2643S Missouri Special Events Application Form

What is the Missouri Form 2643S Special Events Application

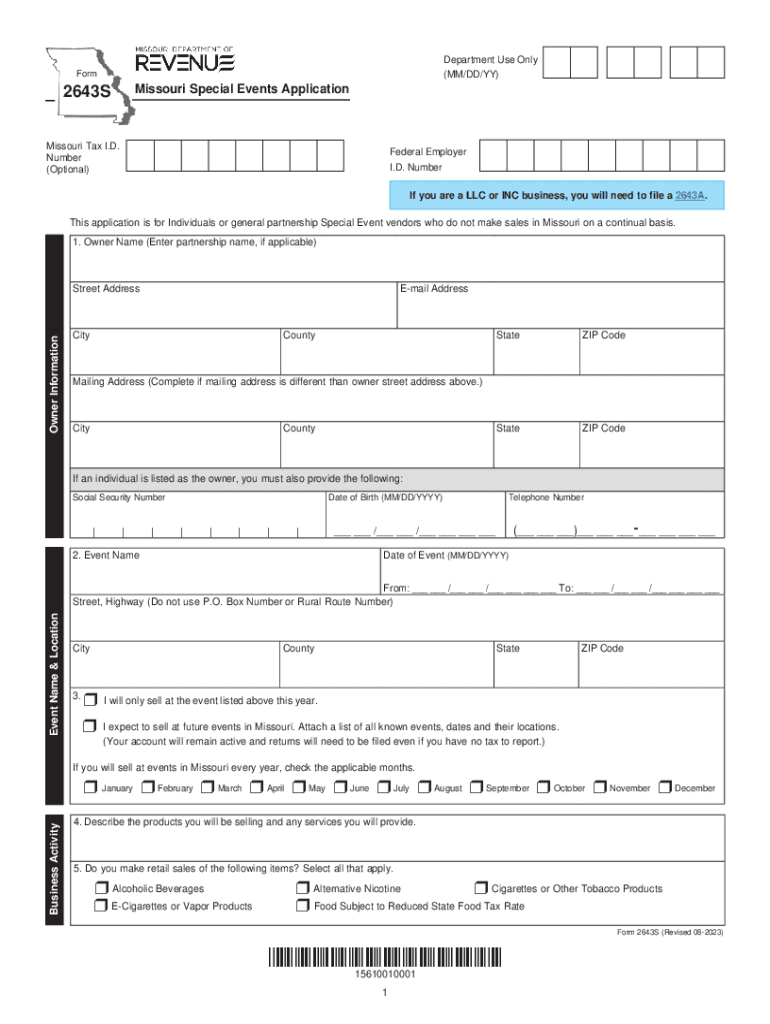

The Missouri Form 2643S, also known as the Missouri Special Events Application, is a crucial document for individuals or organizations planning to host special events within the state. This form is designed to ensure compliance with state regulations and to facilitate the necessary permits for events that may require specific approvals, such as festivals, parades, or public gatherings. By submitting this application, event organizers can provide essential details about the event, including its location, duration, and expected attendance, which helps state authorities assess the impact and necessary resources for public safety and coordination.

How to Obtain the Missouri Form 2643S Special Events Application

To obtain the Missouri Form 2643S, individuals can visit the official website of the Missouri Department of Revenue or the relevant local government office that oversees special events. The form is typically available for download in a PDF format, allowing users to print it for completion. In some cases, local offices may provide physical copies upon request. Additionally, it is advisable to check for any specific local regulations that may apply to the event, as some municipalities may have their own requirements or variations of the form.

Steps to Complete the Missouri Form 2643S Special Events Application

Completing the Missouri Form 2643S involves several steps to ensure all necessary information is accurately provided. Here is a general outline of the process:

- Download the form from the Missouri Department of Revenue or local government website.

- Fill in the required details, including the event name, date, location, and organizer information.

- Provide an estimated number of attendees and any additional services needed, such as security or medical assistance.

- Review the form for completeness and accuracy.

- Submit the completed form to the appropriate local authority, either online, by mail, or in person, as specified by local guidelines.

Key Elements of the Missouri Form 2643S Special Events Application

The Missouri Form 2643S includes several key elements that are essential for the approval process. These elements typically encompass:

- Event Details: Name, date, and location of the event.

- Organizer Information: Contact details and background of the organizing entity.

- Attendance Estimates: Expected number of participants and attendees.

- Safety Measures: Plans for crowd control, security, and medical services, if applicable.

- Permits Required: Any additional permits that may be necessary for the event, such as alcohol licenses or food vendor permits.

Eligibility Criteria for the Missouri Form 2643S Special Events Application

Eligibility to submit the Missouri Form 2643S generally requires that the event organizer is a legal entity, such as an individual, business, or nonprofit organization. Additionally, the event must be planned to take place within Missouri and should not violate any local ordinances or state laws. It is essential for applicants to review specific eligibility requirements set forth by local authorities, as these can vary significantly depending on the nature of the event and its location.

Form Submission Methods for the Missouri Form 2643S Special Events Application

Submitting the Missouri Form 2643S can be done through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many local jurisdictions may offer an online portal for submitting the form electronically.

- Mail: Applicants can send the completed form via postal service to the designated local authority.

- In-Person: Submitting the form directly at the local government office may also be an option, allowing for immediate feedback or clarification.

Quick guide on how to complete 2643s missouri special events application

Complete 2643S Missouri Special Events Application seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage 2643S Missouri Special Events Application on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign 2643S Missouri Special Events Application without hassle

- Obtain 2643S Missouri Special Events Application and click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to retain your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in several clicks from any device of your choosing. Modify and eSign 2643S Missouri Special Events Application and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2643s missouri special events application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri Form 2643s?

Missouri Form 2643s is a specific document used for filing purposes in the state of Missouri. It is crucial for businesses and individuals to understand how to correctly fill out and submit this form to stay compliant with state regulations.

-

How can airSlate SignNow help with completing Missouri Form 2643s?

airSlate SignNow simplifies the process of completing Missouri Form 2643s by providing a user-friendly platform for electronic signatures and document management. You can easily fill out the form and eSign it, making it faster and more efficient to submit.

-

Is there a cost associated with using airSlate SignNow for Missouri Form 2643s?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs, including options for businesses processing Missouri Form 2643s. Choosing the right plan can help ensure that you have access to all necessary features without overspending.

-

Can I store my completed Missouri Form 2643s on airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your completed documents, including Missouri Form 2643s. This feature allows you to access your forms anytime, ensuring that you have relevant documents readily available.

-

What are the benefits of using airSlate SignNow for Missouri Form 2643s?

Using airSlate SignNow for Missouri Form 2643s greatly enhances your efficiency and compliance. The platform allows for quick customization, streamlined signing processes, and audit trails, ensuring that every step is documented and accessible.

-

Does airSlate SignNow integrate with other software for managing Missouri Form 2643s?

Yes, airSlate SignNow integrates with numerous software tools that can help you manage Missouri Form 2643s effectively. This includes CRMs and document storage systems, enabling smooth workflows and better document handling.

-

Is airSlate SignNow user-friendly for first-time users filling out Missouri Form 2643s?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, making it an excellent choice for first-time users filling out Missouri Form 2643s. The interface guides you through each step, ensuring you can complete and submit your forms with ease.

Get more for 2643S Missouri Special Events Application

- Biloxi seafood festival vendor application form

- Placing events on a timeline worksheet form

- Transfer credit re evaluation appeal form pdf george mason gmu

- Additional details form 6

- Form 9 1909 employee financial interests certification ja usgs

- Cid complaint form

- Logo design graphic design contract template form

- Logo ownership contract template form

Find out other 2643S Missouri Special Events Application

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself