IL 1040 ES Estimated Income Tax Payment for Individuals Form

What is the IL 1040 ES Estimated Income Tax Payment For Individuals

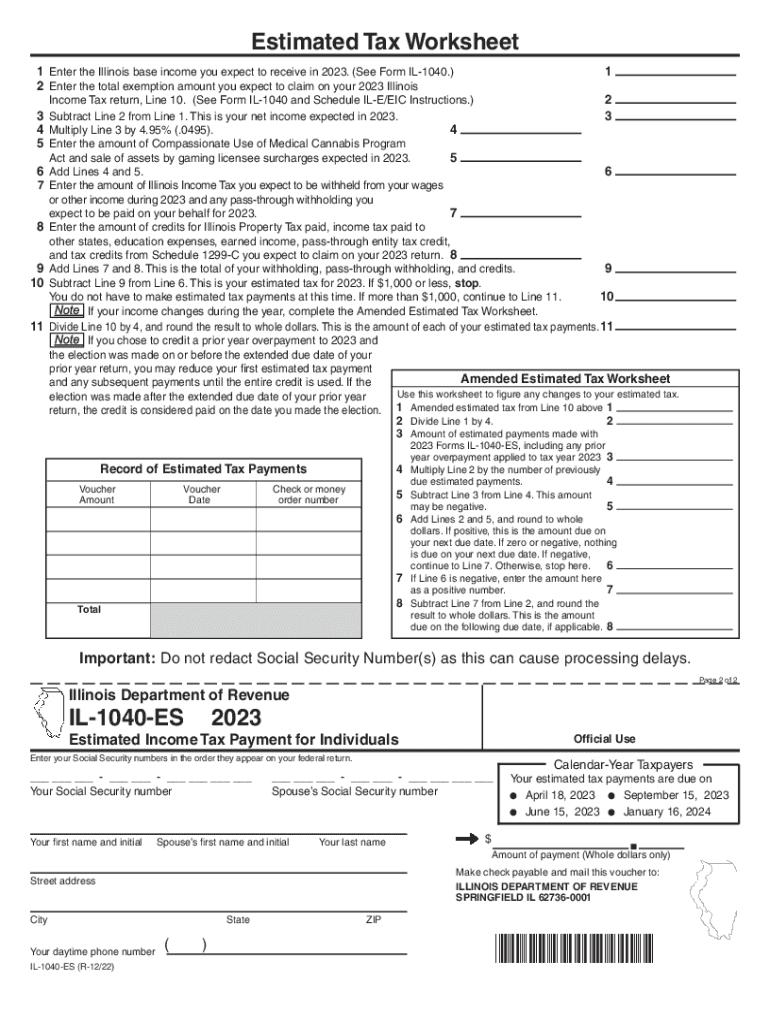

The 2023 IL 1040 ES form is used by individuals in Illinois to report and pay estimated income tax payments. This form is particularly relevant for those who expect to owe tax of $1,000 or more when they file their annual return. It is designed for self-employed individuals, retirees, and others whose income is not subject to withholding. By submitting this form, taxpayers can ensure they meet their tax obligations throughout the year, avoiding penalties for underpayment.

How to use the IL 1040 ES Estimated Income Tax Payment For Individuals

To utilize the IL 1040 ES form effectively, individuals need to calculate their estimated tax liability based on expected income, deductions, and credits. The form consists of several payment vouchers, which allow taxpayers to submit payments quarterly. Each voucher must be filled out with the taxpayer's information and the amount due. It is essential to keep track of payment deadlines to avoid penalties. Payments can be made online, by mail, or in person, depending on the taxpayer's preference.

Steps to complete the IL 1040 ES Estimated Income Tax Payment For Individuals

Completing the IL 1040 ES form involves several steps:

- Gather financial information, including income sources and expected deductions.

- Calculate the estimated tax liability using the current tax rates and guidelines.

- Fill out the IL 1040 ES form, ensuring all personal and financial information is accurate.

- Determine the payment amount for each quarter based on the total estimated tax liability.

- Submit the completed form along with the payment voucher by the appropriate deadline.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the IL 1040 ES form to avoid penalties. For the 2023 tax year, the estimated payment due dates are typically as follows:

- First payment: April 15, 2023

- Second payment: June 15, 2023

- Third payment: September 15, 2023

- Fourth payment: January 15, 2024

Taxpayers should verify these dates each year, as they may vary slightly based on weekends or holidays.

Legal use of the IL 1040 ES Estimated Income Tax Payment For Individuals

The IL 1040 ES form is legally required for individuals who meet specific criteria regarding their income and tax liability. It is essential for taxpayers to understand their obligations under Illinois tax law. Failing to file or pay estimated taxes can result in penalties and interest on the owed amount. Taxpayers should ensure that they are compliant with both state and federal tax regulations when using this form.

Key elements of the IL 1040 ES Estimated Income Tax Payment For Individuals

Key components of the IL 1040 ES form include:

- Taxpayer identification information, such as name, address, and Social Security number.

- Calculation of estimated income tax based on projected earnings.

- Payment vouchers for quarterly submissions.

- Instructions for completing and submitting the form.

Understanding these elements is vital for accurate and timely tax payments.

Quick guide on how to complete il 1040 es estimated income tax payment for individuals

Complete IL 1040 ES Estimated Income Tax Payment For Individuals effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and store it securely online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage IL 1040 ES Estimated Income Tax Payment For Individuals on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign IL 1040 ES Estimated Income Tax Payment For Individuals with ease

- Locate IL 1040 ES Estimated Income Tax Payment For Individuals and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign IL 1040 ES Estimated Income Tax Payment For Individuals and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1040 es estimated income tax payment for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 IL 1040 ES form?

The 2023 IL 1040 ES form is used by individuals to make estimated tax payments to the state of Illinois. This form helps taxpayers estimate their tax liability for the year and ensure timely payments to avoid penalties. Understanding how to fill out the 2023 IL 1040 ES form can streamline your tax preparation process.

-

How can airSlate SignNow assist with the 2023 IL 1040 ES form?

airSlate SignNow simplifies the process of signing and sending your 2023 IL 1040 ES form by offering a secure eSigning platform. With features like document tracking and cloud storage, you can ensure your forms are submitted on time. Using SignNow makes compliance with tax deadlines easier.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. These plans include options for monthly or annual subscriptions, with no hidden fees. Investing in airSlate SignNow provides a cost-effective solution for managing your 2023 IL 1040 ES form effortlessly.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers a range of features including customizable templates, in-person signing, and multi-party signing options. Additionally, the platform ensures secure data storage and easy access to your 2023 IL 1040 ES form and other tax documents. These features enhance the overall client experience for taxpayers.

-

Can I integrate airSlate SignNow with other software applications?

Yes, airSlate SignNow integrates seamlessly with various business applications, including CRM systems and cloud storage services. This allows for a more cohesive workflow when handling documents like the 2023 IL 1040 ES form. Integration enhances efficiency and helps you manage all your digital documentation in one place.

-

What are the benefits of using airSlate SignNow for eSignatures?

Using airSlate SignNow for eSignatures provides enhanced security, faster turnaround times, and improved customer satisfaction. By adopting our solution, you can securely sign and send your 2023 IL 1040 ES form without the delays associated with traditional paper methods. This results in a more streamlined and professional process.

-

Is it easy to learn how to use airSlate SignNow for the 2023 IL 1040 ES form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, requiring minimal training to get started. The intuitive interface makes it easy for users to create, sign, and manage their 2023 IL 1040 ES form effectively. Additionally, comprehensive tutorials are available to assist with any questions.

Get more for IL 1040 ES Estimated Income Tax Payment For Individuals

- Hmrc p14 form

- Sa401 form

- Ca5403 form 31477334

- C88 exp tran continuation sheet use form c 88 exp tran for the export or transit of goods hmrc gov

- Official transcript request st gregoryamp39s university form

- Please guide whether we can do neft imps through debit slipog 7374 if customer writes details of beneficiary overleaf and signs form

- Form sf ppr e the white house whitehouse

- Pon 2112 attachment c initial incentive request form nyserda

Find out other IL 1040 ES Estimated Income Tax Payment For Individuals

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF