Schedule K 1 Form 1120S Alternative Minimum Tax AMT

Understanding the Schedule K-1 Form 1120S and Alternative Minimum Tax (AMT)

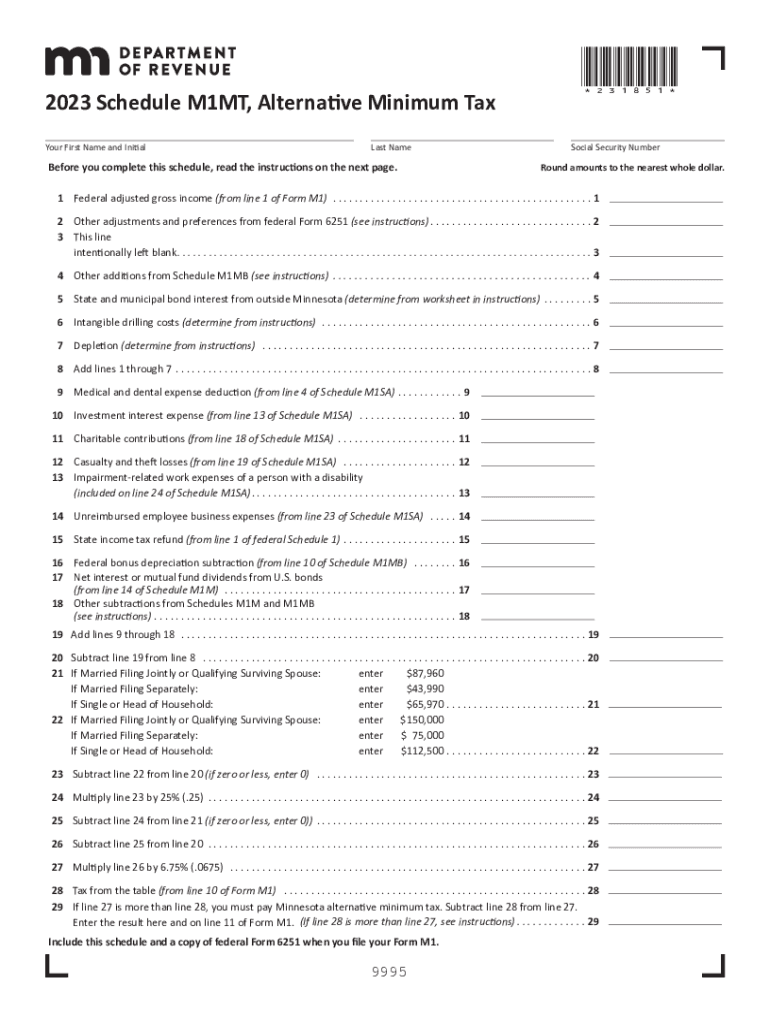

The Schedule K-1 Form 1120S is a crucial document for S corporations, detailing each shareholder's share of income, deductions, and credits. The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income earners pay a minimum amount of tax. For shareholders of S corporations, understanding how AMT interacts with the K-1 form is essential for accurate tax reporting and compliance.

Steps to Complete the Schedule K-1 Form 1120S for AMT

Completing the Schedule K-1 Form 1120S for AMT involves several key steps:

- Gather necessary financial documents, including the corporation's tax return and any other relevant financial statements.

- Identify your share of the corporation's income, deductions, and credits as reported on the K-1.

- Calculate any adjustments required for AMT purposes, such as preference items and adjustments to income.

- Complete the K-1 form accurately, ensuring all figures are correctly reported to reflect your share of the corporation's tax attributes.

Legal Use of the Schedule K-1 Form 1120S for AMT

The legal use of the Schedule K-1 Form 1120S in relation to AMT is fundamental for compliance with IRS regulations. Shareholders must report the income and deductions from the K-1 on their personal tax returns. Failure to accurately report this information can lead to penalties and interest from the IRS. It is important to ensure that all figures are correct and that any AMT adjustments are properly documented.

Filing Deadlines for the Schedule K-1 Form 1120S

Filing deadlines for the Schedule K-1 Form 1120S align with the tax return deadlines for S corporations. Typically, S corporations must file their returns by March 15. Shareholders should receive their K-1 forms in a timely manner to ensure they can file their personal tax returns by the April 15 deadline. It is crucial to be aware of these dates to avoid late filing penalties.

Required Documents for Completing the Schedule K-1 Form 1120S

To complete the Schedule K-1 Form 1120S accurately, shareholders should have the following documents ready:

- The corporation's tax return (Form 1120S).

- Financial statements that detail the corporation's income and expenses.

- Any prior year K-1 forms for reference.

- Documentation of any adjustments for AMT purposes.

Examples of Using the Schedule K-1 Form 1120S for AMT Calculations

Examples can help clarify how to use the Schedule K-1 Form 1120S for AMT calculations. For instance, if a shareholder receives a K-1 showing $50,000 in ordinary income and $10,000 in deductions, they would need to adjust these figures based on AMT rules. This may involve adding back certain deductions or income that are treated differently under the AMT system. Understanding these examples can aid shareholders in accurately reporting their tax obligations.

Quick guide on how to complete schedule k 1 form 1120s alternative minimum tax amt

Set Up Schedule K 1 Form 1120S Alternative Minimum Tax AMT Effortlessly on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Schedule K 1 Form 1120S Alternative Minimum Tax AMT across any platform using the airSlate SignNow Android or iOS applications and enhance your document-related tasks today.

The Easiest Method to Modify and eSign Schedule K 1 Form 1120S Alternative Minimum Tax AMT with Ease

- Obtain Schedule K 1 Form 1120S Alternative Minimum Tax AMT and then press Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive data with tools available through airSlate SignNow designed specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule K 1 Form 1120S Alternative Minimum Tax AMT and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1120s alternative minimum tax amt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota minimum for electronic signatures?

The Minnesota minimum for electronic signatures refers to the legal requirements that must be met for an eSignature to be valid in Minnesota. airSlate SignNow complies with these regulations, ensuring that your eSigned documents are legally binding and secure. This makes it easier for businesses to manage their documentation needs without worrying about compliance issues.

-

How does airSlate SignNow handle Minnesota minimum compliance?

airSlate SignNow is designed to adhere to the Minnesota minimum legal standards for electronic signatures. Our platform uses advanced encryption and authentication methods to guarantee that all eSignatures are valid under Minnesota law. This feature not only builds trust but also ensures that your agreements hold up in legal settings.

-

What pricing options does airSlate SignNow offer for Minnesota businesses?

airSlate SignNow provides various pricing plans suitable for businesses in Minnesota, catering to different needs and budgets. With options to pay monthly or annually, you can choose the plan that meets your requirements without overspending. This flexibility ensures that even small businesses can meet the Minnesota minimum requirements efficiently.

-

What features does airSlate SignNow include to help meet the Minnesota minimum?

Our platform includes a range of features such as customizable templates, automated workflows, and secure document storage that align with the Minnesota minimum for eSignatures. These tools help streamline your signing processes, making it easier to manage contracts and agreements online. Additionally, you can track document status in real time to ensure compliance.

-

How can airSlate SignNow benefit Minnesota small businesses?

For Minnesota small businesses, airSlate SignNow offers cost-effective solutions for document management and electronic signatures. Satisfying the Minnesota minimum, our platform simplifies complex signing processes, saving time and reducing administrative burdens. This allows you to focus more on your business operations rather than paperwork.

-

Can airSlate SignNow integrate with other software commonly used in Minnesota?

Yes, airSlate SignNow integrates with several popular software applications used by businesses in Minnesota, such as CRM systems and cloud storage solutions. These integrations help streamline your workflow and ensure compliance with the Minnesota minimum for electronic signatures. You can easily connect your tools to enhance productivity and collaboration.

-

Is customer support available for Minnesota users of airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support for users in Minnesota to assist with any queries related to the Minnesota minimum and our services. Our support team is available via chat, email, and phone to provide timely assistance and ensure you can effectively utilize our platform.

Get more for Schedule K 1 Form 1120S Alternative Minimum Tax AMT

- Change name a make form

- Florida change name form

- Florida petition change form

- Change name instructions form

- Final judgment change name form

- Florida petition change 497303007 form

- Final judgment change name 497303008 form

- 3 day notice to pay rent or lease terminated for residential property florida form

Find out other Schedule K 1 Form 1120S Alternative Minimum Tax AMT

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer