Collector of Revenue HomepageGregory F X Daly Form

Understanding the Collector of Revenue Homepage

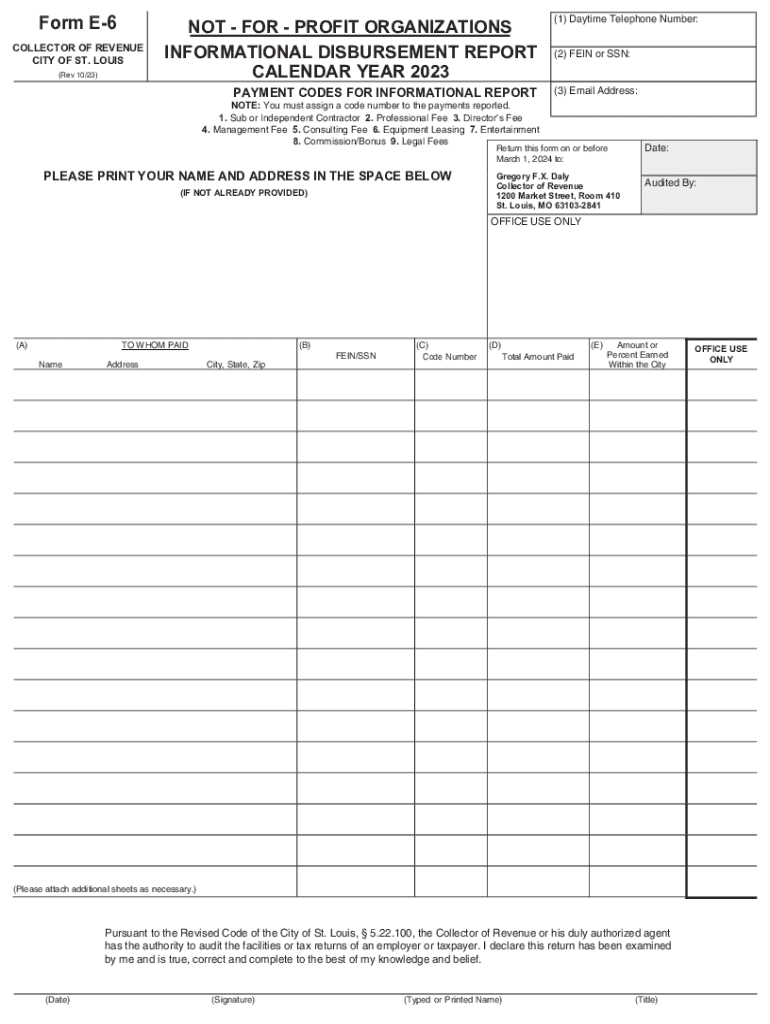

The Collector of Revenue Homepage serves as a central hub for individuals and businesses in Missouri to manage their tax-related responsibilities. This platform provides essential information regarding property taxes, business licenses, and other revenue-related services. Users can navigate through various sections to access forms, guidelines, and contact information for assistance. The homepage is designed to be user-friendly, ensuring that all necessary resources are readily available to meet the needs of Missouri residents.

Steps to Complete the Collector of Revenue Homepage Tasks

To effectively utilize the Collector of Revenue Homepage, users can follow these steps:

- Visit the homepage and familiarize yourself with the layout.

- Identify the specific service or information you need, such as tax payment options or form downloads.

- Follow the links provided to access detailed instructions or forms.

- Complete any required forms accurately, ensuring all necessary information is included.

- Submit the forms electronically or via mail, as specified on the site.

Legal Use of the Collector of Revenue Homepage

The Collector of Revenue Homepage is designed to comply with state regulations and legal requirements. Users must ensure that they are using the site in accordance with Missouri laws regarding tax payments and submissions. This includes understanding the deadlines for property tax payments and the proper channels for submitting forms. Adhering to these legal guidelines helps prevent penalties and ensures compliance with state tax laws.

Required Documents for Tax Submission

When utilizing the services on the Collector of Revenue Homepage, certain documents may be required for tax submissions. Commonly needed documents include:

- Proof of identity, such as a driver's license or state ID.

- Property tax statements or business license applications.

- Any previous tax returns that may be relevant to the current submission.

Having these documents ready can streamline the process and reduce the likelihood of errors during submission.

Form Submission Methods

The Collector of Revenue Homepage offers multiple methods for submitting forms. Users can choose between:

- Online submission through the website, which is often the fastest method.

- Mailing physical forms to the designated address provided on the site.

- In-person submissions at local government offices, if applicable.

Each method has its own set of guidelines, so users should review the instructions carefully to ensure successful submission.

Eligibility Criteria for Tax Services

Eligibility for various tax services on the Collector of Revenue Homepage may depend on factors such as property ownership, business status, or residency. Generally, residents of Missouri who own property or operate a business within the state are eligible to access the services provided. It is important to review the specific eligibility requirements for each service to avoid any complications during the application process.

Quick guide on how to complete collector of revenue homepagegregory f x daly

Effortlessly Prepare Collector Of Revenue HomepageGregory F X Daly on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Collector Of Revenue HomepageGregory F X Daly from any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Collector Of Revenue HomepageGregory F X Daly with Ease

- Obtain Collector Of Revenue HomepageGregory F X Daly and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers for that specific need.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Collector Of Revenue HomepageGregory F X Daly and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collector of revenue homepagegregory f x daly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri e-signing and how does it work?

Missouri e-signing refers to the electronic signing of documents that comply with Missouri state laws. Using airSlate SignNow, businesses can securely sign, send, and store their documents online. This easy-to-use solution streamlines the signing process, making it faster and more efficient.

-

How much does airSlate SignNow cost for Missouri e-signature services?

AirSlate SignNow offers competitive pricing plans for Missouri e-signature services, tailored to various business sizes and needs. Pricing begins with a free trial, followed by subscription plans that provide access to advanced features such as templates and integrations. This cost-effective solution ensures that businesses in Missouri can manage their signing needs without breaking the bank.

-

What features does airSlate SignNow offer for users in Missouri?

AirSlate SignNow provides a variety of features tailored for Missouri users, including customizable templates, bulk sending, and integration with popular apps. Additionally, the platform ensures compliance with Missouri e-signing laws, offering users peace of mind. These features are designed to enhance productivity and streamline document management.

-

Is airSlate SignNow easy to use for Missouri businesses?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, catering specifically to Missouri businesses. Its intuitive interface allows users to navigate easily through the signing process, making it ideal for individuals and teams alike. Training is minimal, enabling quick adoption and immediate benefits.

-

Can airSlate SignNow integrate with other applications used in Missouri?

Yes, airSlate SignNow offers seamless integration with a wide range of applications frequently used by Missouri businesses. By connecting with tools like Google Workspace, Salesforce, and Microsoft Office, users can enhance their workflow and document management efficiency. These integrations empower businesses to streamline their processes further.

-

What are the benefits of using airSlate SignNow for Missouri e-signing?

Using airSlate SignNow for Missouri e-signing brings several benefits, including faster turnaround times, reduced paperwork, and enhanced security. As it complies with Missouri e-signature laws, businesses can trust the integrity of their signed documents. Additionally, the solution signNowly cuts costs and improves customer satisfaction.

-

Are there any legal considerations for e-signing documents in Missouri?

Yes, Missouri has specific laws governing e-signatures that airSlate SignNow complies with. The Missouri Uniform Electronic Transactions Act (MUETA) ensures that electronic signatures hold the same legal weight as traditional signatures. By using airSlate SignNow, businesses can confidently sign documents while staying compliant with Missouri regulations.

Get more for Collector Of Revenue HomepageGregory F X Daly

- Indiana notice form

- Interrogatories 481379561 form

- 10 day notice form

- Indiana assignment of mortgage by corporate mortgage holder form

- Indiana agreed written termination of lease by landlord and tenant form

- Indiana notice of dishonored check civil keywords bad check bounced check form

- Indiana agreement form

- Indiana residential rental lease application form

Find out other Collector Of Revenue HomepageGregory F X Daly

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation