How to File the Colorado Retail Sales Tax Return YouTube Form

Steps to Complete the Colorado Retail Sales Tax Return

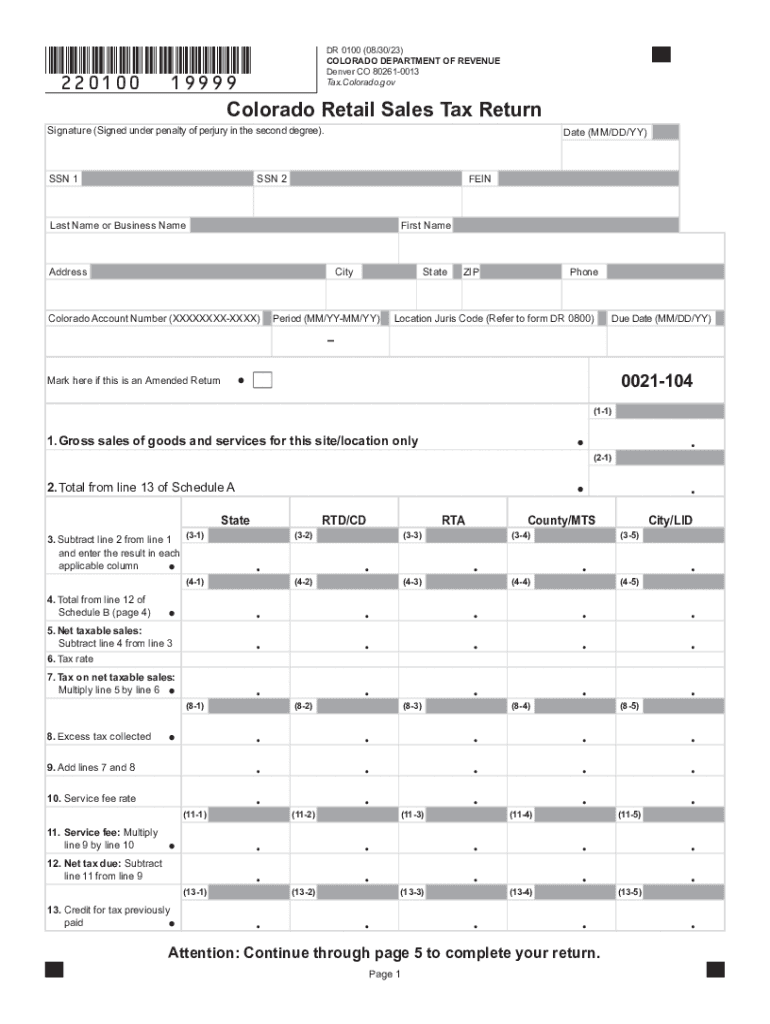

Filing the Colorado retail sales tax return involves several key steps to ensure compliance with state regulations. Begin by gathering all necessary financial records, including sales receipts and any applicable exemptions. Next, access the Colorado Form DR 0100, which is the official sales tax return form.

Fill out the form with accurate sales figures, including total sales, taxable sales, and any deductions. Be mindful of the specific instructions provided for each section of the form to avoid errors. After completing the form, review it thoroughly for accuracy before submission.

Finally, submit the completed form either online through the Colorado Department of Revenue's website or by mailing it to the appropriate address. Ensure you keep a copy of the submitted form for your records.

Required Documents for Filing

To file the Colorado sales tax return, you will need several documents to support your submission. Essential documents include:

- Sales records detailing all transactions made during the reporting period.

- Any exemption certificates for tax-exempt sales.

- Previous sales tax returns for reference and consistency.

- Bank statements or financial reports that reflect sales activity.

Having these documents on hand will facilitate a smoother filing process and help ensure that all information reported is accurate and complete.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Colorado retail sales tax return is crucial for compliance. Generally, the sales tax return is due on the 20th day of the month following the end of the reporting period. For example, sales made in January must be reported by February 20.

It is important to note that if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping a calendar of these dates can help prevent late submissions and potential penalties.

Form Submission Methods

When it comes to submitting the Colorado sales tax return, there are multiple methods available. You can file online through the Colorado Department of Revenue's website, which is often the fastest and most efficient option. Alternatively, you may choose to mail the completed Form DR 0100 to the designated address provided by the department.

For those who prefer in-person submissions, visiting a local Department of Revenue office is also an option. Regardless of the method chosen, ensure that you retain proof of submission for your records.

Penalties for Non-Compliance

Failing to file the Colorado sales tax return on time can lead to significant penalties. The state imposes a late filing penalty, which typically starts at a percentage of the unpaid tax amount and increases with the duration of the delay. Additionally, interest accrues on any unpaid tax from the due date until the tax is paid in full.

To avoid these penalties, it is advisable to file on time and ensure that all sales tax obligations are met promptly. If you encounter difficulties in meeting deadlines, consider reaching out to the Colorado Department of Revenue for assistance.

Eligibility Criteria for Filing

Eligibility to file the Colorado retail sales tax return generally applies to businesses that sell tangible personal property or certain services within the state. If your business is registered with the Colorado Department of Revenue and has collected sales tax from customers, you are required to file the return.

Additionally, businesses that meet specific thresholds for sales volume may be subject to different filing requirements. It is essential to review the state's guidelines to determine your specific obligations based on your business type and sales activity.

Quick guide on how to complete how to file the colorado retail sales tax return youtube

Easily prepare How To File The Colorado Retail Sales Tax Return YouTube on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct forms and securely store them online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage How To File The Colorado Retail Sales Tax Return YouTube on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign How To File The Colorado Retail Sales Tax Return YouTube effortlessly

- Locate How To File The Colorado Retail Sales Tax Return YouTube and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click the Done button to confirm your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any preferred device. Edit and electronically sign How To File The Colorado Retail Sales Tax Return YouTube and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file the colorado retail sales tax return youtube

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr colorado revenue online and how does it work?

Dr colorado revenue online refers to the digital platform that enables businesses to manage their revenue processes efficiently. By integrating airSlate SignNow, organizations can securely send and eSign documents related to their revenue operations. This solution streamlines procedures, promoting increased productivity and accuracy in handling financial documents.

-

How can airSlate SignNow help with dr colorado revenue online?

AirSlate SignNow enhances dr colorado revenue online by providing a simple, user-friendly interface for document management. With our platform, you can easily create, send, and sign documents electronically, eliminating manual processes. This not only saves time but also reduces the risk of errors in revenue-related documentation.

-

Is there a cost associated with using airSlate SignNow for dr colorado revenue online?

Yes, airSlate SignNow offers various pricing plans to fit different business needs when using dr colorado revenue online. Our plans are designed to be cost-effective and scalable, allowing businesses to choose options that best meet their volume of document transactions. Explore our pricing page for detailed information on available packages.

-

What features does airSlate SignNow offer for managing dr colorado revenue online?

AirSlate SignNow boasts a range of features tailored for managing dr colorado revenue online, including customizable templates, real-time tracking, and document analytics. Our solution allows users to automate workflows and streamline the signing process, making it easier to manage revenue-related documents efficiently.

-

Can airSlate SignNow integrate with other tools for dr colorado revenue online?

Absolutely! AirSlate SignNow offers robust integrations with various business tools and platforms that enhance dr colorado revenue online. Whether you use CRM systems, cloud storage, or financial software, our solution seamlessly connects with the applications you rely on to optimize your revenue management.

-

How secure is airSlate SignNow for managing documents related to dr colorado revenue online?

Security is paramount at airSlate SignNow, especially when handling dr colorado revenue online. Our platform employs advanced encryption and secure authentication methods to ensure that your documents are protected from unauthorized access. This commitment to security helps safeguard sensitive revenue information.

-

What are the benefits of using airSlate SignNow for dr colorado revenue online?

Using airSlate SignNow for dr colorado revenue online provides numerous benefits including faster turnaround times for document signing, enhanced compliance, and improved overall efficiency in your revenue processes. With our easy-to-use solution, businesses can reduce paperwork and focus more on core operations, directly impacting their bottom line.

Get more for How To File The Colorado Retail Sales Tax Return YouTube

- Spay station consent form pasados safe haven pasadosafehaven

- Tenancy residential 462649178 form

- Child care registration form

- Bcertificateb of age rhode island department of labor and training form

- Group enrollment application change form fill and sign

- Chelation therapy informed consent agreement dr bloem drbloem

- Forestrydefensible space inspection report form

- Calocuslocus user account or termination request form dmh dc

Find out other How To File The Colorado Retail Sales Tax Return YouTube

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors