Form 39NR, Part Year Resident and Nonresident

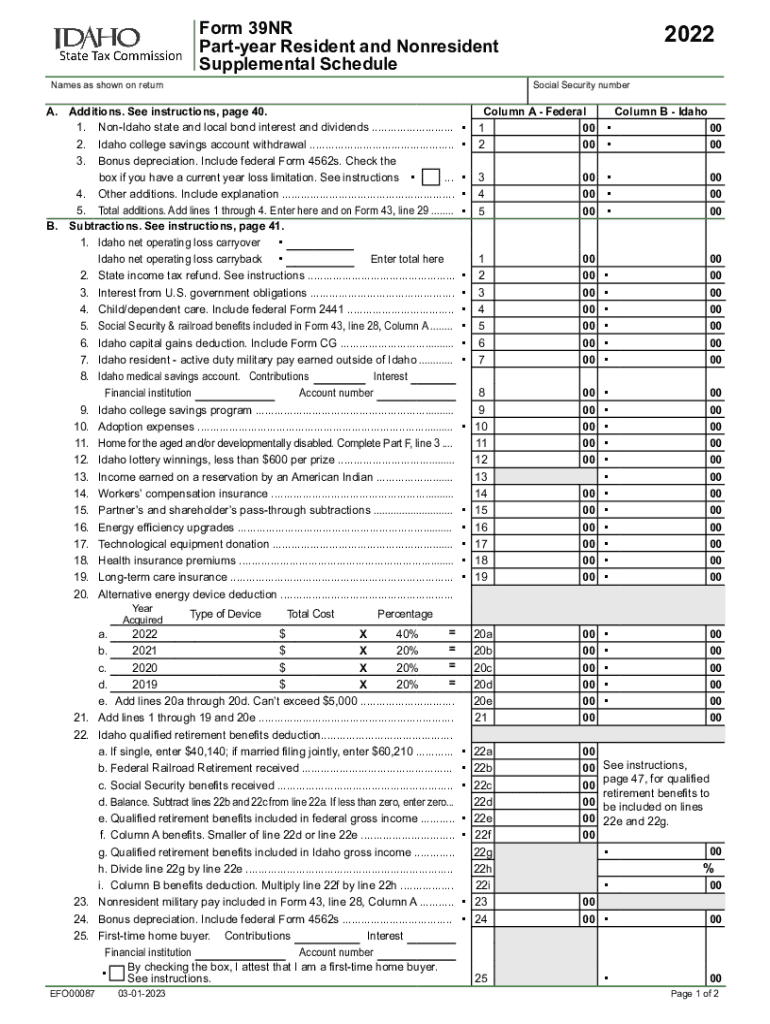

What is the Idaho Form 39NR?

The Idaho Form 39NR is a tax document designed for part-year residents and nonresidents of Idaho. This form is used to report income earned within the state during the period of residency or while working in Idaho as a nonresident. Understanding this form is crucial for individuals who have moved in or out of Idaho during the tax year, as it ensures compliance with state tax regulations.

How to use the Idaho Form 39NR

To use the Idaho Form 39NR effectively, individuals must gather all relevant financial information for the tax year. This includes income earned in Idaho, any applicable deductions, and credits. The form guides users through reporting their Idaho-specific income and calculating any taxes owed or refunds due. It is important to follow the instructions carefully to ensure accurate filing, which can help avoid penalties or delays in processing.

Steps to complete the Idaho Form 39NR

Completing the Idaho Form 39NR involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine the period of residency in Idaho and the total income earned during that time.

- Fill out the form by entering personal information, income details, and deductions.

- Calculate the total tax owed or refund due based on the provided instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Idaho Form 39NR

Eligibility for using the Idaho Form 39NR primarily depends on residency status. Individuals who are part-year residents or nonresidents of Idaho for the tax year qualify to use this form. Part-year residents are those who lived in Idaho for part of the year, while nonresidents are individuals who earned income in Idaho but did not establish residency. It is essential to determine the correct status to ensure proper tax reporting.

Filing Deadlines for the Idaho Form 39NR

Filing deadlines for the Idaho Form 39NR typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable for taxpayers to be aware of these deadlines to avoid late fees or penalties.

Form Submission Methods for the Idaho Form 39NR

Taxpayers have several options for submitting the Idaho Form 39NR. The form can be filed online through the Idaho State Tax Commission's website, mailed to the appropriate tax office, or submitted in person at designated locations. Each method has its own processing times, so individuals should choose the option that best fits their needs and timelines.

Quick guide on how to complete form 39nr part year resident and nonresident

Prepare Form 39NR, Part year Resident And Nonresident effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary template and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Form 39NR, Part year Resident And Nonresident on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 39NR, Part year Resident And Nonresident effortlessly

- Find Form 39NR, Part year Resident And Nonresident and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 39NR, Part year Resident And Nonresident to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 39nr part year resident and nonresident

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 39nr?

airSlate SignNow is a powerful eSignature solution that helps businesses streamline their document workflows. The platform provides a cost-effective and user-friendly way to send and eSign documents, making it ideal for users looking for reliable solutions like 39nr.

-

What are the key features of the airSlate SignNow platform?

airSlate SignNow boasts several key features including customizable templates, advanced security, and real-time tracking. These features not only enhance user experience but also ensure that solutions like 39nr meet various business demands effectively.

-

How does pricing work for airSlate SignNow and 39nr?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for large enterprises. This affordability makes it an attractive choice for users seeking solutions like 39nr, providing great value for the features available.

-

Can airSlate SignNow integrate with other software services?

Yes, airSlate SignNow easily integrates with various software applications, enhancing its functionality. This compatibility allows users to connect it with tools they already use, making it a comprehensive solution in line with needs like those presented by 39nr.

-

What benefits does airSlate SignNow offer for businesses using 39nr?

For businesses using 39nr, airSlate SignNow offers enhanced efficiency through streamlined document workflows. This solution reduces turnaround time for eSigning documents, making it easier to close deals and improve overall productivity.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its affordability and ease of use make it an excellent choice for small enterprises looking for reliable eSigning solutions like 39nr.

-

What makes airSlate SignNow secure for eSigning documents?

airSlate SignNow employs advanced security features such as encryption, two-factor authentication, and compliance with industry standards. This focus on security ensures that users can trust airSlate SignNow as a safe solution for sensitive documents, such as those related to 39nr.

Get more for Form 39NR, Part year Resident And Nonresident

- Office of the registrarnevada state collegeoffice of the registrarnevada state collegeoffice of the registrarnevada state form

- Lakotaonline form

- Bob lawhorn scholarship form

- Persuasion packet aurora city school district form

- Ymca waiver 217099128 form

- Play school registration form doc

- Reset form ohio department of job and family servi

- Ged test application owens form

Find out other Form 39NR, Part year Resident And Nonresident

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement