Instructions 1040 Schedule D Instructions for Schedule D Form 1040 Irs

Understanding the Instructions for Schedule D Form 1040

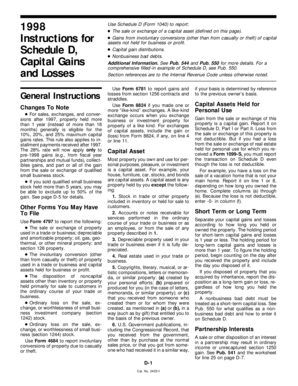

The Instructions 1040 Schedule D provide essential guidance for taxpayers who need to report capital gains and losses on their federal income tax returns. This form is crucial for individuals who have sold assets such as stocks, bonds, or real estate. It helps determine the tax implications of these transactions, ensuring compliance with IRS regulations. Understanding these instructions is vital for accurate reporting and avoiding potential penalties.

Steps to Complete the Instructions for Schedule D Form 1040

Completing the Schedule D requires careful attention to detail. Here are the key steps:

- Gather all necessary documentation, including records of asset purchases and sales.

- Determine the type of gain or loss for each transaction, categorizing them as short-term or long-term.

- Fill out the form according to the provided instructions, ensuring all calculations are accurate.

- Transfer the totals to your Form 1040, ensuring consistency across your tax return.

- Review the completed form for any errors before submission.

Key Elements of the Instructions for Schedule D Form 1040

The Instructions for Schedule D highlight several critical components that taxpayers must understand:

- Short-term vs. Long-term Gains: Different tax rates apply based on the duration of asset ownership.

- Capital Losses: Taxpayers can use losses to offset gains, potentially reducing their tax liability.

- Special Reporting Requirements: Certain transactions, such as those involving collectibles or real estate, may have unique reporting rules.

Obtaining the Instructions for Schedule D Form 1040

Taxpayers can easily obtain the Instructions for Schedule D by visiting the IRS website or through tax preparation software. These instructions are typically available in PDF format, allowing for easy printing and reference. Additionally, tax professionals can provide guidance and copies of the instructions as part of their services.

Filing Deadlines for Schedule D Form 1040

It is essential to be aware of the filing deadlines associated with the Schedule D. Generally, the deadline for submitting Form 1040, including Schedule D, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure they file on time to avoid penalties.

IRS Guidelines for Schedule D Form 1040

The IRS provides comprehensive guidelines for completing Schedule D, which include detailed explanations of each line item on the form. These guidelines help taxpayers understand how to report their transactions accurately. Familiarity with these guidelines can aid in navigating complex situations, such as reporting wash sales or inherited assets.

Quick guide on how to complete instructions 1040 schedule d instructions for schedule d form 1040 irs

Complete [SKS] effortlessly on any device

Web-based document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to edit and eSign [SKS] easily

- Locate [SKS] and click on Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or an invitation link, or download it to your computer.

Simplify your life by eliminating concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure excellent communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs

Create this form in 5 minutes!

How to create an eSignature for the instructions 1040 schedule d instructions for schedule d form 1040 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs?

The Instructions 1040 Schedule D guide offers detailed information on how to fill out Schedule D for reporting capital gains and losses on Form 1040 for the IRS. It includes key definitions and explanations for each section that taxpayers need to complete accurately.

-

How does airSlate SignNow support the completion of Instructions 1040 Schedule D?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign documents, including those requiring Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs. By using our tools, completing your IRS forms becomes streamlined and hassle-free.

-

What is the pricing structure for airSlate SignNow solutions?

airSlate SignNow offers flexible pricing plans designed to accommodate various business sizes and needs. Our cost-effective solutions make it easy to access features that assist with completing Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs, ensuring a great value for your investment.

-

What features does airSlate SignNow provide to help with IRS forms?

With airSlate SignNow, users can take advantage of powerful features like template customization, automated workflows, and secure eSigning. These features signNowly enhance the process of following the Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs, making document management simple and efficient.

-

Are there integrations available with airSlate SignNow to access IRS forms?

Yes, airSlate SignNow seamlessly integrates with various applications to provide easy access to IRS forms and other important documents. This integration supports users in following Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs without switching between multiple platforms.

-

How can I find help with Instructions 1040 Schedule D when using airSlate SignNow?

airSlate SignNow offers extensive support resources, including tutorials, FAQs, and customer service to assist users with their questions. Our team can help guide you through the process of adhering to Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs, ensuring you have the help you need.

-

Can airSlate SignNow ensure the security of my tax documents?

Absolutely! Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure storage to protect your sensitive tax documents, including those that involve Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs, giving you peace of mind.

Get more for Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs

- Iec 62271 102 pdf download form

- Utilization review process flowchart form

- Cpf form download

- Deed in lieu of foreclosure form

- Tarrant county business personal property tax rendition form

- Opwdd amap manual form

- Declaration of highway driving experience form

- Milestone of young children development form

Find out other Instructions 1040 Schedule D Instructions For Schedule D Form 1040 Irs

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form