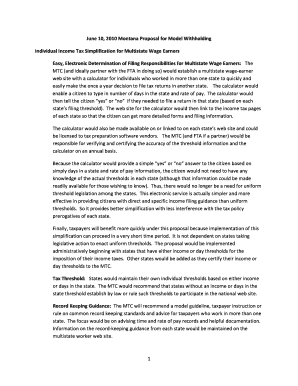

Individual Income Tax Simplification for Multistate Wage Earners Form

Understanding Individual Income Tax Simplification for Multistate Wage Earners

The Individual Income Tax Simplification for Multistate Wage Earners is designed to ease the tax filing process for individuals who earn wages in multiple states. This simplification addresses the complexities that arise from differing state tax laws, allowing wage earners to navigate their tax obligations more efficiently. By streamlining the process, it minimizes the risk of errors and reduces the time spent on tax preparation.

Steps to Complete the Individual Income Tax Simplification for Multistate Wage Earners

Completing the Individual Income Tax Simplification involves several key steps:

- Gather all necessary documentation, including W-2 forms from each state where you earned income.

- Determine your residency status in each state to understand your tax obligations.

- Calculate your total income from all states and identify any applicable deductions or credits.

- Complete the required state tax forms, ensuring you apply the simplification guidelines where applicable.

- Review your completed forms for accuracy before submission.

State-Specific Rules for Individual Income Tax Simplification

Each state has its own tax regulations, which can significantly impact multistate wage earners. Understanding state-specific rules is crucial for accurate tax filing. Some states may offer credits for taxes paid to other states, while others may have unique deductions or exemptions. It is essential to research the rules of each state where income was earned to ensure compliance and maximize potential refunds.

Required Documents for Filing

To successfully file using the Individual Income Tax Simplification, certain documents are necessary:

- W-2 forms from all employers in each state.

- State tax returns from previous years, if applicable.

- Documentation of any deductions or credits claimed.

- Proof of residency in each state, if required.

IRS Guidelines for Multistate Wage Earners

The IRS provides specific guidelines for multistate wage earners to ensure compliance with federal tax laws. These guidelines outline how to report income earned in different states and the implications for federal tax returns. It's important to consult the IRS website or a tax professional for the most current information regarding multistate income reporting.

Filing Deadlines and Important Dates

Filing deadlines for individual income tax returns can vary by state. Generally, federal tax returns are due on April 15. However, some states may have different deadlines or extensions. Keeping track of these important dates is essential to avoid penalties and ensure timely submissions.

Quick guide on how to complete individual income tax simplification for multistate wage earners

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Income Tax Simplification For Multistate Wage Earners

Create this form in 5 minutes!

How to create an eSignature for the individual income tax simplification for multistate wage earners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Individual Income Tax Simplification For Multistate Wage Earners?

Individual Income Tax Simplification For Multistate Wage Earners refers to the strategies and tools that help simplify the filing process for individuals who earn wages in multiple states. This can save time and reduce the complexities of navigating different state tax laws, ultimately making tax season less stressful.

-

How can airSlate SignNow assist with Individual Income Tax Simplification For Multistate Wage Earners?

airSlate SignNow offers features that streamline the document signing process related to tax filings. By facilitating easy electronic signatures for necessary tax documents, airSlate SignNow makes the process of managing mulitstate income tax easier and more efficient for wage earners.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow provides flexible pricing plans tailored for various needs, including solutions for Individual Income Tax Simplification For Multistate Wage Earners. Users can choose from monthly or annual subscriptions, helping them manage costs effectively while ensuring they meet all documentation needs.

-

Are there any integrations available with airSlate SignNow that support tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software solutions. These integrations enhance Individual Income Tax Simplification For Multistate Wage Earners by allowing users to effortlessly import and export their tax-related documents.

-

What features of airSlate SignNow specifically help with tax document management?

Key features of airSlate SignNow that aid in tax document management include customizable templates, secure cloud storage, and automated reminders for signatures. These functionalities contribute to the overall Individual Income Tax Simplification For Multistate Wage Earners by ensuring timely and organized tax filing.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes the security of all documents, employing industry-standard encryption and compliance measures. This is particularly crucial for Individual Income Tax Simplification For Multistate Wage Earners, as handling sensitive tax information requires robust protection against unauthorized access.

-

Can airSlate SignNow help individuals staying in one state but working in multiple states?

Absolutely! airSlate SignNow can greatly assist individuals who reside in one state while earning wages in multiple states through its efficient document management features. This efficiency is key in achieving Individual Income Tax Simplification For Multistate Wage Earners, making it easier to manage various state tax obligations.

Get more for Individual Income Tax Simplification For Multistate Wage Earners

Find out other Individual Income Tax Simplification For Multistate Wage Earners

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online