Credit for Nonresident or Part Year ResidentIowa 2021

What is the Credit For Nonresident Or Part Year Resident Iowa

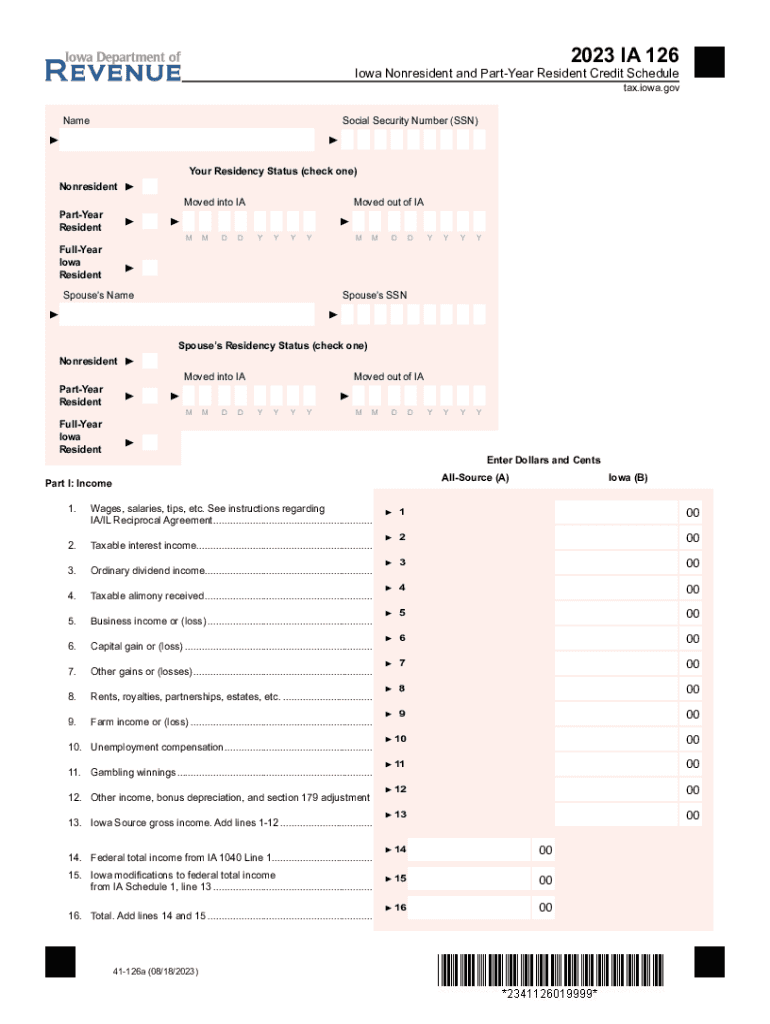

The Credit For Nonresident Or Part Year Resident Iowa is a tax benefit designed for individuals who do not reside in Iowa for the entire year but have earned income from Iowa sources. This credit allows eligible taxpayers to reduce their Iowa tax liability based on the income earned while residing in the state. It is particularly beneficial for those who have moved in or out of Iowa during the tax year, ensuring they are not taxed on income earned outside the state.

How to use the Credit For Nonresident Or Part Year Resident Iowa

To utilize the Credit For Nonresident Or Part Year Resident Iowa, taxpayers must first determine their eligibility based on the income earned during the period they resided in Iowa. After confirming eligibility, individuals should complete the appropriate Iowa tax forms, including the nonresident or part-year resident return. The credit is calculated based on the proportion of Iowa-source income to total income, allowing for a fair adjustment of taxes owed.

Steps to complete the Credit For Nonresident Or Part Year Resident Iowa

Completing the Credit For Nonresident Or Part Year Resident Iowa involves several key steps:

- Gather all necessary income documentation, including W-2s and 1099s.

- Determine the period of residency in Iowa and identify Iowa-source income.

- Complete the Iowa nonresident or part-year resident tax return, ensuring to include the credit calculation.

- Review the completed forms for accuracy before submission.

- Submit the forms by the designated filing deadline, either electronically or via mail.

Eligibility Criteria

To qualify for the Credit For Nonresident Or Part Year Resident Iowa, taxpayers must meet specific criteria. Individuals must have earned income from Iowa sources during the tax year while being classified as a nonresident or part-year resident. Additionally, they should not have been a full-year resident of Iowa during the same tax year. It is essential to provide accurate documentation of residency and income to support the claim for the credit.

Required Documents

When applying for the Credit For Nonresident Or Part Year Resident Iowa, certain documents are necessary to substantiate the claim. Taxpayers should prepare the following:

- W-2 forms showing Iowa wages.

- 1099 forms for any self-employment or other income earned in Iowa.

- Proof of residency, such as lease agreements or utility bills, indicating the duration of stay in Iowa.

- Completed Iowa nonresident or part-year resident tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Credit For Nonresident Or Part Year Resident Iowa typically align with the general Iowa tax filing deadlines. Taxpayers should be aware that the deadline for submitting tax returns is usually April 30 of the following year. If additional time is needed, an extension may be requested, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Quick guide on how to complete credit for nonresident or part year residentiowa

Effortlessly prepare Credit For Nonresident Or Part Year ResidentIowa on any device

Digital document management has gained popularity among both enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Credit For Nonresident Or Part Year ResidentIowa on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Credit For Nonresident Or Part Year ResidentIowa effortlessly

- Obtain Credit For Nonresident Or Part Year ResidentIowa and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Credit For Nonresident Or Part Year ResidentIowa and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit for nonresident or part year residentiowa

Create this form in 5 minutes!

How to create an eSignature for the credit for nonresident or part year residentiowa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit For Nonresident Or Part Year Resident Iowa?

The Credit For Nonresident Or Part Year Resident Iowa is a tax benefit that allows eligible individuals to receive a credit on their tax return based on the amount of income earned in Iowa. This credit is specifically designed for those who do not reside in Iowa for the entire tax year, thus making it easier for them to manage their tax obligations.

-

How do I qualify for the Credit For Nonresident Or Part Year Resident Iowa?

To qualify for the Credit For Nonresident Or Part Year Resident Iowa, you must file your Iowa tax return and meet specific residency criteria. Typically, this includes showing proof of income earned while residing in or working in Iowa during the taxable year.

-

What information is required to apply for the Credit For Nonresident Or Part Year Resident Iowa?

When applying for the Credit For Nonresident Or Part Year Resident Iowa, you'll need to provide information including your residency status, income earned in Iowa, and any related documentation to support your claim. It's essential to have all necessary records to ensure a smooth application process.

-

Is there a fee associated with applying for the Credit For Nonresident Or Part Year Resident Iowa?

There is generally no fee directly associated with applying for the Credit For Nonresident Or Part Year Resident Iowa. However, you may incur costs if you choose to use a tax professional to assist with your application. airSlate SignNow can help streamline document preparation at a cost-effective rate.

-

How can airSlate SignNow assist with the Credit For Nonresident Or Part Year Resident Iowa process?

airSlate SignNow enables users to efficiently prepare and eSign documents related to the Credit For Nonresident Or Part Year Resident Iowa application. Our platform simplifies the entire documentation process, ensuring you don’t miss any critical steps or information required for your credit.

-

What are the benefits of obtaining the Credit For Nonresident Or Part Year Resident Iowa?

The benefits of obtaining the Credit For Nonresident Or Part Year Resident Iowa include potentially lowering your tax bill and receiving a refund on taxes paid while you were a nonresident. This credit can provide signNow financial relief for eligible individuals and make tax season less stressful.

-

Are there any integrations that enhance the process for Credit For Nonresident Or Part Year Resident Iowa?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making the process of applying for the Credit For Nonresident Or Part Year Resident Iowa more efficient. These integrations allow for easier data management and streamline the preparation of necessary documents.

Get more for Credit For Nonresident Or Part Year ResidentIowa

- Travel state govcontenttraveldna relationship testing procedures travel form

- Application for enrollment mille lacs mlbo dev form

- Thinking report examples form

- Police lansing form

- Standard loan contract template form

- Standard for service contract template form

- Standard occupation contract template form

- Standard model contract template form

Find out other Credit For Nonresident Or Part Year ResidentIowa

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe