DR 0104X Amended Individual Income Return Instructions If You Are Using a Screen Reader or Other Assistive Technology, Please No Form

Understanding the Colorado Form 104X

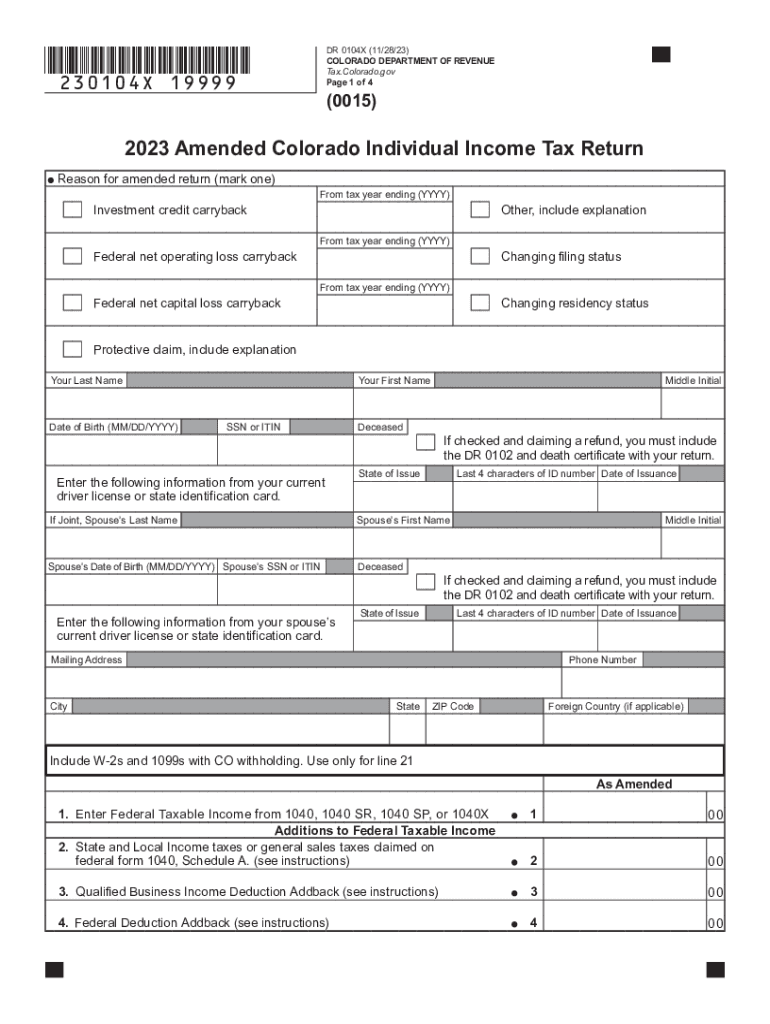

The Colorado Form 104X, also known as the DR 0104X Amended Individual Income Return, is used by taxpayers to amend their previously filed Colorado tax returns. This form allows individuals to correct errors, claim additional deductions or credits, or report changes in income. It is essential for ensuring that your tax records are accurate and up to date. Understanding the purpose and function of this form is crucial for maintaining compliance with Colorado tax laws.

Steps to Complete the Colorado Form 104X

Completing the DR 0104X requires careful attention to detail. Here are the steps to follow:

- Begin by obtaining a copy of your original tax return.

- Fill out the DR 0104X form, ensuring that you clearly indicate the changes being made.

- Provide a detailed explanation for each amendment in the designated section of the form.

- Attach any supporting documents that validate your claims, such as W-2s or 1099s.

- Review the completed form for accuracy before submission.

Filing Deadlines for the DR 0104X

Timely filing of the Colorado Form 104X is important to avoid penalties. Generally, you must file the amended return within three years of the original due date of the return you are amending. This means that if you filed your original return on April 15, you have until April 15 of the third year to submit your amendment. It is advisable to check the Colorado Department of Revenue's website for any specific updates regarding deadlines.

Required Documents for Submission

When submitting the Colorado Form 104X, certain documents are necessary to support your amendments. These may include:

- The original tax return that you are amending.

- Any additional forms or schedules that pertain to the changes.

- Supporting documentation, such as proof of income or deductions.

Having these documents ready will streamline the process and help ensure that your amendment is processed efficiently.

Form Submission Methods

The Colorado Form 104X can be submitted through various methods. Taxpayers have the option to file the amended return online, by mail, or in person. If you choose to file online, ensure that you are using compatible software that supports the DR 0104X. For mail submissions, send the completed form and all necessary documents to the address specified by the Colorado Department of Revenue. In-person submissions can be made at local tax offices.

Key Elements of the Colorado Form 104X

Understanding the key elements of the DR 0104X is essential for successful completion. The form includes sections for personal information, the original amounts reported, the corrected amounts, and an explanation of the changes. Additionally, taxpayers must sign and date the form to certify its accuracy. Each section must be filled out completely to avoid delays in processing.

Quick guide on how to complete dr 0104x amended individual income return instructions if you are using a screen reader or other assistive technology please

Prepare DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No with ease

- Find DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No and click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Modify and electronically sign DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0104x amended individual income return instructions if you are using a screen reader or other assistive technology please

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 104x instructions?

The form 104x instructions provide detailed guidelines on how to amend a previously filed tax return. These instructions are essential for ensuring accuracy and compliance with the IRS regulations. By following the form 104x instructions, you can successfully correct errors or change your filing status.

-

How can airSlate SignNow help with form 104x instructions?

airSlate SignNow simplifies the process of completing and signing your form 104x with its intuitive interface. Our platform allows you to upload, fill out, and eSign documents directly, making the adherence to form 104x instructions easier than ever. This streamlines your filing process and improves efficiency.

-

What pricing options does airSlate SignNow offer for users needing help with form 104x instructions?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes, including options that suit individual needs for filing form 104x. Pricing starts at competitive rates, ensuring you get the necessary tools to understand and utilize form 104x instructions. Explore our subscription models to find the best fit for your budget.

-

Can I integrate airSlate SignNow with other applications for managing form 104x instructions?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow around form 104x instructions. Whether you are using CRM software, document management systems, or cloud storage services, our integrations support efficient document handling and sharing. Optimize your processes with ease.

-

What are the benefits of using airSlate SignNow for form 104x instructions?

Using airSlate SignNow for your form 104x instructions comes with numerous benefits, including time savings and enhanced accuracy. Our platform allows you to edit, sign, and send documents quickly while guiding you through the instructions properly. Experience a streamlined process that ultimately reduces the hassle of tax filing.

-

Is there customer support available if I have questions about form 104x instructions?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions regarding form 104x instructions. Our knowledgeable team is available through various channels to ensure you receive timely and helpful assistance, making your experience smooth and stress-free.

-

How secure is airSlate SignNow when dealing with sensitive form 104x instructions information?

airSlate SignNow prioritizes security and compliance, especially when handling sensitive information related to form 104x instructions. We implement robust encryption and data protection measures to safeguard your documents. Trust us to maintain the confidentiality and integrity of your information at all times.

Get more for DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No

- Addiction and recovery treatment services arts service authorization review form extension requests

- Illinois identification card form

- Form must be filled out using blue or black ink only

- Cds renewal nj form

- Authorization for the release of records to toc form

- Carolina youth symphony parental release ampamp consent form medical

- 1800463 0095 form

- Health alaska govdphepi2020 provider agreement to receive state supplied vaccine form

Find out other DR 0104X Amended Individual Income Return Instructions If You Are Using A Screen Reader Or Other Assistive Technology, Please No

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast