Schedule WD, Capital Gains and Losses Wisconsin Form

Understanding the Schedule WD, Capital Gains and Losses Wisconsin

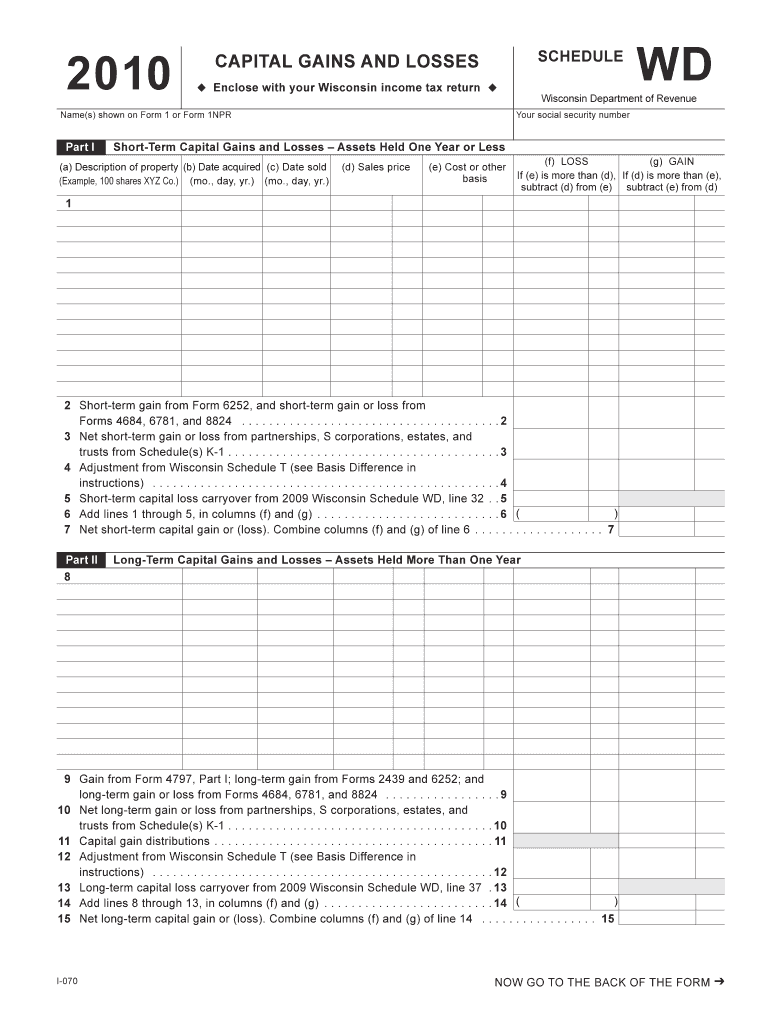

The Schedule WD, Capital Gains and Losses Wisconsin, is a tax form used by residents of Wisconsin to report capital gains and losses from the sale of assets. This form is essential for individuals who have sold stocks, bonds, real estate, or other investments within the tax year. The information reported on this schedule helps determine the taxpayer's overall tax liability by calculating the net capital gain or loss, which is then transferred to the main tax return.

Steps to Complete the Schedule WD, Capital Gains and Losses Wisconsin

Completing the Schedule WD involves several key steps:

- Gather Documentation: Collect all relevant documents related to asset sales, including purchase and sale receipts, and any records of expenses incurred during the transactions.

- Calculate Gains and Losses: Determine the capital gains or losses for each asset sold. This involves subtracting the purchase price (plus any associated costs) from the sale price.

- Fill Out the Form: Input the calculated figures into the appropriate sections of the Schedule WD. Ensure accuracy to avoid potential penalties.

- Review and Submit: Double-check all entries for errors before submitting the form with your state tax return.

State-Specific Rules for the Schedule WD, Capital Gains and Losses Wisconsin

Wisconsin has specific regulations regarding capital gains and losses that differ from federal guidelines. Key points include:

- Exemptions: Certain capital gains may be exempt from taxation under specific conditions, such as gains from the sale of a primary residence.

- Loss Carryforward: Taxpayers may carry forward capital losses to offset future capital gains, subject to state rules.

- Tax Rates: The tax rates applied to capital gains may vary based on the taxpayer's income level and the type of asset sold.

How to Obtain the Schedule WD, Capital Gains and Losses Wisconsin

The Schedule WD can be obtained through various means:

- Department of Revenue Website: The Wisconsin Department of Revenue provides downloadable versions of the form on its official website.

- Tax Preparation Software: Many tax preparation software programs include the Schedule WD as part of their state filing options.

- Local Tax Offices: Taxpayers can also visit local tax offices or libraries to access printed copies of the form.

Examples of Using the Schedule WD, Capital Gains and Losses Wisconsin

Here are a few scenarios illustrating the use of the Schedule WD:

- Sale of Stocks: If an individual sells stocks for a profit, they must report the gain on Schedule WD, detailing the sale price and purchase price.

- Real Estate Transactions: Homeowners selling their property may report capital gains or losses from the sale, considering any improvements made to the home.

- Investment Property: Investors selling rental properties must report gains or losses, factoring in depreciation and other costs associated with the property.

Filing Deadlines for the Schedule WD, Capital Gains and Losses Wisconsin

Timely submission of the Schedule WD is crucial. The filing deadline typically aligns with the federal tax return deadline, which is usually April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that they submit the Schedule WD along with their Wisconsin income tax return to avoid penalties.

Quick guide on how to complete schedule wd capital gains and losses wisconsin

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to distribute your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule WD, Capital Gains And Losses Wisconsin

Create this form in 5 minutes!

How to create an eSignature for the schedule wd capital gains and losses wisconsin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule WD for Capital Gains And Losses in Wisconsin?

Schedule WD is a form used in Wisconsin to report capital gains and losses for tax purposes. It allows taxpayers to detail their sales of assets, ensuring proper compliance with state tax regulations. Understanding how to accurately complete Schedule WD for capital gains and losses in Wisconsin is crucial for minimizing tax liability.

-

How does airSlate SignNow assist with filling out Schedule WD for Capital Gains And Losses in Wisconsin?

AirSlate SignNow simplifies the process of eSigning and sending documents like Schedule WD for capital gains and losses in Wisconsin. It provides an intuitive platform for users to complete their tax documents efficiently, enabling them to focus more on their tax planning and less on paperwork.

-

Is there a cost associated with using airSlate SignNow for Schedule WD, Capital Gains And Losses in Wisconsin?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans ensure that users can efficiently manage their tax documentation, including Schedule WD for capital gains and losses in Wisconsin, at a cost-effective price.

-

What features does airSlate SignNow offer for managing Schedule WD submissions?

AirSlate SignNow offers advanced features such as document templates, eSigning, and real-time tracking to ensure your Schedule WD for capital gains and losses in Wisconsin is managed seamlessly. These features provide both efficiency and security, catering to the needs of businesses handling tax documents.

-

Can I integrate airSlate SignNow with other accounting software for Schedule WD submissions?

Yes, airSlate SignNow integrates with various accounting software, making it easy to manage your Schedule WD for capital gains and losses in Wisconsin alongside your other financial activities. This integration helps streamline your entire tax process, ensuring all your documents are in one place.

-

What are the benefits of using airSlate SignNow for tax documents like Schedule WD?

Using airSlate SignNow for documents such as Schedule WD, capital gains, and losses in Wisconsin offers signNow benefits including faster document turnaround, improved security, and enhanced collaboration. This leads to a more organized tax filing experience, reducing stress during tax season.

-

How can I ensure compliance when using airSlate SignNow for Schedule WD in Wisconsin?

AirSlate SignNow is designed to help businesses stay compliant by providing accurate templates and guidance for documents like Schedule WD for capital gains and losses in Wisconsin. It’s essential to keep your software updated and to follow any state guidelines, which are readily available through our resources.

Get more for Schedule WD, Capital Gains And Losses Wisconsin

- Da form 5304 55160917

- Competition volleyball skills assessment for individuals specialolympicspa form

- Bt111 form

- Windows for immunizations form

- Eyelash extensions manual beginners courseeyelash extensions manual beginners course qxp form

- Medical records release form dermatology specialists pa

- Lapin plays possum pdf form

- State of new jersey employers first report of accidental injury or occupational illness form

Find out other Schedule WD, Capital Gains And Losses Wisconsin

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors