Form RP 459 C Application for Partial Tax Exemption for Real Property of Persons with Disabilities and Limited Incomes Tax Year

Understanding the RP 459 c Form for Tax Exemption

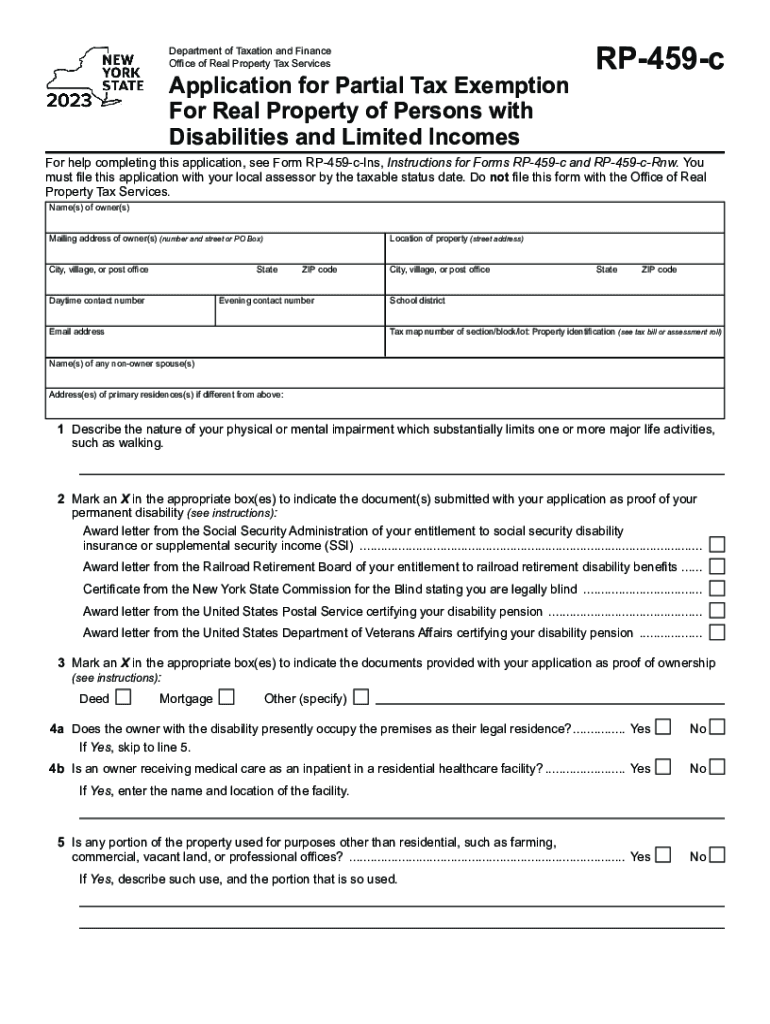

The RP 459 c form is an application designed to provide a partial tax exemption for real property owned by persons with disabilities and limited incomes in the United States. This form allows eligible individuals to reduce their property tax burden, making homeownership more accessible. It is essential for applicants to understand the specific criteria and benefits associated with this exemption to ensure proper completion and submission of the form.

Steps to Complete the RP 459 c Form

Completing the RP 459 c form involves several key steps to ensure accuracy and compliance with state regulations. Applicants should follow these steps:

- Gather necessary documentation, including proof of income and disability status.

- Fill out personal information, including name, address, and property details.

- Provide financial information to demonstrate eligibility based on income limits.

- Sign and date the form to certify that the information provided is accurate.

Double-check all entries for completeness before submission to avoid delays in processing.

Eligibility Criteria for the RP 459 c Form

To qualify for the benefits of the RP 459 c form, applicants must meet specific eligibility criteria. These typically include:

- Being a resident of the state where the property is located.

- Having a disability or being over a certain age, often sixty-five.

- Meeting income limits set by the state to ensure that the exemption is targeted to those in need.

It is important for applicants to review their state’s specific requirements, as they can vary significantly.

Required Documents for Submission

When submitting the RP 459 c form, applicants will need to include several supporting documents to verify their eligibility. Commonly required documents include:

- Proof of income, such as tax returns or pay stubs.

- Documentation of disability, which may include medical records or a disability determination letter.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods

The RP 459 c form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax authority website.

- Mailing a printed copy of the form to the appropriate tax office.

- In-person submission at designated tax offices or local government buildings.

Applicants should check their state’s guidelines for specific submission instructions and deadlines.

Important Dates and Deadlines

Filing deadlines for the RP 459 c form can vary by state and may change annually. It is crucial for applicants to be aware of:

- Annual deadlines for submitting the application to qualify for the current tax year.

- Any specific dates for appeals or reapplications if the initial request is denied.

Staying informed about these dates can help ensure that applicants do not miss out on potential tax savings.

Quick guide on how to complete form rp 459 c application for partial tax exemption for real property of persons with disabilities and limited incomes tax year

Effortlessly Prepare Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without interruptions. Manage Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Edit and eSign Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year with Ease

- Locate Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year and click on Get Form to start.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring document searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rp 459 c application for partial tax exemption for real property of persons with disabilities and limited incomes tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rp 459 c and how does it work with airSlate SignNow?

The rp 459 c is a specific type of document format streamlined for electronic signatures. When you use airSlate SignNow, you can easily upload, send, and eSign rp 459 c documents, ensuring a secure and efficient process for managing your documents.

-

What are the key features of airSlate SignNow for handling rp 459 c documents?

airSlate SignNow offers robust features for managing rp 459 c documents, including customizable templates, automated workflows, and real-time tracking. These tools enhance overall efficiency, making it simple to create, send, and sign documents without any complications.

-

How much does airSlate SignNow cost for services related to rp 459 c documents?

airSlate SignNow provides flexible pricing plans tailored to different business needs, starting as low as $8 per month. This affordable solution enables businesses to manage their rp 459 c documents effectively without exceeding their budget.

-

Can I integrate airSlate SignNow with other applications for managing rp 459 c?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow for rp 459 c documents. By connecting with popular platforms like Google Drive, Dropbox, and Salesforce, you can streamline document management and capture signatures more efficiently.

-

What benefits does airSlate SignNow offer for using rp 459 c in my business?

Using airSlate SignNow for your rp 459 c documents can signNowly reduce turnaround times and improve overall productivity. Its intuitive interface and automation capabilities help businesses speed up the signing process, allowing you to focus on more critical tasks.

-

Is airSlate SignNow secure for signing rp 459 c documents?

Absolutely! airSlate SignNow ensures the highest level of security for your rp 459 c documents. With features such as SSL encryption and multi-factor authentication, you can trust that your signed documents are safe and confidential.

-

How can I get started with airSlate SignNow for rp 459 c documents?

Getting started with airSlate SignNow for your rp 459 c documents is easy! Simply visit our website, sign up for a free trial, and start uploading your documents. Our user-friendly interface guides you through the eSigning process quickly.

Get more for Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year

- Youth sports physical examination form

- Sample script for article 32 preliminary hearing form

- Application processing and summary record recruit form

- Total force learning form

- Medcom forms 200685

- Map evaluation revised per tecom form

- Cyber branch questionnaire form

- Department of the air force 86th airlift wing form

Find out other Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself