Scwithholding Sc Withholding Form

Understanding South Carolina Withholding

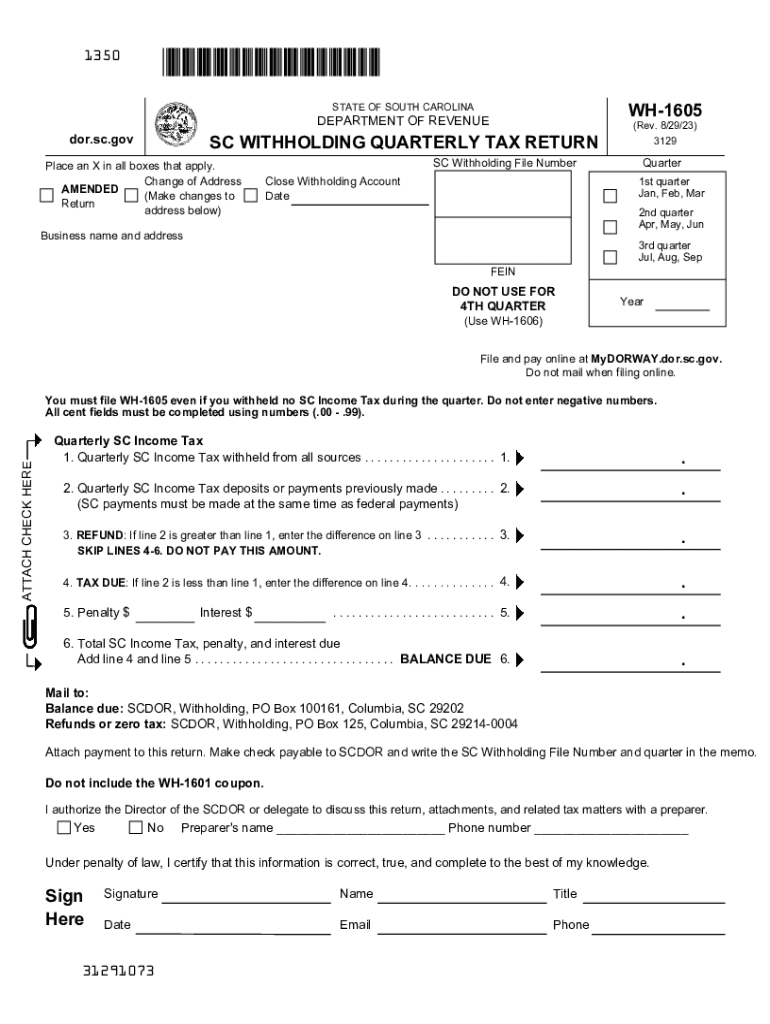

South Carolina withholding refers to the state income tax that employers are required to withhold from employees' wages. This withholding is crucial for ensuring that employees meet their tax obligations throughout the year. The amount withheld is based on the employee's earnings, filing status, and the number of allowances claimed on their South Carolina employee withholding form. Employers must stay compliant with state regulations to avoid penalties.

Steps to Complete the South Carolina Withholding Form

To complete the South Carolina employee withholding form, follow these steps:

- Obtain the form: Download the South Carolina employee withholding form from the South Carolina Department of Revenue website or access it through your payroll software.

- Fill in personal information: Enter your name, address, Social Security number, and filing status.

- Claim allowances: Indicate the number of allowances you are claiming. This will affect the amount withheld from your paycheck.

- Sign and date the form: Ensure that you sign and date the form to validate it.

- Submit to your employer: Provide the completed form to your employer's payroll department.

Filing Deadlines for South Carolina Withholding

Employers must adhere to specific filing deadlines for South Carolina withholding. Monthly filers are required to submit their withholding taxes by the 15th of the month following the reporting period. Quarterly filers must submit their taxes by the last day of the month following the end of each quarter. It is essential for employers to stay informed about these deadlines to avoid late fees and penalties.

Legal Use of the South Carolina Withholding Form

The South Carolina withholding form is legally required for employers to accurately report and remit state income taxes withheld from employees. This form ensures compliance with state tax laws and helps maintain accurate records for both employers and employees. Failure to use the form correctly can result in penalties for employers, including fines and interest on unpaid taxes.

Who Issues the South Carolina Withholding Form

The South Carolina Department of Revenue is responsible for issuing the South Carolina withholding form. This state agency provides guidelines and resources to assist employers and employees in understanding their withholding obligations. Employers can access the form and related materials directly from the Department of Revenue's official website.

Penalties for Non-Compliance with South Carolina Withholding Regulations

Employers who fail to comply with South Carolina withholding regulations may face various penalties. These can include fines for late payments, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is crucial for employers to ensure that they are withholding the correct amounts and submitting them on time to avoid these consequences.

Required Documents for South Carolina Withholding

To properly complete the South Carolina withholding form, certain documents may be required. These include:

- Employee's Social Security number

- Proof of residency (if applicable)

- Previous year’s tax return (for reference)

- Any additional forms related to specific tax situations (e.g., W-4 for federal withholding)

Quick guide on how to complete scwithholding sc withholding

Complete Scwithholding Sc Withholding seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Scwithholding Sc Withholding on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to alter and eSign Scwithholding Sc Withholding effortlessly

- Locate Scwithholding Sc Withholding and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Scwithholding Sc Withholding and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the scwithholding sc withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is South Carolina withholding and why is it important for businesses?

South Carolina withholding is the process where employers deduct state income tax from employee wages. It's important for businesses to understand and manage this effectively to ensure compliance with state tax regulations and avoid penalties.

-

How can airSlate SignNow assist with South Carolina withholding documentation?

airSlate SignNow simplifies the signing and management of documents related to South Carolina withholding. By digitizing forms, businesses can streamline the process, making it easier for employees to fill out, sign, and submit necessary tax forms securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for South Carolina withholding forms?

Yes, there are pricing plans for using airSlate SignNow, which provides a cost-effective solution for businesses. Depending on the plan you choose, you can manage unlimited documents, including those related to South Carolina withholding, while ensuring affordability for your operations.

-

What features does airSlate SignNow offer for managing South Carolina withholding?

airSlate SignNow offers features like customizable templates, bulk sending, and automated reminders which are perfect for managing South Carolina withholding. These functionalities help businesses ensure compliance while saving valuable time and improving productivity.

-

Can airSlate SignNow integrate with payroll software for South Carolina withholding?

Yes, airSlate SignNow integrates seamlessly with various payroll software, providing businesses with a comprehensive solution for managing South Carolina withholding. This ensures that all employee data and tax withholding details are synchronized effectively for accurate reporting.

-

What are the benefits of using airSlate SignNow for South Carolina withholding?

The benefits include enhanced security for sensitive documents, easy access and management of South Carolina withholding forms, and increased efficiency in obtaining signatures. Ultimately, it aids in maintaining compliance while minimizing paperwork and reducing processing time.

-

How do I get started with airSlate SignNow for South Carolina withholding?

Getting started is simple. Visit the airSlate SignNow website, choose a plan that fits your business needs, and create an account. From there, you can begin managing your South Carolina withholding documents with user-friendly tools and resources.

Get more for Scwithholding Sc Withholding

- Recording requested by note when recorded mail t form

- N 643 form

- Baffidavitb of common law bmarriageb request for enrollment of bb form

- Transfer on death deed granters as owners form

- 0630 enterprise income verification eiv system multifamily housing coordinator access authorization form paperwork reduction

- Annual electric power form

- Juvenile community service form chambers county

- Fillable online courts ky audiovideo request form courts ky fax

Find out other Scwithholding Sc Withholding

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed