Minnesota M8 Form Fill Out and Sign

What is the Minnesota M8 Form?

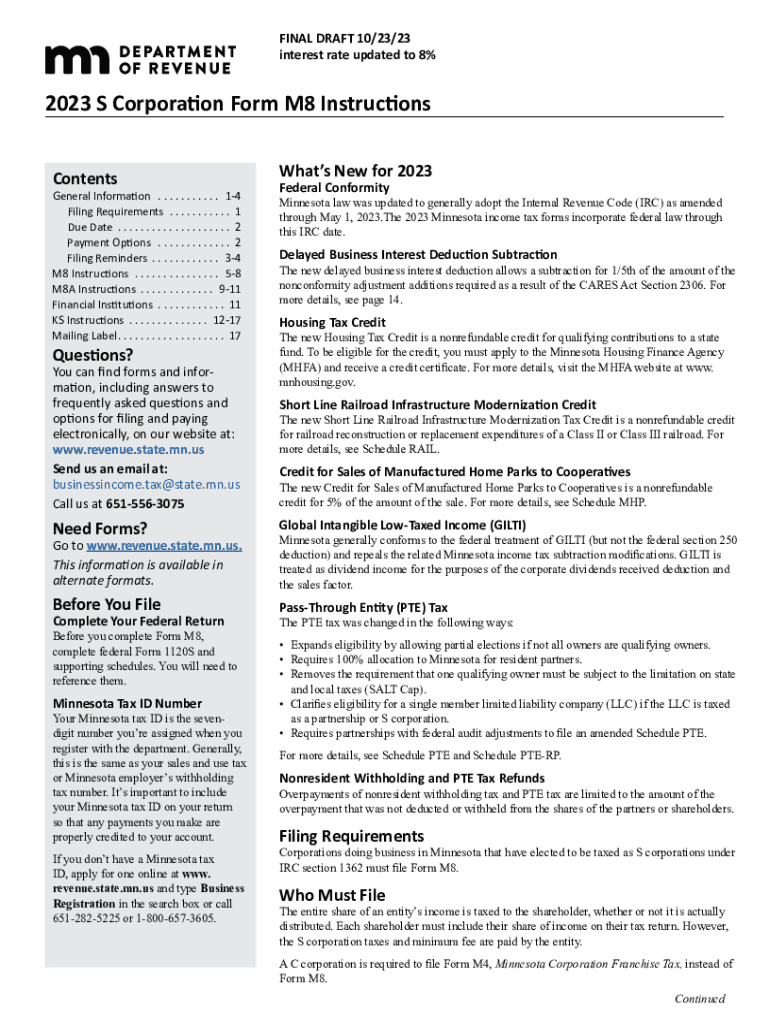

The Minnesota M8 form is a crucial document used for reporting certain tax-related information in the state of Minnesota. Specifically, it is designed for individuals who are seeking to claim benefits or credits associated with their tax filings. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and maximizing potential benefits.

Steps to Complete the Minnesota M8 Form

Completing the Minnesota M8 form involves several key steps:

- Gather all necessary information, including personal identification details and relevant financial data.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out the form accurately, ensuring that all fields are completed as needed.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the guidelines provided, either electronically or via mail.

How to Obtain the Minnesota M8 Form

The Minnesota M8 form can be obtained through several methods:

- Visit the official Minnesota Department of Revenue website, where the form is available for download.

- Request a physical copy from local tax offices or state revenue offices.

- Consult with tax professionals who may provide the form as part of their services.

Legal Use of the Minnesota M8 Form

The Minnesota M8 form is legally required for individuals claiming specific tax benefits or credits. It is important to use this form in accordance with state tax laws to avoid any legal repercussions. Proper use ensures that taxpayers receive the benefits they are entitled to while maintaining compliance with Minnesota’s tax regulations.

Filing Deadlines for the Minnesota M8 Form

Timely submission of the Minnesota M8 form is critical. The filing deadlines typically align with the state tax return deadlines. It is advisable to check the Minnesota Department of Revenue's official announcements for the most current deadlines, as these can vary from year to year. Missing these deadlines may result in penalties or loss of benefits.

Required Documents for the Minnesota M8 Form

When completing the Minnesota M8 form, several documents may be required to support the information provided. Commonly needed documents include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation of any deductions or credits being claimed.

- Identification documents, including Social Security numbers.

Form Submission Methods for the Minnesota M8 Form

The Minnesota M8 form can be submitted through various methods to accommodate different preferences:

- Online submission via the Minnesota Department of Revenue’s e-filing system.

- Mailing a completed paper form to the designated state tax office.

- In-person submission at local tax offices, if available.

Quick guide on how to complete minnesota m8 form fill out and sign

Prepare Minnesota M8 Form Fill Out And Sign effortlessly on any device

Digital document organization has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without any holdups. Manage Minnesota M8 Form Fill Out And Sign on any device through airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Minnesota M8 Form Fill Out And Sign with ease

- Locate Minnesota M8 Form Fill Out And Sign and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and possesses the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost documents, tiring form searches, or errors that necessitate printing new paper copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota M8 Form Fill Out And Sign and maintain seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota m8 form fill out and sign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are mn m8 instructions for using airSlate SignNow?

The mn m8 instructions provide detailed guidance on how to effectively utilize airSlate SignNow's features. They cover everything from setting up your account to sending and signing documents securely. Following these instructions will help ensure a smooth experience with the platform.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. The mn m8 instructions will guide you through the different pricing tiers, which offer a range of features suitable for businesses of all sizes. It's designed to be a cost-effective solution for eSigning needs.

-

What features are included with airSlate SignNow?

AirSlate SignNow offers various features, including document templates, eSignature integrations, and mobile access. The mn m8 instructions highlight how to access and utilize these features effectively to streamline your document workflow. It's tailored for businesses looking for an efficient signing process.

-

How does airSlate SignNow enhance collaboration?

AirSlate SignNow enhances collaboration by allowing multiple users to sign documents and leave comments in real-time. The mn m8 instructions explain how to invite others to collaborate on a document, ensuring everyone stays on the same page. This fosters better communication and efficiency in team projects.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and Dropbox. The mn m8 instructions detail how to set up these integrations, allowing you to enhance your document management and workflow processes. This flexibility aids in achieving a complete digital solution.

-

What are the security features of airSlate SignNow?

Security is a top priority for airSlate SignNow, which includes features like encryption and secure cloud storage. The mn m8 instructions cover these security aspects, ensuring your documents are safe and compliant with regulations. It's crucial for businesses that handle sensitive information.

-

Is there a mobile app for airSlate SignNow?

Yes, there is a mobile app available for airSlate SignNow, which allows you to send and sign documents on the go. The mn m8 instructions guide you on how to download and navigate the app effectively. This mobility ensures you're never out of touch with your document tasks.

Get more for Minnesota M8 Form Fill Out And Sign

- Uscg sar addendum form

- Su plan de accin contra el eccema form

- Form 113627 insurance and annuity change of ownership due to death use this form for riversourceinsurance or annuity policies

- Solar company contract template form

- Sole proprietor contract template form

- Solar sale contract template form

- Sole trader contract template form

- Sole proprietorship contract template form

Find out other Minnesota M8 Form Fill Out And Sign

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed