Changes to the Alternative Minimum Tax as Proposed in Form

Understanding the Changes to the Alternative Minimum Tax

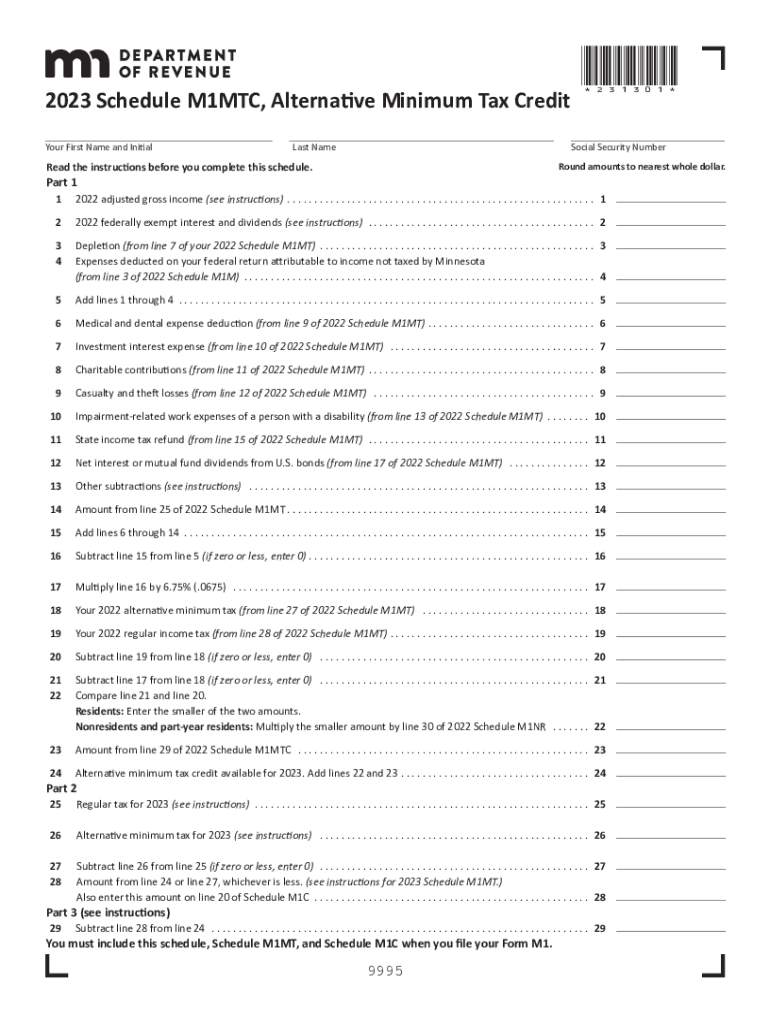

The Changes to the Alternative Minimum Tax (AMT) as proposed in recent legislation aim to adjust how this tax is calculated and applied to taxpayers. The AMT was originally designed to ensure that high-income earners pay a minimum amount of tax, regardless of deductions and credits that may significantly reduce their taxable income. The proposed changes may include adjustments in income thresholds, exemption amounts, and the types of income that are subject to the AMT. These modifications can impact both individual taxpayers and businesses, making it essential to understand the implications of these changes on your tax situation.

Steps to Complete the Changes to the Alternative Minimum Tax

Completing the necessary forms related to the Changes to the Alternative Minimum Tax involves several key steps. First, gather all relevant financial documents, including income statements, deductions, and any applicable credits. Next, review the updated AMT guidelines to determine how the changes affect your tax calculations. After that, fill out the necessary forms accurately, ensuring that you apply the new thresholds and exemptions correctly. Finally, submit your completed forms by the designated deadline to avoid penalties. Keeping detailed records throughout this process can also help in case of audits or inquiries from the IRS.

Legal Use of the Changes to the Alternative Minimum Tax

The legal implications of the Changes to the Alternative Minimum Tax are significant for compliance and reporting. Taxpayers must adhere to the updated regulations to avoid potential penalties. It is crucial to understand how the changes align with existing tax laws and how they might affect your overall tax liability. Consulting with a tax professional can provide insights into the legal aspects of the AMT changes, ensuring that you remain compliant while maximizing your tax benefits.

Required Documents for the Changes to the Alternative Minimum Tax

When preparing to address the Changes to the Alternative Minimum Tax, certain documents are essential. These typically include your W-2 forms, 1099 forms for any additional income, records of deductions, and any relevant tax credits. Additionally, if you are claiming specific exemptions or adjustments due to the new AMT rules, you may need supporting documentation to validate these claims. Keeping these documents organized and readily accessible will streamline the filing process and help ensure accuracy in your tax return.

Filing Deadlines for the Changes to the Alternative Minimum Tax

Filing deadlines for the Changes to the Alternative Minimum Tax are critical to avoid late fees and penalties. Typically, individual taxpayers must file their returns by April 15 each year, but this date may vary slightly based on weekends or holidays. If you are filing for a business entity, different deadlines may apply, so it is important to check the IRS guidelines specific to your situation. Staying informed about these deadlines will help ensure timely compliance with the new AMT regulations.

IRS Guidelines on the Changes to the Alternative Minimum Tax

The IRS provides comprehensive guidelines regarding the Changes to the Alternative Minimum Tax, detailing how these changes should be implemented in tax filings. These guidelines include information on eligibility, calculation methods, and the necessary forms to use. Familiarizing yourself with these IRS instructions can help clarify any uncertainties and ensure that you are following the correct procedures. Regularly checking the IRS website for updates can also provide valuable information on any further changes or clarifications regarding the AMT.

Quick guide on how to complete changes to the alternative minimum tax as proposed in

Complete Changes To The Alternative Minimum Tax As Proposed In effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Changes To The Alternative Minimum Tax As Proposed In on any system using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Changes To The Alternative Minimum Tax As Proposed In without hassle

- Obtain Changes To The Alternative Minimum Tax As Proposed In and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Changes To The Alternative Minimum Tax As Proposed In and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the changes to the alternative minimum tax as proposed in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key changes to the Alternative Minimum Tax as proposed in the recent legislation?

The changes to the Alternative Minimum Tax as proposed in the recent legislation aim to simplify the tax calculation and alter the income thresholds that trigger AMT liability. This means that more taxpayers may be exempt from AMT, allowing for signNow tax savings. Staying informed about these changes is crucial for effective tax planning.

-

How can airSlate SignNow help in managing documents related to the changes to the Alternative Minimum Tax as proposed in?

airSlate SignNow offers a streamlined way to manage and eSign documents, enabling users to quickly adapt to changes to the Alternative Minimum Tax as proposed in. With features like cloud storage and secure sharing, businesses can ensure that their tax documents are compliant and easily accessible. This can lead to more efficient tax filing processes.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with changes to the Alternative Minimum Tax as proposed in?

Yes, airSlate SignNow is a cost-effective solution designed to maximize efficiency for businesses navigating changes to the Alternative Minimum Tax as proposed in. By reducing the need for paper documentation and physical signatures, businesses can save time and money. This, in turn, allows for reallocation of resources towards compliance and strategic financial planning.

-

What features does airSlate SignNow offer to assist with documentation related to the changes to the Alternative Minimum Tax as proposed in?

airSlate SignNow includes features such as customizable templates, audit trails, and real-time collaboration that are particularly beneficial for handling changes to the Alternative Minimum Tax as proposed in. These features ensure that all parties are up to date on document versions and that compliance is maintained throughout the process. This makes it easier to adapt to any tax changes efficiently.

-

How does airSlate SignNow ensure security for documents related to tax changes?

Security is a top priority at airSlate SignNow, especially when handling sensitive information related to changes to the Alternative Minimum Tax as proposed in. The platform uses encryption, secure cloud storage, and rigorous authentication methods to protect your documents. This ensures that your tax documents remain confidential and are handled in compliance with legal regulations.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely, airSlate SignNow can integrate with various tax preparation software, making it easier to address the changes to the Alternative Minimum Tax as proposed in. Integrations streamline the document workflow, allowing you to import and export relevant data effortlessly. This enhances productivity and ensures accuracy in your tax-related processes.

-

Will using airSlate SignNow improve compliance with new tax regulations?

By utilizing airSlate SignNow, businesses can substantially improve their compliance with new tax regulations, including changes to the Alternative Minimum Tax as proposed in. The platform's robust tracking and management features ensure that all documents are completed correctly and submitted on time. Ultimately, this minimizes the risk of errors and potential penalties.

Get more for Changes To The Alternative Minimum Tax As Proposed In

- Final notice of forfeiture and request to vacate property under contract for deed connecticut form

- Buyers request for accounting from seller under contract for deed connecticut form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed connecticut form

- General notice of default for contract for deed connecticut form

- Ct rights form

- Seller disclosure form

- Ct seller form

- Notice of default for past due payments in connection with contract for deed connecticut form

Find out other Changes To The Alternative Minimum Tax As Proposed In

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template