Schedule K 1 Form 1065

What is the Schedule K-1 Form 1065

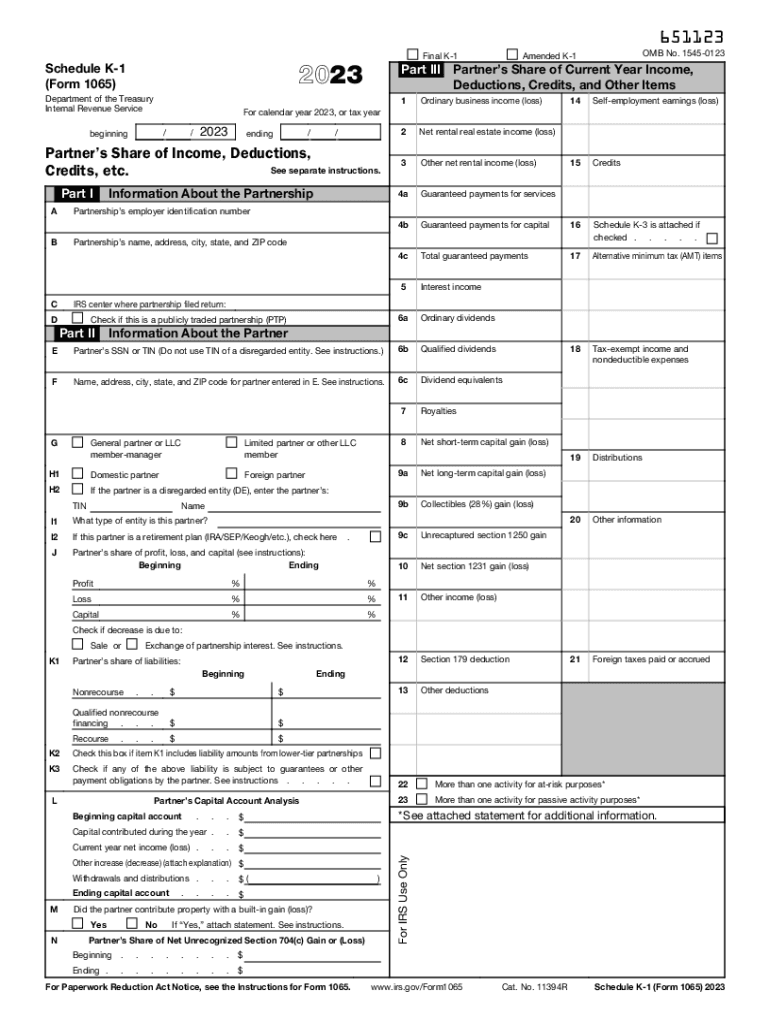

The Schedule K-1 Form 1065 is a crucial document used in the United States tax system. It is primarily issued by partnerships to report each partner's share of income, deductions, and credits. The form provides detailed information about the financial performance of the partnership, allowing partners to accurately report their earnings on their individual tax returns. Each partner receives a separate K-1, which outlines their specific share of the partnership's financial activities for the tax year.

How to use the Schedule K-1 Form 1065

Using the Schedule K-1 Form 1065 involves several steps. First, partners must review the information provided on the K-1 to ensure accuracy. The details reported include income, losses, and other tax-related items. Partners then use this information to fill out their individual tax returns, typically on Form 1040. It is essential to include the K-1 details accurately to avoid discrepancies with the IRS.

Steps to complete the Schedule K-1 Form 1065

Completing the Schedule K-1 Form 1065 requires careful attention to detail. Here are the key steps:

- Gather necessary financial information from the partnership's records.

- Fill out the form with accurate figures reflecting the partner's share of income, deductions, and credits.

- Ensure all required sections are completed, including the partner's information and the partnership's details.

- Review the form for any errors before submission.

- Provide a copy of the completed K-1 to each partner for their tax filing.

Key elements of the Schedule K-1 Form 1065

The Schedule K-1 Form 1065 contains several key elements that are vital for accurate reporting. These include:

- Partner's Information: This section includes the partner's name, address, and identifying number.

- Partnership Information: Details about the partnership, including its name and Employer Identification Number (EIN).

- Income and Losses: This part outlines the partner's share of the partnership's income, losses, and other tax items.

- Tax Credits and Deductions: Any credits or deductions that the partner can claim based on their share of the partnership's activities.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Schedule K-1 Form 1065 is essential for compliance. Generally, partnerships must file their tax returns, including the K-1, by March 15 of each year. Partners should receive their K-1 forms in a timely manner, typically by the same deadline, to ensure they can accurately report their income when filing their individual tax returns. It is advisable to keep track of these dates to avoid penalties.

Who Issues the Form

The Schedule K-1 Form 1065 is issued by partnerships to their partners. Partnerships are required to prepare and distribute K-1 forms to each partner annually. This document serves as a record of each partner's share of the partnership's income and expenses, ensuring that all partners can report their earnings correctly on their personal tax returns. It is important for partnerships to maintain accurate records to facilitate the proper completion of the K-1 forms.

Quick guide on how to complete schedule k 1 form 1065

Complete Schedule K 1 Form 1065 effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your files promptly without hold-ups. Manage Schedule K 1 Form 1065 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Schedule K 1 Form 1065 without hassle

- Locate Schedule K 1 Form 1065 and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form: via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from a device of your choosing. Edit and electronically sign Schedule K 1 Form 1065 and guarantee outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to k1?

AirSlate SignNow is an innovative e-signature platform that streamlines the process of sending and signing documents. It offers a user-friendly interface and integrates seamlessly with various applications, making it an ideal choice for businesses seeking effective k1 solutions.

-

How much does airSlate SignNow cost for k1 users?

AirSlate SignNow offers competitive pricing tailored for k1 users, featuring diverse subscription plans to fit various business needs. These plans provide access to all essential features, ensuring that you get the most cost-effective solution for handling your documents.

-

What features does airSlate SignNow provide for optimal k1 management?

AirSlate SignNow includes a robust set of features designed specifically for k1 management, such as customizable templates, real-time tracking, and advanced security options. These features help businesses simplify document workflows and enhance productivity signNowly.

-

Can airSlate SignNow integrate with other software for k1 processes?

Yes, airSlate SignNow offers extensive integrations with popular software applications, making it a versatile solution for k1 processes. You can seamlessly connect with various tools like CRM systems, cloud storage, and productivity suites to enhance your document management capabilities.

-

What benefits does using airSlate SignNow provide for k1 document workflows?

Utilizing airSlate SignNow for k1 document workflows leads to increased efficiency, reduced turnaround times, and enhanced user satisfaction. By simplifying the e-signature process, businesses can focus more on their core activities rather than getting bogged down by paperwork.

-

Is airSlate SignNow suitable for small businesses handling k1 documents?

Absolutely! AirSlate SignNow is specifically designed to be cost-effective and easy to use, making it an ideal choice for small businesses handling k1 documents. Its scalability ensures that as your business grows, you can easily adapt the platform to meet your evolving needs.

-

How secure is airSlate SignNow for handling sensitive k1 information?

AirSlate SignNow prioritizes the security of your k1 information, implementing robust encryption and compliance with industry standards. This ensures that your documents are protected throughout the signing process, giving you peace of mind in your business transactions.

Get more for Schedule K 1 Form 1065

- Manufacturer qap rules nmeda form

- Certificate of special qualification for university studies 616921914 form

- Foundation course application form foundation college

- Register for organs donor form for maryland

- Us bully registry litter registration form

- Far 43 appendix d form

- Swaziland revenue authority s r a form

- Rbc personal statement of affairs form

Find out other Schedule K 1 Form 1065

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free