Small Business Property Tax Exemption Claim under Form

Understanding the Small Business Property Tax Exemption Claim

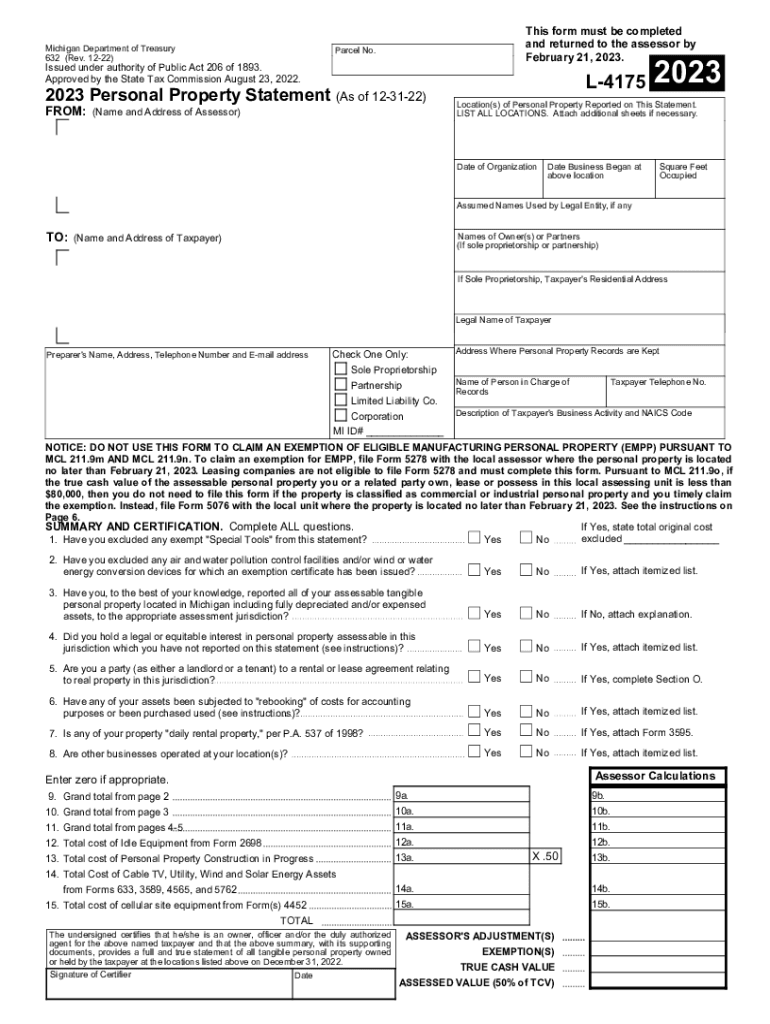

The Small Business Property Tax Exemption Claim is designed to provide financial relief to qualifying small businesses by exempting certain property from local property taxes. This exemption can significantly reduce the tax burden for small business owners, allowing them to allocate resources more effectively. The criteria for eligibility typically include factors such as the size of the business, the type of property owned, and the overall value of the business assets.

Steps to Complete the Small Business Property Tax Exemption Claim

Completing the Small Business Property Tax Exemption Claim involves several key steps. First, gather all necessary documentation, including proof of business ownership and property details. Next, fill out the claim form accurately, ensuring that all required fields are completed. After completing the form, submit it according to the instructions provided, either online, by mail, or in person. It is crucial to double-check the submission for any errors to avoid delays in processing.

Eligibility Criteria for the Small Business Property Tax Exemption Claim

To qualify for the Small Business Property Tax Exemption Claim, businesses must meet specific eligibility criteria. Generally, this includes being classified as a small business under state guidelines, which often considers factors such as annual revenue and the number of employees. Additionally, the property for which the exemption is claimed must be used for business purposes and not exceed certain value limits. Understanding these criteria is essential for business owners looking to benefit from the exemption.

Required Documents for the Small Business Property Tax Exemption Claim

When filing for the Small Business Property Tax Exemption Claim, certain documents are required to support the application. These typically include a completed claim form, proof of business registration, property tax statements, and financial statements that demonstrate the business's eligibility. Having these documents ready can streamline the application process and help ensure a successful claim.

Form Submission Methods for the Small Business Property Tax Exemption Claim

There are various methods available for submitting the Small Business Property Tax Exemption Claim. Business owners can choose to submit their claims online through the state treasury's website, which offers a convenient and efficient option. Alternatively, claims can be mailed to the appropriate local tax authority or submitted in person at designated offices. Each method has its own set of instructions, so it is important to follow the guidelines carefully to ensure proper processing.

Penalties for Non-Compliance with the Small Business Property Tax Exemption Claim

Failure to comply with the requirements of the Small Business Property Tax Exemption Claim can result in penalties. These may include fines, loss of the exemption, or additional tax liabilities. It is essential for business owners to understand the implications of non-compliance and to ensure that all claims are filed accurately and on time to avoid any adverse consequences.

Key Elements of the Small Business Property Tax Exemption Claim

Key elements of the Small Business Property Tax Exemption Claim include understanding the specific property types that qualify for exemption, the application process, and the deadlines for submission. Additionally, business owners should be aware of any local variations in the application process, as these can differ from state to state. Familiarity with these elements can enhance the likelihood of a successful claim and ensure that businesses benefit from available tax relief.

Quick guide on how to complete small business property tax exemption claim under

Complete Small Business Property Tax Exemption Claim Under effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Small Business Property Tax Exemption Claim Under on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Small Business Property Tax Exemption Claim Under with ease

- Locate Small Business Property Tax Exemption Claim Under and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from the device of your choice. Edit and eSign Small Business Property Tax Exemption Claim Under and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the small business property tax exemption claim under

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in treasury management?

airSlate SignNow streamlines treasury management by enabling businesses to efficiently send and eSign documents. This digital solution reduces paperwork and accelerates the signing processes, ensuring that your treasury operations are both secure and compliant. With airSlate SignNow, manage your treasury documents effortlessly.

-

How does airSlate SignNow enhance the treasury workflow?

airSlate SignNow enhances treasury workflows by automating document handling, which saves time and minimizes manual errors. Integrated electronic signature capabilities mean that approvals are quicker, allowing treasury teams to focus on strategic tasks rather than administrative ones. This results in improved efficiency and accuracy in treasury management.

-

Is airSlate SignNow suitable for small businesses in the treasury sector?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses in the treasury sector. Its cost-effective pricing plans ensure even startups can access essential tools for eSigning and document management. This empowers small treasury teams to operate effectively without breaking the bank.

-

What are the pricing options for airSlate SignNow tailored for treasury departments?

airSlate SignNow offers flexible pricing plans that accommodate the unique needs of treasury departments. These plans provide access to features that streamline document management while ensuring compliance. Customers can choose a subscription that fits their treasury budget and operational requirements.

-

Can airSlate SignNow integrate with existing treasury software?

Yes, airSlate SignNow seamlessly integrates with various existing treasury management software systems and productivity tools. This integration allows you to maintain your current workflows while enhancing them with eSigning capabilities. It ensures that treasury teams can work efficiently across multiple platforms.

-

What features does airSlate SignNow include for treasury professionals?

airSlate SignNow includes features essential for treasury professionals, such as customizable templates, automated reminders, and real-time tracking of document status. These features simplify the signing process and enhance document security, which is critical for treasury operations. In this way, treasury professionals can manage their documents with confidence.

-

How does airSlate SignNow ensure the security of treasury documents?

airSlate SignNow employs advanced security measures to protect treasury documents, including encryption and secure cloud storage. This ensures that sensitive financial information remains confidential and accessible only to authorized personnel. Regulatory compliance is also maintained through strong security protocols.

Get more for Small Business Property Tax Exemption Claim Under

- Images template netwp contentuploadsgym fitness center membership application contract printable form

- New creations boarding school form

- Fillable online valpoymca valparaiso family ymca form

- Sais health pa govcommonpoccontententrance conference worksheet for nha pa gov form

- Kids summer camp registration forms pic

- Updating your cdo personal profile episcopal church arc episcopalchurch form

- Falltastic cheer competition registration form d6nuj45qr4kz7 cloudfront

- Ecetp form

Find out other Small Business Property Tax Exemption Claim Under

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed