Minnesota Form M1 Instructions

What is the Minnesota Form M1 Instructions

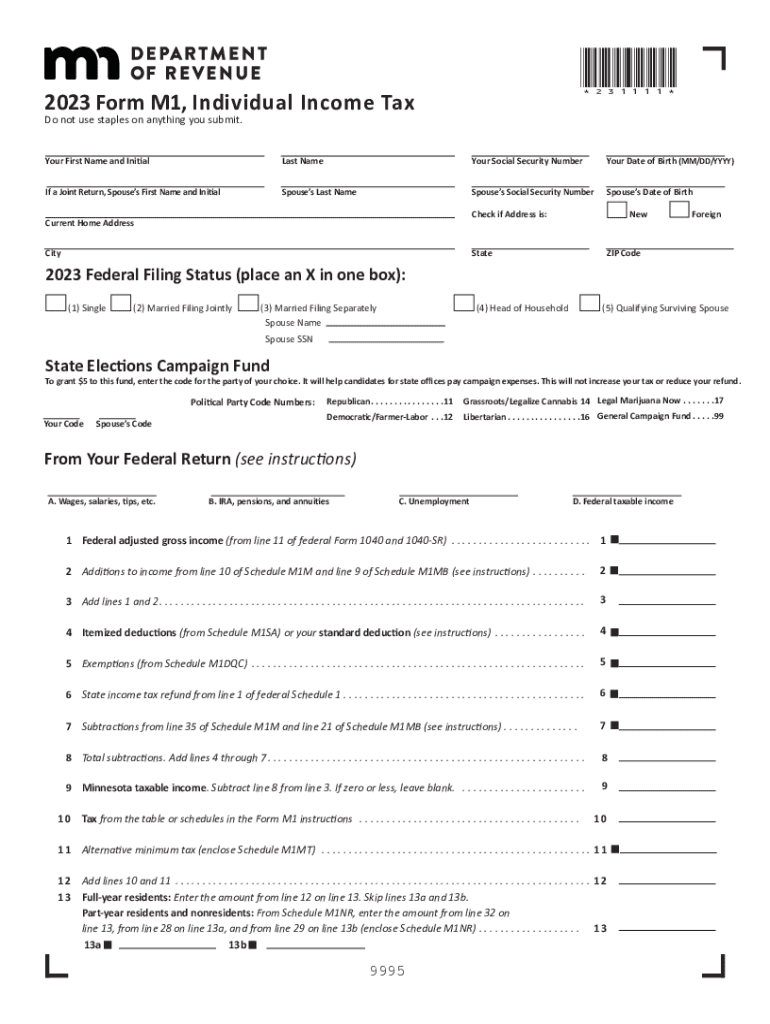

The Minnesota Form M1 Instructions provide guidance for individuals filing their state income tax returns. This form is essential for residents and part-year residents of Minnesota to report their income, claim deductions, and calculate their tax liability. The instructions detail the necessary steps to complete the form accurately, ensuring compliance with state tax laws.

Steps to complete the Minnesota Form M1 Instructions

Completing the Minnesota Form M1 requires several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions for eligibility requirements and specific line item details.

- Fill out the form by entering your personal information, income details, and any applicable deductions.

- Double-check your calculations to ensure accuracy.

- Sign and date the form before submitting it to the Minnesota Department of Revenue.

How to obtain the Minnesota Form M1 Instructions

The Minnesota Form M1 Instructions can be obtained through the Minnesota Department of Revenue's official website. They are available in a printable format, allowing taxpayers to download and print the document for easy reference. Additionally, physical copies may be available at local tax offices and public libraries.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Minnesota Form M1. Generally, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any specific deadlines for extensions or estimated tax payments.

Required Documents

To complete the Minnesota Form M1, taxpayers need to gather several key documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for any deductions or credits claimed

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Minnesota Form M1. The form can be filed electronically through approved e-filing software, which often simplifies the process. Alternatively, individuals may choose to print the completed form and mail it to the Minnesota Department of Revenue. In-person submissions may be made at designated tax offices, although this option may vary based on location and availability.

Quick guide on how to complete minnesota form m1 instructions

Easily Prepare Minnesota Form M1 Instructions on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Form M1 Instructions on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Minnesota Form M1 Instructions Effortlessly

- Obtain Minnesota Form M1 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Minnesota Form M1 Instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m1 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an MN tax form, and why do I need it?

An MN tax form is a document required for filing taxes in Minnesota. It provides important information regarding your income and expenses to ensure accurate tax reporting. Using airSlate SignNow to eSign your MN tax form streamlines the process, making it easy and efficient.

-

How can airSlate SignNow help me with MN tax forms?

airSlate SignNow enables users to electronically sign MN tax forms quickly and securely. The platform's user-friendly interface allows for easy document management, ensuring that your forms are completed accurately and submitted on time. This functionality can save you valuable time during tax season.

-

Is there a cost associated with using airSlate SignNow for MN tax forms?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. You can choose a plan based on the number of users and features you require, ensuring you have the right tools for managing your MN tax forms without overspending. Check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other applications for my MN tax forms?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing your ability to manage MN tax forms. This integration allows you to pull in data from sources like spreadsheets or CRM systems, simplifying the workflow around tax preparation and filing.

-

Are there any security measures in place when signing MN tax forms with airSlate SignNow?

Yes, airSlate SignNow prioritizes your data security while handling MN tax forms. The platform employs advanced encryption protocols, multi-factor authentication, and compliant storage to protect your sensitive information. You can confidently sign and send documents knowing your data is secure.

-

What features does airSlate SignNow offer for handling MN tax forms?

Some of the key features of airSlate SignNow include document templates, customizable workflows, and real-time tracking for MN tax forms. These tools help streamline the eSigning process, ensuring that your documents are not only accurate but also efficiently managed from start to finish.

-

How do I get started with airSlate SignNow for MN tax forms?

Getting started with airSlate SignNow for your MN tax forms is easy! Simply create an account on our website, choose the right pricing plan, and start uploading your tax documents. You'll have access to various tools and features to help simplify your tax filing process.

Get more for Minnesota Form M1 Instructions

- Assumption agreement of deed of trust and release of original mortgagors colorado form

- Colorado foreign 497300165 form

- Colorado unlawful form

- Colorado summons form

- Colorado garnishment support form

- Colorado writ attachment form

- Fillable online courts state co 4 pattern interrogatories domestic form

- Request production form

Find out other Minnesota Form M1 Instructions

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement