Form it 2106 Estimated Income Tax Payment Voucher for Fiduciaries Tax Year

What is the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

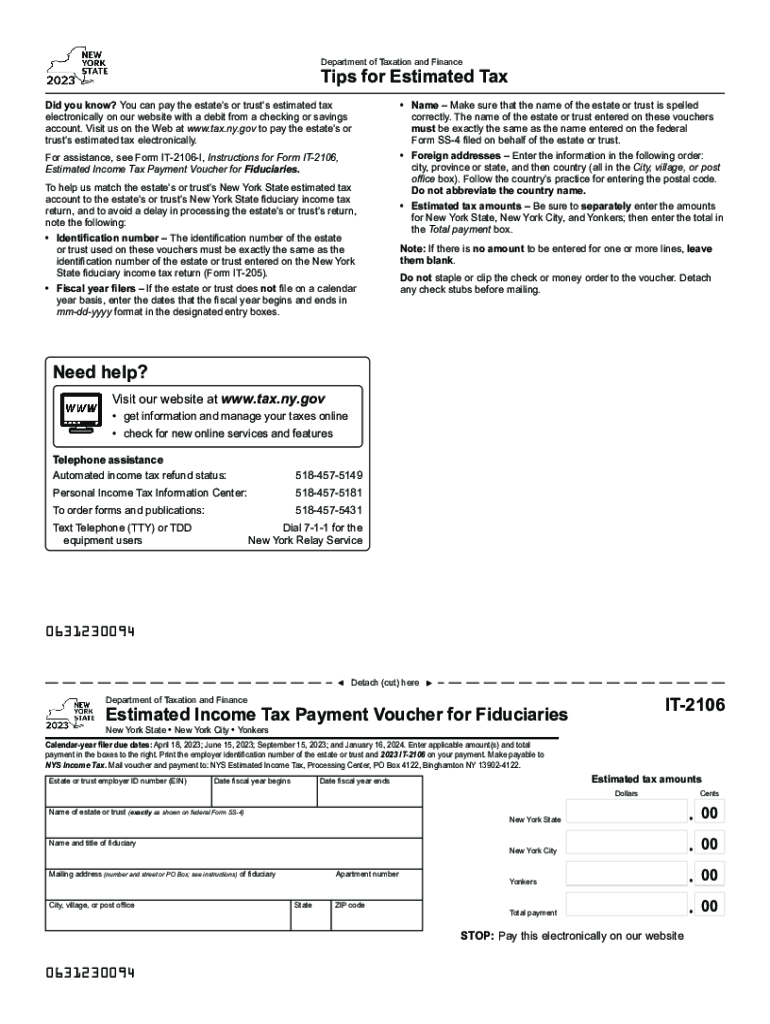

The Form IT 2106 is an essential document used by fiduciaries in the United States to make estimated income tax payments. This form is specifically designed for fiduciaries who manage estates or trusts and need to report and pay taxes on income generated from these entities. The IT 2106 allows fiduciaries to calculate their estimated tax liability for the tax year and submit payments to ensure compliance with federal and state tax regulations. By using this form, fiduciaries can avoid penalties associated with underpayment of taxes and ensure that they meet their tax obligations in a timely manner.

How to use the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

Using the Form IT 2106 involves several straightforward steps. First, fiduciaries need to gather all relevant financial information related to the estate or trust, including income sources and deductions. Next, they should calculate the estimated tax liability based on the income generated. Once the calculations are complete, fiduciaries fill out the form, ensuring all required fields are accurately completed. After filling out the form, it can be submitted along with the payment to the appropriate tax authority, either online or via mail. This process helps ensure that fiduciaries remain compliant with tax laws while managing their responsibilities effectively.

Steps to complete the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

Completing the Form IT 2106 requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate the estimated income for the tax year, considering all sources of income.

- Determine the applicable tax rate and calculate the estimated tax liability.

- Fill out the Form IT 2106, entering the calculated amounts in the appropriate fields.

- Review the completed form for accuracy and completeness.

- Submit the form along with the estimated tax payment to the tax authority.

Key elements of the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

The Form IT 2106 includes several key elements that are crucial for accurate tax reporting. These elements consist of:

- The fiduciary's name and contact information.

- The name and identification number of the estate or trust.

- Estimated income for the tax year.

- Applicable tax rates and calculations for estimated tax liability.

- Payment information, including the amount being submitted.

Each of these elements must be completed accurately to ensure proper processing by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2106 are critical for fiduciaries to avoid penalties. Typically, estimated tax payments are due quarterly, with specific deadlines set by the tax authority. For the current tax year, fiduciaries should be aware of the following important dates:

- First quarter payment: Due on April 15.

- Second quarter payment: Due on June 15.

- Third quarter payment: Due on September 15.

- Fourth quarter payment: Due on January 15 of the following year.

Meeting these deadlines ensures that fiduciaries remain compliant and avoid unnecessary penalties.

Who Issues the Form IT 2106

The Form IT 2106 is issued by the New York State Department of Taxation and Finance. This agency is responsible for managing tax administration in New York, including the collection of income taxes from fiduciaries. The form is specifically tailored for those managing estates and trusts, providing a structured way to report and pay estimated taxes. Fiduciaries can access the form through the department's official website or by contacting their office directly for assistance.

Quick guide on how to complete form it 2106 estimated income tax payment voucher for fiduciaries tax year

Effortlessly Complete Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, as you can access the appropriate forms and securely save them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year seamlessly

- Obtain Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight essential sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your edits.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and eSign Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2106 estimated income tax payment voucher for fiduciaries tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2106 feature in airSlate SignNow?

The it 2106 feature in airSlate SignNow provides users with advanced document management capabilities. This allows for seamless collaboration and efficient eSigning processes. With it 2106, businesses can improve their workflow and ensure timely document approvals.

-

How does airSlate SignNow pricing work for the it 2106 solution?

AirSlate SignNow offers flexible pricing plans that cater to various business needs for the it 2106 solution. You can choose from monthly or annual subscriptions based on your usage requirements. This cost-effective solution ensures that you only pay for the features you need.

-

What benefits does it 2106 provide for my business?

The it 2106 feature enhances operational efficiency by simplifying the document signing process. Businesses benefit from reduced turnaround times and increased productivity. With airSlate SignNow’s it 2106, you can streamline your workflows and improve customer experiences.

-

Can I integrate it 2106 with other software?

Yes, airSlate SignNow’s it 2106 can be easily integrated with various third-party applications. This includes CRM systems and cloud storage solutions, allowing for a seamless workflow across platforms. Integration with it 2106 helps in automating processes and reducing manual tasks.

-

Is it easy to use the it 2106 feature?

Absolutely! The it 2106 feature in airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface makes it easy for anyone, regardless of technical skills, to manage and eSign documents quickly and efficiently.

-

What types of documents can I sign using it 2106?

The it 2106 feature allows you to sign a wide range of documents, including contracts, agreements, and forms. This flexibility is key for businesses that handle various document types. It ensures a comprehensive approach to digital signing.

-

Is there any customer support for it 2106?

Yes, airSlate SignNow provides robust customer support for the it 2106 feature. Users can access resources such as tutorials, FAQs, and direct support channels to resolve any issues. This support ensures that you can maximize the benefits of the it 2106 feature.

Get more for Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

- Phh financial worksheet for customer loss mitt2 contact your bb form

- Actris listing transfer form aborcom

- Not furnished chicago apartment lease broz group form

- Multi board residential real estate contract 40 charles rutenberg form

- Link redetermination 2014 2019 form

- Louisiana real estate inspection response form

- Homesteps amendment form

- Fillable online delaware board of medical licensure and form

Find out other Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF