Minnesota Family Credits Marriage Penalty Credit Form

Understanding the Minnesota Family Credits Marriage Penalty Credit

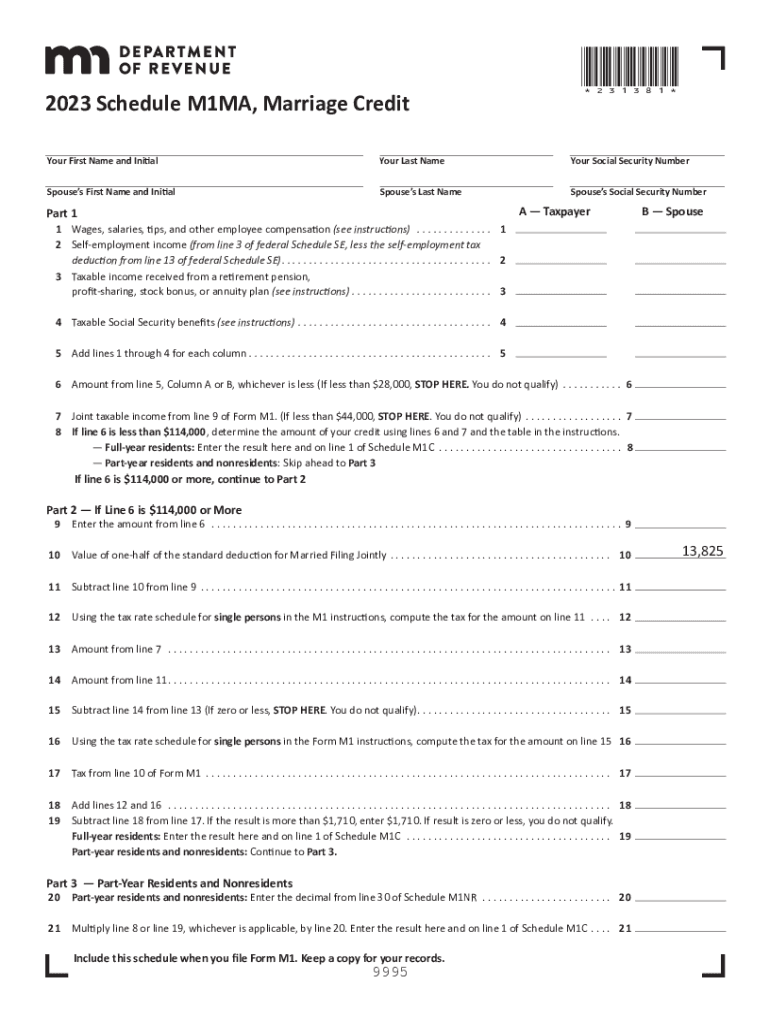

The Minnesota Family Credits Marriage Penalty Credit is designed to provide financial relief to married couples who may face a higher tax burden compared to single filers. This credit aims to alleviate the so-called "marriage penalty" that can occur when two individuals combine their incomes. The credit is particularly beneficial for those with moderate incomes, helping to ensure that marriage does not result in a higher tax obligation.

Eligibility Criteria for the Minnesota Family Credits Marriage Penalty Credit

To qualify for the Minnesota Family Credits Marriage Penalty Credit, couples must meet specific criteria. Both spouses must be legally married and file a joint tax return. Additionally, their combined income must fall within certain limits set by the Minnesota Department of Revenue. It is essential to review these income thresholds annually, as they may change. Couples with dependents may also find that they qualify for additional credits, further enhancing their tax benefits.

Steps to Complete the Minnesota Family Credits Marriage Penalty Credit

Completing the Minnesota Family Credits Marriage Penalty Credit involves a few straightforward steps:

- Gather necessary financial documents, including W-2s and any other income statements.

- Obtain the Minnesota M1MA form, which is used to claim the marriage penalty credit.

- Fill out the M1MA form, ensuring all information is accurate and complete.

- Calculate the credit amount based on your income and the guidelines provided by the Minnesota Department of Revenue.

- Submit the completed form along with your tax return by the designated filing deadline.

Required Documents for the Minnesota Family Credits Marriage Penalty Credit

When applying for the Minnesota Family Credits Marriage Penalty Credit, certain documents are necessary to support your claim. These include:

- Completed Minnesota M1MA form.

- Federal tax return (Form 1040) for the tax year in question.

- W-2 forms or other income statements for both spouses.

- Documentation of any additional credits or deductions claimed.

Filing Deadlines for the Minnesota Family Credits Marriage Penalty Credit

It is crucial to be aware of the filing deadlines for the Minnesota Family Credits Marriage Penalty Credit. Typically, the deadline aligns with the federal tax filing date, which is April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify the specific dates each year to ensure timely filing and avoid penalties.

Form Submission Methods for the Minnesota Family Credits Marriage Penalty Credit

Taxpayers can submit the Minnesota M1MA form through various methods. Options include:

- Online submission via the Minnesota Department of Revenue’s e-filing system.

- Mailing the completed form along with the tax return to the appropriate address provided by the state.

- In-person submission at designated state tax offices, if applicable.

Quick guide on how to complete minnesota family credits marriage penalty credit

Complete Minnesota Family Credits Marriage Penalty Credit effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Family Credits Marriage Penalty Credit across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Minnesota Family Credits Marriage Penalty Credit with ease

- Locate Minnesota Family Credits Marriage Penalty Credit and then click Obtain Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Signature feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Finish button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Minnesota Family Credits Marriage Penalty Credit and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota family credits marriage penalty credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 MN credit and how can airSlate SignNow help with it?

The 2023 MN credit refers to specific tax credits available to Minnesota residents in 2023. airSlate SignNow can assist businesses by providing a seamless platform to eSign necessary documents for claiming these credits, ensuring compliance and timely submissions.

-

How much does airSlate SignNow cost and does it support 2023 MN credit applications?

airSlate SignNow offers competitive pricing plans designed for businesses of all sizes. Our platform supports the eSigning of documents related to 2023 MN credit applications, helping you streamline the process and save costs.

-

What features does airSlate SignNow offer for managing 2023 MN credit documentation?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage. These tools help you efficiently manage all documentation related to the 2023 MN credit, ensuring you have everything organized and accessible.

-

How can I integrate airSlate SignNow with my existing systems to support 2023 MN credit applications?

airSlate SignNow offers seamless integrations with popular tools and software such as CRM systems and document management platforms. This way, you can easily incorporate eSigning into your existing workflows for processing 2023 MN credit applications.

-

Is airSlate SignNow secure for sensitive documents related to 2023 MN credit?

Yes, airSlate SignNow prioritizes security and compliance, utilizing advanced encryption standards and secure storage to protect your documents. You can confidently eSign sensitive paperwork for the 2023 MN credit without compromising safety.

-

What are the benefits of using airSlate SignNow for 2023 MN credit processing?

Using airSlate SignNow streamlines the eSigning process, reduces paperwork, and enhances productivity. By leveraging our platform for 2023 MN credit, businesses can ensure faster processing times, leading to quicker access to credits and improved cash flow.

-

Can I use airSlate SignNow on mobile devices for 2023 MN credit documentation?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to eSign documents related to 2023 MN credit anytime and anywhere. This flexibility ensures that you stay productive, even when on the go.

Get more for Minnesota Family Credits Marriage Penalty Credit

- Concrete mason contract for contractor michigan form

- Demolition contract for contractor michigan form

- Framing contract for contractor michigan form

- Security contract for contractor michigan form

- Insulation contract for contractor michigan form

- Paving contract for contractor michigan form

- Site work contract for contractor michigan form

- Siding contract for contractor michigan form

Find out other Minnesota Family Credits Marriage Penalty Credit

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile