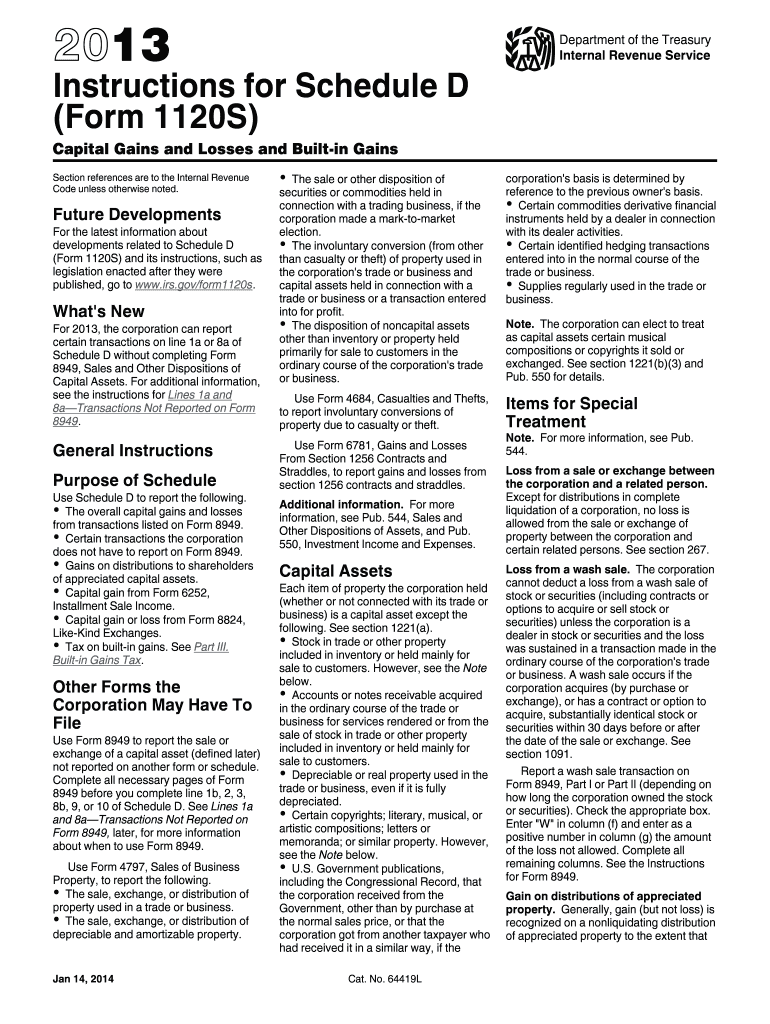

Instructions for Schedule D Form 1120S Instructions for Schedule D Form 1120S, Capital Gains and Losses and Built in Gains

Understanding Schedule D Form 1120S

The Schedule D Form 1120S is used by S corporations to report capital gains and losses. This form is essential for determining the tax implications of the sale or exchange of capital assets. It allows S corporations to summarize their capital transactions for the tax year, including gains and losses from the sale of stocks, bonds, and other investments. Proper completion of this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to Complete Schedule D Form 1120S

Completing Schedule D Form 1120S involves several steps. First, gather all necessary documentation related to capital transactions, including purchase and sale records. Next, categorize each transaction as a short-term or long-term gain or loss based on the holding period of the asset. Fill out the form by entering the details of each transaction, including the asset description, acquisition date, sale date, proceeds, and cost basis. Finally, calculate the total gains and losses and transfer the net amount to the appropriate section of the corporate tax return.

Key Components of Schedule D Form 1120S

Schedule D Form 1120S consists of several key components that must be accurately reported. These include:

- Short-term capital gains and losses: Reported for assets held for one year or less.

- Long-term capital gains and losses: Reported for assets held for more than one year.

- Net capital gain or loss: The overall result of short-term and long-term transactions.

- Built-in gains: Specific to S corporations, these are gains on assets that were appreciated at the time of the S corporation election.

Obtaining Schedule D Form 1120S

Schedule D Form 1120S can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. Additionally, tax professionals can provide assistance in obtaining and completing this form accurately.

Filing Deadlines for Schedule D Form 1120S

Filing deadlines for Schedule D Form 1120S align with the tax return deadlines for S corporations. Generally, the form must be filed by the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a deadline of March 15. Extensions may be requested, but it is essential to file the form on time to avoid penalties.

Penalties for Non-Compliance

Failure to file Schedule D Form 1120S accurately or on time can result in significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, incorrect reporting of capital gains and losses can lead to audits or further scrutiny from the IRS. It is advisable to ensure that all information is correct and submitted by the deadline to avoid these potential issues.

Quick guide on how to complete instructions for schedule d form 1120s instructions for schedule d form 1120s capital gains and losses and built in gains

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Schedule D Form 1120S Instructions For Schedule D Form 1120S, Capital Gains And Losses And Built in Gains

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule d form 1120s instructions for schedule d form 1120s capital gains and losses and built in gains

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic Instructions For Schedule D Form 1120S, Capital Gains And Losses And Built in Gains?

The basic Instructions For Schedule D Form 1120S cover how to report capital gains and losses for S corporations. These instructions guide users in determining the correct calculations and forms necessary for disclosing both realized gains and losses, as well as any built-in gains during the year.

-

How can airSlate SignNow assist with preparing the Instructions For Schedule D Form 1120S?

airSlate SignNow streamlines the document signing process, making it easier for businesses to prepare their Instructions For Schedule D Form 1120S. By utilizing our platform, users can quickly collect signatures and manage assets, ensuring that all necessary documentation related to capital gains and losses is efficiently compiled.

-

What pricing options are available for airSlate SignNow when managing Instructions For Schedule D Form 1120S?

airSlate SignNow offers flexible pricing plans tailored for businesses of various sizes. Whether you need a basic plan for occasional use or a premium plan for full features, our pricing remains cost-effective while providing essential functionalities to manage your Instructions For Schedule D Form 1120S effectively.

-

What features does airSlate SignNow offer to support the completion of the Instructions For Schedule D Form 1120S?

Our platform provides robust features like document templates, collaboration tools, and secure electronic signatures to help users efficiently complete their Instructions For Schedule D Form 1120S. These tools ensure that you stay organized and compliant while handling capital gains and losses documentation.

-

Can I integrate airSlate SignNow with other software to assist with Instructions For Schedule D Form 1120S?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications, allowing for easier management of your financial documents. By connecting with accounting or tax preparation tools, you can simplify the process of preparing the Instructions For Schedule D Form 1120S.

-

What are the benefits of using airSlate SignNow for Instructions For Schedule D Form 1120S?

Using airSlate SignNow for your Instructions For Schedule D Form 1120S provides numerous benefits, such as increased efficiency in document handling and reduced turnaround times for signatures. This ensures that your capital gains and losses reporting remains timely and accurate, which is crucial for tax compliance.

-

Is there customer support available for help with Instructions For Schedule D Form 1120S?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with their Instructions For Schedule D Form 1120S and any related issues. Our team is ready to provide guidance and answer any questions you may have about using our platform effectively.

Get more for Instructions For Schedule D Form 1120S Instructions For Schedule D Form 1120S, Capital Gains And Losses And Built in Gains

Find out other Instructions For Schedule D Form 1120S Instructions For Schedule D Form 1120S, Capital Gains And Losses And Built in Gains

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later