The Federal FSA Program over the Counter Quick Reference Guide Form

What is the Federal FSA Program Over The Counter Quick Reference Guide

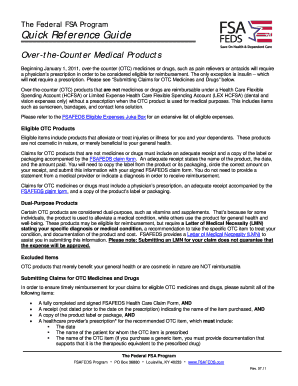

The Federal FSA Program Over The Counter Quick Reference Guide serves as a comprehensive resource for individuals utilizing Flexible Spending Accounts (FSAs) to manage their healthcare expenses. This guide outlines eligible over-the-counter (OTC) items that can be purchased using FSA funds, ensuring users maximize their benefits while adhering to federal regulations. It is essential for participants to understand which products qualify under the program to avoid unnecessary out-of-pocket expenses.

How to use the Federal FSA Program Over The Counter Quick Reference Guide

To effectively use the Federal FSA Program Over The Counter Quick Reference Guide, individuals should first familiarize themselves with the list of eligible OTC items. Users can reference the guide to identify products such as pain relievers, allergy medications, and first-aid supplies that qualify for FSA reimbursement. When making purchases, it is crucial to retain receipts and documentation, as these may be required for reimbursement claims. Additionally, users should regularly check for updates to the guide, as eligible items may change based on federal regulations.

Key elements of the Federal FSA Program Over The Counter Quick Reference Guide

Key elements of the Federal FSA Program Over The Counter Quick Reference Guide include:

- Eligible OTC Items: A detailed list of products that can be purchased with FSA funds.

- Documentation Requirements: Information on what receipts and documentation are necessary for reimbursement.

- Changes in Eligibility: Updates on any changes in the list of eligible products based on federal guidelines.

- Usage Guidelines: Instructions on how to properly utilize the guide for maximum benefit.

Steps to complete the Federal FSA Program Over The Counter Quick Reference Guide

Completing the Federal FSA Program Over The Counter Quick Reference Guide involves several straightforward steps:

- Review the list of eligible OTC items to determine what products you may need.

- Make purchases of eligible items at authorized retailers.

- Collect and organize receipts for all OTC purchases.

- Submit your receipts along with any required forms to your FSA administrator for reimbursement.

- Keep a copy of your submission for your records.

Legal use of the Federal FSA Program Over The Counter Quick Reference Guide

Legal use of the Federal FSA Program Over The Counter Quick Reference Guide requires adherence to federal regulations governing FSAs. Participants must ensure that all purchases made with FSA funds are for eligible items as defined in the guide. Misuse of FSA funds, such as purchasing ineligible items, can result in penalties, including tax implications. It is important for users to stay informed about any updates to laws and regulations that may affect their eligibility and usage of the guide.

Examples of using the Federal FSA Program Over The Counter Quick Reference Guide

Examples of using the Federal FSA Program Over The Counter Quick Reference Guide include:

- Purchasing allergy medications like antihistamines for seasonal allergies.

- Buying first-aid supplies such as band-aids and antiseptic wipes for home care.

- Acquiring pain relief medications like ibuprofen or acetaminophen for headaches or muscle pain.

Quick guide on how to complete the federal fsa program over the counter quick reference guide

Easily prepare [SKS] on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the federal fsa program over the counter quick reference guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Federal FSA Program Over The Counter Quick Reference Guide?

The Federal FSA Program Over The Counter Quick Reference Guide is a comprehensive resource designed to help users navigate eligible over-the-counter products that can be purchased with FSA funds. This guide simplifies the process of understanding what expenses are covered, ensuring that users maximize their benefits. It’s an essential tool for individuals managing their FSA accounts.

-

How can The Federal FSA Program Over The Counter Quick Reference Guide benefit me?

Utilizing The Federal FSA Program Over The Counter Quick Reference Guide can lead to signNow savings on healthcare expenses. By clearly identifying eligible products, users can make informed purchasing decisions, ensuring that they get the most out of their FSA funds. Enhanced clarity and accessibility of information will help avoid unexpected out-of-pocket costs.

-

Are there any costs associated with The Federal FSA Program Over The Counter Quick Reference Guide?

The Federal FSA Program Over The Counter Quick Reference Guide itself is often available at no cost through various platforms, including employer benefits websites. However, it’s essential to check with your specific FSA provider as some services may vary. The guide is designed to provide value without extra fees, enhancing your overall FSA experience.

-

What types of products are listed in The Federal FSA Program Over The Counter Quick Reference Guide?

The Federal FSA Program Over The Counter Quick Reference Guide includes a variety of eligible products such as pain relievers, allergy medications, and first-aid supplies. The guide is continually updated to reflect changes in regulations, ensuring that users have the most accurate information regarding over-the-counter purchases. This comprehensive listing helps individuals use their FSA funds wisely.

-

Can I easily find The Federal FSA Program Over The Counter Quick Reference Guide online?

Yes, The Federal FSA Program Over The Counter Quick Reference Guide is easily accessible online through various healthcare and benefits websites. Many FSA providers offer a downloadable version for convenience. This accessibility ensures users can refer to the guide whenever needed, aiding in effective money management.

-

How often is The Federal FSA Program Over The Counter Quick Reference Guide updated?

The Federal FSA Program Over The Counter Quick Reference Guide is regularly updated to reflect current policies and eligible products as dictated by federal regulations. Keeping abreast of these updates is crucial for ensuring that users remain compliant and informed about their FSA options. Check with your FSA administrator for the latest version for optimal use.

-

Is The Federal FSA Program Over The Counter Quick Reference Guide suitable for all FSA holders?

Absolutely! The Federal FSA Program Over The Counter Quick Reference Guide is designed for all holders of Flexible Spending Accounts (FSA), regardless of employer or personal plan. It standardizes the understanding of eligible expenses, making it a valuable tool for everyone looking to capitalize on their health benefits.

Get more for The Federal FSA Program Over The Counter Quick Reference Guide

Find out other The Federal FSA Program Over The Counter Quick Reference Guide

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online