Tax Vermont Exempt Form

Understanding the Tax Vermont Exempt Form

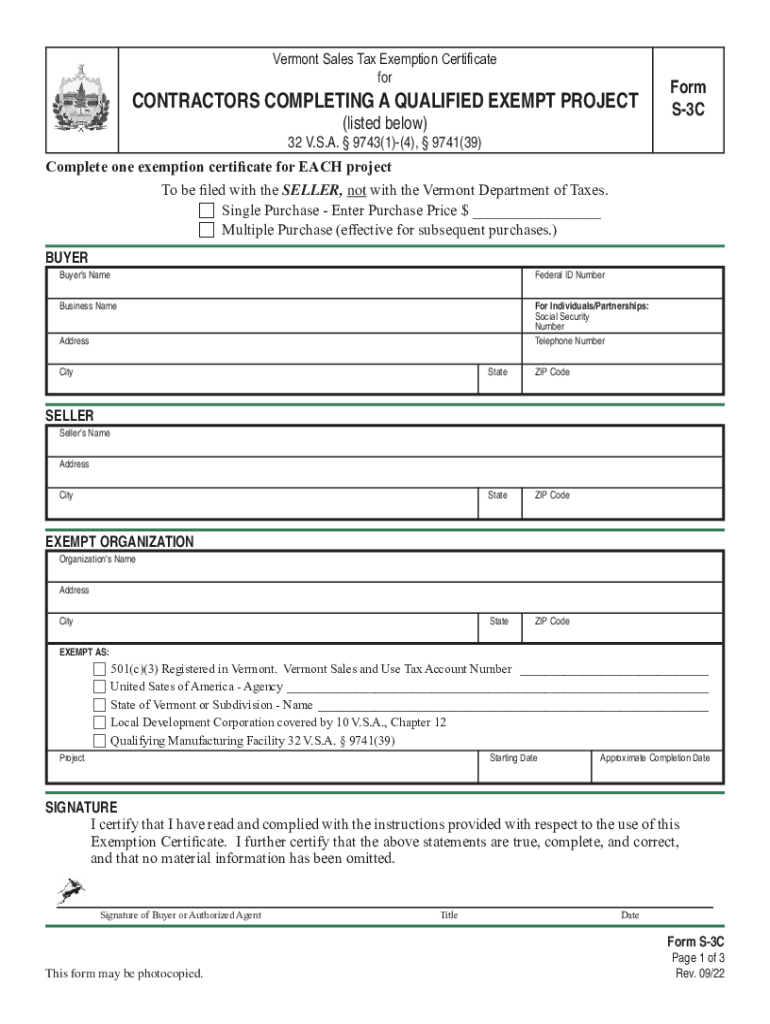

The Tax Vermont Exempt Form is a crucial document for contractors operating in Vermont who seek exemption from certain sales and use taxes. This form is designed to certify that the contractor is eligible for tax-exempt status under Vermont law. It is essential for businesses to understand the specific criteria that qualify them for exemption, which can include factors such as the nature of the project or the type of materials used.

Steps to Complete the Tax Vermont Exempt Form

Completing the Tax Vermont Exempt Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and the nature of the work being performed. Next, fill out the form by providing specific details about the project and the exemption being claimed. Be sure to review the form for any errors before submission, as inaccuracies can lead to delays or rejections.

How to Obtain the Tax Vermont Exempt Form

The Tax Vermont Exempt Form can be obtained through the Vermont Department of Taxes website or by contacting their office directly. It is available in both printable and digital formats, allowing contractors the flexibility to choose the method that best suits their needs. Ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Tax Vermont Exempt Form

Using the Tax Vermont Exempt Form legally requires adherence to state-specific regulations. Contractors must ensure that the exemptions claimed are valid and that the form is used solely for eligible transactions. Misuse of the form can lead to penalties or legal repercussions, making it vital to understand the legal framework surrounding its use.

Eligibility Criteria for the Tax Vermont Exempt Form

Eligibility for the Tax Vermont Exempt Form is determined by specific criteria set forth by the state. Generally, contractors must demonstrate that their work falls under exempt categories, such as certain public projects or non-profit activities. It is important to review the guidelines provided by the Vermont Department of Taxes to confirm eligibility before submitting the form.

Form Submission Methods

Contractors can submit the Tax Vermont Exempt Form through various methods, including online submission via the Vermont Department of Taxes website, mailing a hard copy, or delivering it in person. Each method has its own processing times and requirements, so it is advisable to choose the method that aligns with your timeline and preferences.

Key Elements of the Tax Vermont Exempt Form

The Tax Vermont Exempt Form contains several key elements that must be accurately completed for successful processing. These include the contractor's information, a detailed description of the project, the specific exemption being claimed, and the signature of the authorized representative. Ensuring that all sections are filled out correctly is essential for compliance and to avoid delays in processing.

Quick guide on how to complete tax vermont exempt form

Prepare Tax Vermont Exempt Form easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage Tax Vermont Exempt Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Tax Vermont Exempt Form effortlessly

- Locate Tax Vermont Exempt Form and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or missing documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Tax Vermont Exempt Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax vermont exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services do Vermont tax contractors offer?

Vermont tax contractors provide a variety of services, including tax preparation, consulting, and compliance assistance. They are equipped to handle both individual and business tax needs, ensuring clients meet state and federal regulations effectively. These professionals can help you maximize deductions and minimize liabilities.

-

How can airSlate SignNow benefit Vermont tax contractors?

airSlate SignNow offers Vermont tax contractors an efficient way to manage documents and signatures digitally. By using our platform, contractors can speed up the client onboarding process, ensuring essential paperwork is signed and returned quickly. This enhances overall productivity and saves valuable time in busy tax seasons.

-

What is the pricing structure for Vermont tax contractors using airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to Vermont tax contractors of all sizes. Our plans are tailored to meet different document volume needs and feature requirements. By offering a cost-effective solution, we help contractors manage their budgets while accessing premium functionalities.

-

Is airSlate SignNow compliant with Vermont tax regulations?

Yes, airSlate SignNow is designed to comply with Vermont tax regulations and industry standards. Our platform ensures that all electronic signatures and document storage meet necessary legal requirements. This makes it a reliable choice for Vermont tax contractors who want to stay compliant with state laws.

-

What features does airSlate SignNow offer for Vermont tax contractors?

airSlate SignNow provides features specifically beneficial for Vermont tax contractors, such as customizable templates, cloud storage, and secure eSigning. These tools simplify document handling, allowing contractors to manage client files with ease. Additionally, users can track document status in real-time, enhancing communication and efficiency.

-

Can airSlate SignNow integrate with other platforms used by Vermont tax contractors?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software that Vermont tax contractors typically use. This integration streamlines workflows and helps avoid duplicate data entry, making it easier for contractors to maintain accurate records and manage client information efficiently.

-

What are the benefits of using airSlate SignNow for client document management?

Using airSlate SignNow offers numerous benefits for Vermont tax contractors, including improved efficiency, enhanced security, and cost savings. The platform allows for quick document turnaround, reducing bottlenecks in client interactions. Additionally, our secure cloud storage protects sensitive client information, providing peace of mind.

Get more for Tax Vermont Exempt Form

- Mc 703 application for order to vacate prefiling order cebcom form

- Gc 040 form

- Tr 205 fillable editable and saveable california judicial council forms

- Fl 103 form

- Ud 105 2014 2019 form

- Virginia experience verification form state legal forms

- New mexico continuing education course state legal forms

- Missouri standardized credentialling form state legal forms

Find out other Tax Vermont Exempt Form

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe