W 4MN, Minnesota Withholding AllowanceExemption Certificate Form

What is the W-4MN, Minnesota Withholding Allowance Exemption Certificate

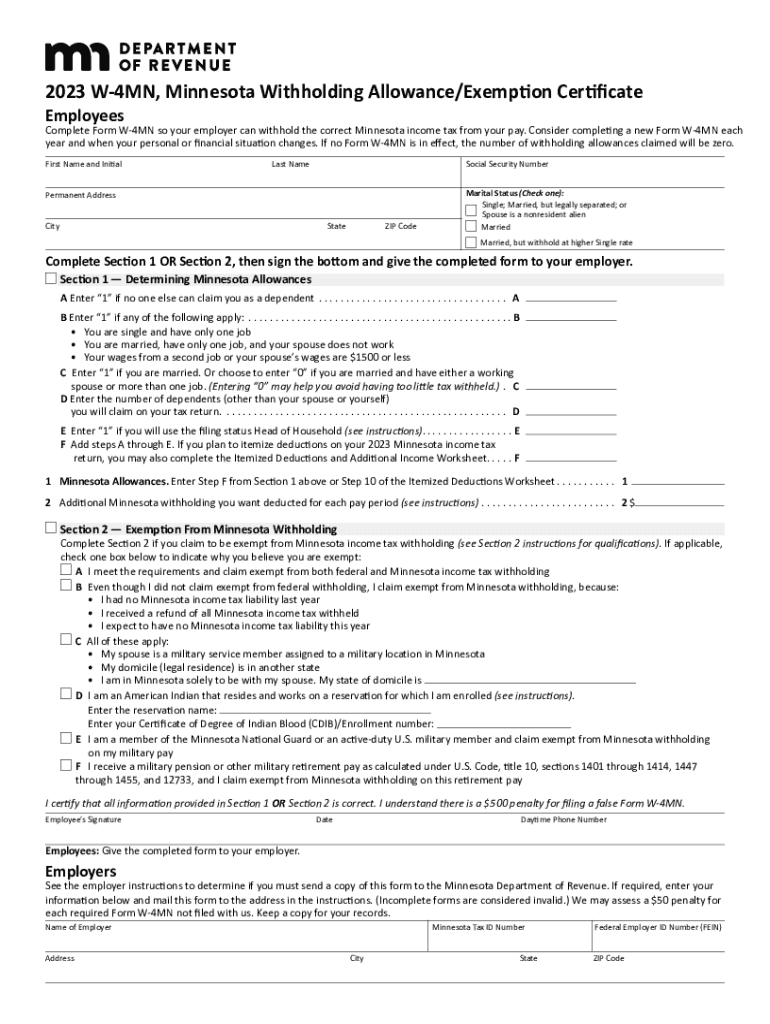

The W-4MN, also known as the Minnesota Withholding Allowance Exemption Certificate, is a form used by employees in Minnesota to determine the amount of state income tax to withhold from their paychecks. This form allows employees to claim allowances based on their personal circumstances, such as dependents and other tax credits. By accurately completing the W-4MN, employees can ensure that the correct amount of state tax is withheld, helping to avoid underpayment or overpayment at tax time.

Steps to Complete the W-4MN, Minnesota Withholding Allowance Exemption Certificate

Completing the W-4MN involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Allowances: Calculate the number of allowances you are eligible to claim. This may include yourself, your spouse, and any dependents.

- Additional Withholding: If you wish to have additional amounts withheld from your paycheck, specify that amount on the form.

- Signature: Sign and date the form to validate your submission.

How to Obtain the W-4MN, Minnesota Withholding Allowance Exemption Certificate

The W-4MN form can be obtained through several means:

- Visit the Minnesota Department of Revenue website to download a printable version.

- Request a copy from your employer’s human resources or payroll department.

- Access the form through tax preparation software that includes state tax forms.

Key Elements of the W-4MN, Minnesota Withholding Allowance Exemption Certificate

Understanding the key elements of the W-4MN is essential for accurate completion:

- Personal Information: Essential for identification and processing.

- Allowances Claimed: Determines the amount of state tax withheld.

- Additional Withholding: Provides flexibility for those who anticipate owing more taxes.

- Signature: Confirms the accuracy of the information provided.

Legal Use of the W-4MN, Minnesota Withholding Allowance Exemption Certificate

The W-4MN is a legally recognized document in Minnesota that must be completed by employees for proper tax withholding. Employers are required to keep this form on file for each employee and use it to calculate the appropriate state income tax deductions from wages. Failure to provide accurate information can lead to penalties for both employees and employers.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines associated with the W-4MN:

- Employees should submit the W-4MN to their employer upon starting a new job or when their personal circumstances change.

- Employers must process the W-4MN and apply the withholding allowances as soon as possible, typically within one pay period.

- Annual tax filing deadlines for state income tax returns generally fall on April 15, unless extended.

Quick guide on how to complete w 4mn minnesota withholding allowanceexemption certificate

Prepare W 4MN, Minnesota Withholding AllowanceExemption Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed materials, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage W 4MN, Minnesota Withholding AllowanceExemption Certificate on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign W 4MN, Minnesota Withholding AllowanceExemption Certificate without hassle

- Obtain W 4MN, Minnesota Withholding AllowanceExemption Certificate and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign W 4MN, Minnesota Withholding AllowanceExemption Certificate and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 4mn minnesota withholding allowanceexemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w 4mn and why is it important for businesses?

W 4mn is a crucial document for employees that outlines tax withholding from their paychecks. Businesses must ensure accurate w 4mn submissions to comply with tax regulations and avoid penalties. Using airSlate SignNow simplifies the process, allowing for efficient eSigning and document management.

-

How can airSlate SignNow help in completing a w 4mn form?

AirSlate SignNow provides a user-friendly platform for completing and signing w 4mn forms electronically. By streamlining the process, it reduces the chances of errors and ensures that the forms are submitted in a timely manner. Businesses can also track the status of each w 4mn form for improved visibility.

-

What features does airSlate SignNow offer for managing w 4mn documents?

AirSlate SignNow offers various features that are beneficial for managing w 4mn documents, including customizable templates, secure cloud storage, and real-time collaboration tools. These features make it easier for businesses to execute and archive w 4mn forms, enhancing overall efficiency. Additionally, the platform is designed to protect sensitive information.

-

Is airSlate SignNow cost-effective for businesses handling w 4mn?

Yes, airSlate SignNow is a cost-effective solution for businesses handling w 4mn documents. The pricing plans are designed to be budget-friendly while offering robust functionality that meets the needs of various businesses. Investing in airSlate SignNow can lead to signNow time and cost savings in document management.

-

Can airSlate SignNow integrate with other software for processing w 4mn?

Absolutely! AirSlate SignNow seamlessly integrates with various HR and accounting software, making it easy to incorporate w 4mn processes into your existing workflows. This integration ensures that businesses can manage their w 4mn documents alongside other essential operational tasks without disruption.

-

How secure is airSlate SignNow for handling sensitive w 4mn information?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive w 4mn information. The platform meets industry standards for data protection, giving businesses peace of mind as they manage critical documents. You can trust that your w 4mn forms are safe and secure.

-

What kind of support does airSlate SignNow offer for w 4mn users?

AirSlate SignNow provides comprehensive support for users managing w 4mn documents. This includes access to help articles, tutorial videos, and dedicated customer support representatives who can assist with any queries. The goal is to ensure that users can effectively utilize the platform to manage their w 4mn forms.

Get more for W 4MN, Minnesota Withholding AllowanceExemption Certificate

- Fax completed requisition to form

- Cbc eligibility form assessor report be completed

- Maintenance contract hometalents net form

- Maintenance contract 424639953 form

- Spa membership contract template 787755580 form

- Spa contract template form

- Spay neuter contract template 787755656 form

- Speak contract template form

Find out other W 4MN, Minnesota Withholding AllowanceExemption Certificate

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy