MTA 9Underpayment of Estimated Metropolitain Commuter Form

What is the MTA 9Underpayment Of Estimated Metropolitan Commuter

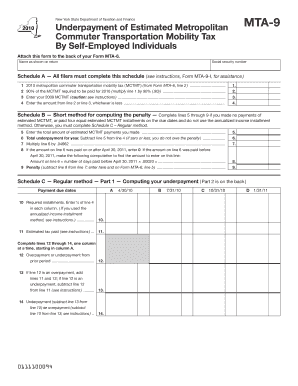

The MTA 9Underpayment Of Estimated Metropolitan Commuter is a tax form used by individuals and businesses in New York to report and pay any underpayment of estimated metropolitan commuter transportation mobility tax. This tax applies to employers and self-employed individuals who earn income from sources within the Metropolitan Commuter Transportation District. The form helps ensure compliance with state tax regulations and facilitates the proper allocation of funds for public transportation services in the area.

How to use the MTA 9Underpayment Of Estimated Metropolitan Commuter

To use the MTA 9Underpayment Of Estimated Metropolitan Commuter, taxpayers must first determine if they have underpaid their estimated metropolitan commuter transportation mobility tax. This involves calculating the total tax owed for the year and comparing it to the estimated payments made. If the total payments are less than the owed amount, the taxpayer must complete the MTA 9 form to report the underpayment and submit the necessary payment. Accurate calculations and timely submissions are crucial to avoid penalties.

Steps to complete the MTA 9Underpayment Of Estimated Metropolitan Commuter

Completing the MTA 9Underpayment Of Estimated Metropolitan Commuter involves several key steps:

- Gather financial records, including income statements and previous estimated tax payments.

- Calculate the total metropolitan commuter transportation mobility tax owed based on your income.

- Determine the amount of estimated payments already made during the tax year.

- Subtract the total estimated payments from the total tax owed to find the underpayment amount.

- Fill out the MTA 9 form with the required information, including personal details and payment amounts.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the MTA 9Underpayment Of Estimated Metropolitan Commuter are typically aligned with the annual tax filing schedule. Taxpayers must submit the form by the due date specified by the New York State Department of Taxation and Finance. It is essential to stay informed about these dates to avoid late fees and penalties. Generally, the form is due on the same date as the personal income tax return, which is usually April fifteenth each year.

Penalties for Non-Compliance

Failure to comply with the requirements of the MTA 9Underpayment Of Estimated Metropolitan Commuter can result in significant penalties. These may include interest on unpaid taxes, late filing fees, and additional charges for underpayment. It is important for taxpayers to understand their obligations and ensure timely filing and payment to avoid these consequences. Staying informed about tax regulations and maintaining accurate financial records can help mitigate the risk of non-compliance.

Required Documents

When completing the MTA 9Underpayment Of Estimated Metropolitan Commuter, certain documents are necessary to ensure accurate reporting. These documents typically include:

- Income statements, such as W-2s or 1099s, detailing earnings.

- Records of estimated tax payments made throughout the year.

- Any relevant documentation that supports tax deductions or credits claimed.

Having these documents readily available can simplify the process and help ensure compliance with tax obligations.

Quick guide on how to complete mta 9underpayment of estimated metropolitain commuter

Complete [SKS] effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate template and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MTA 9Underpayment Of Estimated Metropolitain Commuter

Create this form in 5 minutes!

How to create an eSignature for the mta 9underpayment of estimated metropolitain commuter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MTA 9Underpayment Of Estimated Metropolitan Commuter form?

The MTA 9Underpayment Of Estimated Metropolitan Commuter form is used to report underpayment of estimated taxes to the Metropolitan Transportation Authority. This form is essential for businesses and individuals who owe taxes but have paid less than required throughout the year. Using airSlate SignNow, you can easily fill out and eSign this form, ensuring compliance and timely submission.

-

How can airSlate SignNow help with MTA 9Underpayment Of Estimated Metropolitan Commuter filings?

airSlate SignNow streamlines the process of preparing and submitting the MTA 9Underpayment Of Estimated Metropolitan Commuter form. Our platform allows users to digitally fill, sign, and send documents securely. This saves time and reduces the risk of errors, ensuring that your filings are accurate and timely.

-

What are the costs associated with using airSlate SignNow for MTA 9Underpayment Of Estimated Metropolitan Commuter submissions?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Our subscription includes access to features essential for completing and eSigning the MTA 9Underpayment Of Estimated Metropolitan Commuter form. We also provide a free trial, allowing users to test the platform before committing to a plan.

-

Are there templates available for the MTA 9Underpayment Of Estimated Metropolitan Commuter in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for the MTA 9Underpayment Of Estimated Metropolitan Commuter form. These templates help streamline the completion process, ensuring that all necessary information is included without hassle. Users can easily modify templates to fit their specific situations, enhancing efficiency.

-

Can airSlate SignNow integrate with accounting software to manage MTA 9Underpayment Of Estimated Metropolitan Commuter submissions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, providing a holistic solution for managing MTA 9Underpayment Of Estimated Metropolitan Commuter submissions. This integration allows you to sync data, making it simpler to keep your financial records up to date and compliant with tax regulations.

-

What benefits does airSlate SignNow offer for MTA 9Underpayment Of Estimated Metropolitan Commuter document management?

Using airSlate SignNow for MTA 9Underpayment Of Estimated Metropolitan Commuter document management provides benefits such as increased security, improved workflow efficiency, and easy accessibility. You can access your documents anytime, from anywhere, giving you the flexibility needed to submit your filings on time. Moreover, our platform ensures documents are securely stored and compliant with regulations.

-

Is airSlate SignNow suitable for both individuals and businesses needing to file MTA 9Underpayment Of Estimated Metropolitan Commuter?

Yes, airSlate SignNow is designed to cater to both individuals and businesses needing to file the MTA 9Underpayment Of Estimated Metropolitan Commuter form. Our platform's user-friendly interface simplifies the process, making it accessible for users of all levels of experience, ensuring that everyone can complete their documents with ease.

Get more for MTA 9Underpayment Of Estimated Metropolitain Commuter

Find out other MTA 9Underpayment Of Estimated Metropolitain Commuter

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself