Nyc 200v Form

What is the NYC 200V?

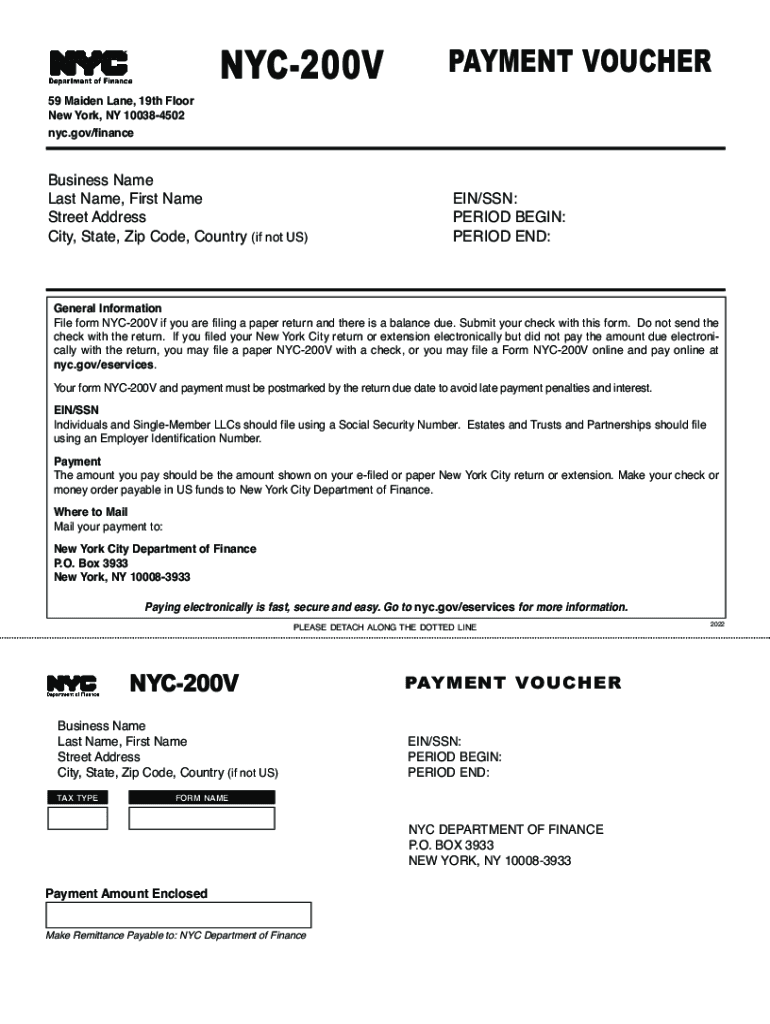

The NYC 200V payment voucher is a form used by taxpayers in New York City to submit payments for various taxes, including personal income tax and business taxes. It serves as a record of payment and is essential for ensuring that the amount paid is credited to the correct account. The form is particularly useful for individuals and businesses that prefer to make payments by mail or in person rather than electronically.

How to Use the NYC 200V

To use the NYC 200V payment voucher, taxpayers must first complete the form accurately. This involves entering personal information, such as name and address, along with the tax type and payment amount. Once the form is filled out, it should be submitted along with the payment to the appropriate tax authority. It is important to keep a copy of the completed voucher for personal records.

Steps to Complete the NYC 200V

Completing the NYC 200V involves several straightforward steps:

- Obtain the form from a reliable source, either online or at a tax office.

- Fill out your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Indicate the type of tax payment you are making and the amount you wish to pay.

- Review the completed form for accuracy.

- Sign and date the form before submitting it.

Legal Use of the NYC 200V

The NYC 200V payment voucher is legally recognized as a valid method for submitting tax payments. It is important for taxpayers to use this form correctly to avoid any issues with payment processing. Failure to submit the form properly may result in penalties or delays in crediting the payment to the taxpayer's account.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when submitting the NYC 200V payment voucher. Generally, payments are due on the same schedule as the corresponding tax returns. It is advisable to check the official NYC Department of Finance website for the most current deadlines to ensure timely submission and avoid penalties.

Form Submission Methods

The NYC 200V can be submitted through various methods, including:

- By mail: Send the completed form along with the payment to the designated tax office.

- In person: Deliver the form and payment directly to a local tax office.

- Online: While the NYC 200V is primarily for paper submissions, taxpayers should check if electronic payment options are available for their specific tax type.

Quick guide on how to complete nyc 200v 701699585

Effortlessly Prepare Nyc 200v on Any Device

Digital document handling has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Nyc 200v on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based processes today.

The Easiest Way to Modify and eSign Nyc 200v without Stress

- Find Nyc 200v and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nyc 200v and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 200v 701699585

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an NYC 200V payment voucher?

The NYC 200V payment voucher is a document used in New York City to facilitate payments for various city services and fees. It provides a streamlined way for individuals and businesses to process their payments efficiently.

-

How can airSlate SignNow help with NYC 200V payment vouchers?

AirSlate SignNow allows you to easily create, send, and eSign NYC 200V payment vouchers digitally. Our platform simplifies the signing and workflow process, making it more convenient to manage payment vouchers from anywhere.

-

Are there any fees associated with using airSlate SignNow for NYC 200V payment vouchers?

Using airSlate SignNow for NYC 200V payment vouchers is cost-effective, with various pricing plans to suit different needs. We offer competitive pricing that helps businesses save time and money when managing their payment documents.

-

What features does airSlate SignNow offer for handling NYC 200V payment vouchers?

AirSlate SignNow offers features like document templates, electronic signatures, and automated workflows specifically designed for NYC 200V payment vouchers. These tools help ensure that your payment processes are both efficient and secure.

-

Can I integrate airSlate SignNow with other software for NYC 200V payment vouchers?

Yes, airSlate SignNow can integrate seamlessly with various software applications, enhancing your ability to manage NYC 200V payment vouchers. This integration helps create a more streamlined workflow, allowing data to flow between systems effortlessly.

-

Is airSlate SignNow compliant with local regulations for NYC 200V payment vouchers?

Absolutely! AirSlate SignNow adheres to all necessary regulations and standards for conducting electronic transactions, including those related to NYC 200V payment vouchers. You can trust that your documents are handled in compliance with local laws.

-

What are the benefits of using airSlate SignNow for NYC 200V payment vouchers?

Using airSlate SignNow for NYC 200V payment vouchers provides numerous benefits, such as increased efficiency, quicker turnaround times, and enhanced security. Our platform allows you to manage your payment documents hassle-free, saving you both time and effort.

Get more for Nyc 200v

- Pdf voluntary unpaid services san francisco ccsf form

- Transcript request form john jay college of criminal justice johnjay jjay cuny

- Suny empire transcript form

- Transfer credit form

- Ulm edustudent leaveof absence requeststudent leave of absence request form

- Immunization compliance form louisiana state university

- Change request form

- Epcc admissions amp aid admissions forms

Find out other Nyc 200v

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free