Otec dental lab 616367495 form

- Stanford health care she please send she request form

- Responsibility statement for supervision of a speech language pathology assistant 77s 60 rev 522 slpa supervision requirements form

Find out other Form 501 Annual Information Return Summary Of Reports Enclosed Herewith

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT