M4X, Amended Franchise Tax ReturnClaim for Refund Form

Understanding the M4X, Amended Franchise Tax Return Claim For Refund

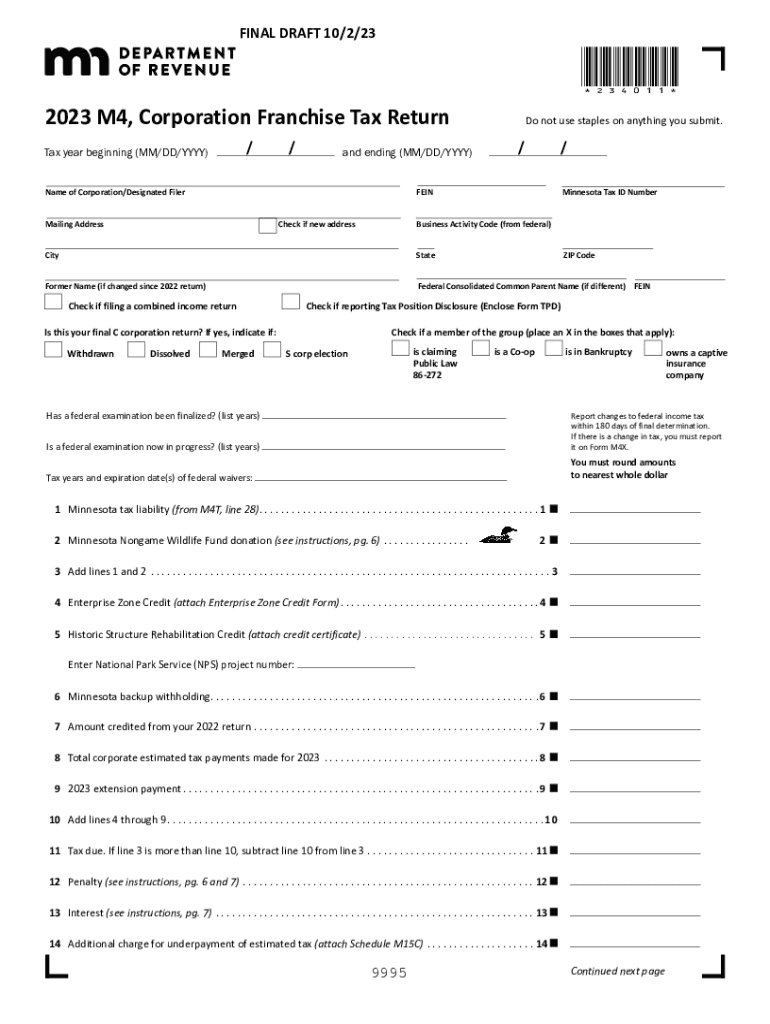

The M4X, Amended Franchise Tax Return Claim For Refund, is a crucial document for businesses that need to amend previously filed franchise tax returns in the United States. This form allows entities to correct errors or omissions that may have occurred in their original submissions. By filing the M4X, businesses can seek refunds for overpaid taxes or adjust their tax liabilities based on updated financial information. It is essential for maintaining compliance with state tax regulations and ensuring accurate tax reporting.

Steps to Complete the M4X, Amended Franchise Tax Return Claim For Refund

Completing the M4X requires careful attention to detail to ensure accuracy and compliance. The following steps outline the process:

- Gather all relevant financial documents and records related to the original tax return.

- Carefully review the original return to identify specific errors or changes needed.

- Fill out the M4X form, ensuring that all required fields are completed accurately.

- Attach any supporting documentation that substantiates the claim for refund.

- Review the completed form for accuracy before submission.

- Submit the M4X form according to the specified submission methods.

Legal Use of the M4X, Amended Franchise Tax Return Claim For Refund

The M4X form is legally recognized as a means for businesses to amend their franchise tax returns. It is important to use this form in accordance with state tax laws to avoid potential penalties. Filing the M4X correctly ensures that businesses can rectify previous errors and maintain compliance with tax obligations. Understanding the legal implications of amending tax returns is crucial for all business entities.

Eligibility Criteria for Filing the M4X, Amended Franchise Tax Return Claim For Refund

To file the M4X, businesses must meet specific eligibility criteria. Generally, the following conditions apply:

- The business must have previously filed a franchise tax return that requires amendment.

- The amendment must be based on legitimate reasons such as corrected income, deductions, or credits.

- The claim for refund must be made within the time frame established by state tax regulations.

Required Documents for the M4X, Amended Franchise Tax Return Claim For Refund

When filing the M4X, it is essential to include all necessary documentation to support the amendment. Required documents typically include:

- A copy of the original franchise tax return.

- Any documentation that verifies the changes being made, such as revised financial statements.

- Proof of payment for any taxes previously submitted, if applicable.

Form Submission Methods for the M4X, Amended Franchise Tax Return Claim For Refund

The M4X can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax portal.

- Mailing a hard copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete m4x amended franchise tax returnclaim for refund

Manage M4X, Amended Franchise Tax ReturnClaim For Refund effortlessly on any device

Web-based document administration has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without complications. Manage M4X, Amended Franchise Tax ReturnClaim For Refund on any device using airSlate SignNow's Android or iOS applications, and simplify any document-related task today.

Steps to modify and electronically sign M4X, Amended Franchise Tax ReturnClaim For Refund effortlessly

- Find M4X, Amended Franchise Tax ReturnClaim For Refund and click on Get Form to begin.

- Utilize the tools at your disposal to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method for sending your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Edit and electronically sign M4X, Amended Franchise Tax ReturnClaim For Refund to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m4x amended franchise tax returnclaim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is m4 corporate and how does it benefit businesses?

m4 corporate is a digital solution provided by airSlate SignNow that enables businesses to efficiently manage document signing and approvals. With its streamlined processes, m4 corporate helps organizations save time and reduce paper waste, ultimately increasing productivity and enhancing customer experience.

-

How much does the m4 corporate solution cost?

The pricing for m4 corporate varies depending on the number of users and specific features required by your business. airSlate SignNow offers competitive pricing tailored to fit various business needs, ensuring that you receive excellent value for your investment.

-

What features does m4 corporate offer for document management?

m4 corporate includes features like customizable templates, real-time tracking, and automated workflows to simplify the document management process. Additionally, users can ensure document security with advanced encryption and compliance measures for sensitive information.

-

Can m4 corporate integrate with other software applications?

Yes, m4 corporate seamlessly integrates with a variety of popular business applications, such as CRM systems, cloud storage platforms, and productivity tools. This integration capability enhances your workflow efficiency and allows for easier access to documents across different platforms.

-

Is m4 corporate suitable for small businesses?

Absolutely! m4 corporate is designed to cater to businesses of all sizes, including small businesses. With its user-friendly interface and cost-effective pricing, small businesses can harness the power of digital signatures and document management without the complexity of traditional processes.

-

What are the benefits of using m4 corporate for remote teams?

m4 corporate is particularly beneficial for remote teams as it allows for seamless collaboration and quick access to essential documents from anywhere. This flexibility promotes efficient communication and ensures that team members can stay productive, regardless of their location.

-

How secure is the m4 corporate solution?

m4 corporate employs industry-standard security measures, including end-to-end encryption and secure cloud storage, to protect your documents and sensitive information. With airSlate SignNow, you can trust that your data is safe and compliant with relevant regulations.

Get more for M4X, Amended Franchise Tax ReturnClaim For Refund

- T his form may be used for annual reporting of regularly scheduled sos ok

- Take in depoe bays rural urban sights statesman journal form

- Marketing fee agreement form

- Shingles shingrix vaccine consent form

- Content creator contract template form

- Software project contract template form

- Software sale contract template form

- Software service contract template form

Find out other M4X, Amended Franchise Tax ReturnClaim For Refund

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online