IRS Form 656 B, Offer in Compromise Instructions

Understanding the Offer in Compromise Process

An Offer in Compromise (OIC) is a tax settlement option that allows taxpayers to settle their tax debts for less than the full amount owed. This process is particularly relevant for individuals and businesses facing financial difficulties. The California Franchise Tax Board (FTB) offers this option through specific forms, including the FTB 4905. The key to a successful OIC is demonstrating that paying the full tax liability would cause financial hardship.

Eligibility Criteria for the FTB Offer in Compromise

To qualify for an FTB Offer in Compromise, taxpayers must meet certain eligibility requirements. These include:

- Being unable to pay the full tax liability due to financial hardship.

- Having filed all required tax returns.

- Not being in an open bankruptcy proceeding.

- Meeting specific income and asset thresholds as determined by the FTB.

Understanding these criteria is essential before initiating the OIC process, as failure to meet them can result in rejection of the offer.

Steps to Complete the FTB 4905 Form

Completing the FTB 4905 form involves several key steps:

- Gather all necessary financial documents, including income statements and asset information.

- Complete the FTB 4905 form accurately, ensuring all sections are filled out as required.

- Calculate the offer amount based on your financial situation and the FTB guidelines.

- Submit the form along with any required documentation and payment for the application fee.

Following these steps carefully increases the likelihood of a successful offer submission.

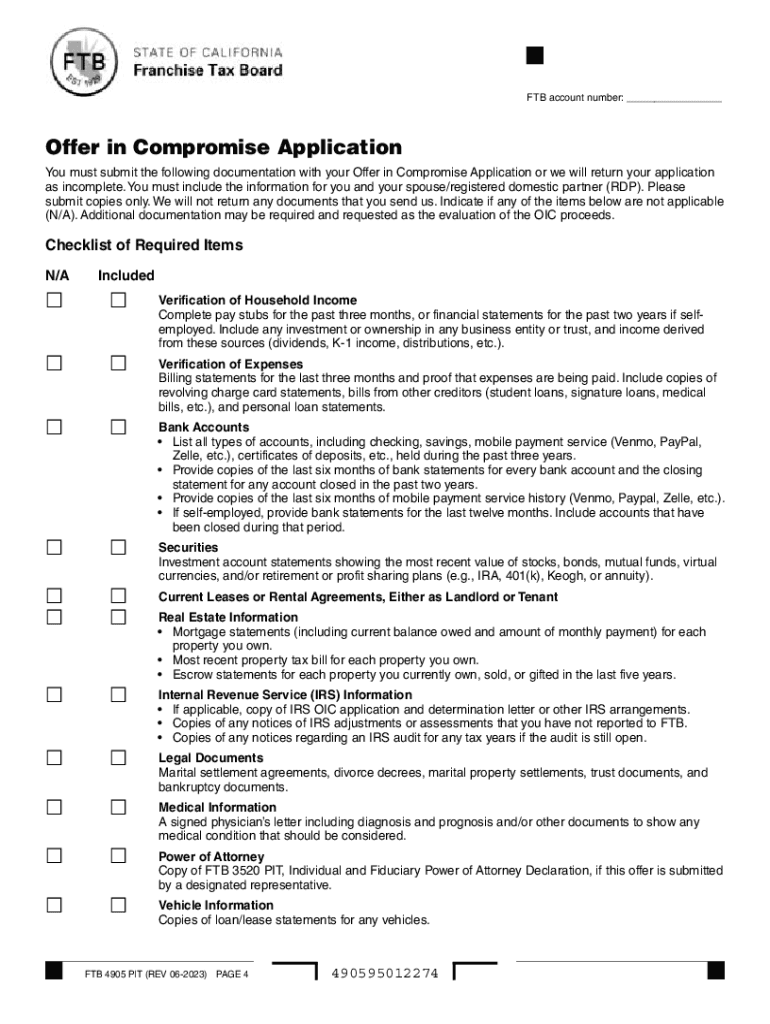

Required Documents for Submission

When submitting an Offer in Compromise, certain documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of expenses, including bills and receipts.

- Asset statements, such as bank statements or property appraisals.

Providing comprehensive documentation helps the FTB assess your financial situation accurately.

Form Submission Methods

Taxpayers can submit the FTB 4905 form through various methods:

- Online submission via the FTB website, if available.

- Mailing the completed form and documents to the appropriate FTB address.

- In-person submission at designated FTB offices.

Choosing the right submission method can impact the processing time of your offer.

IRS Guidelines for Offers in Compromise

While the FTB manages offers in compromise in California, it is important to understand the broader IRS guidelines as well. The IRS Form 656 B outlines similar processes for federal tax liabilities. Taxpayers should familiarize themselves with both state and federal requirements to ensure compliance and maximize their chances of acceptance.

Quick guide on how to complete irs form 656 b offer in compromise instructions

Handle IRS Form 656 B, Offer In Compromise Instructions effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the needed form and securely save it online. airSlate SignNow provides you all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage IRS Form 656 B, Offer In Compromise Instructions on any system with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign IRS Form 656 B, Offer In Compromise Instructions easily

- Obtain IRS Form 656 B, Offer In Compromise Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to secure your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign IRS Form 656 B, Offer In Compromise Instructions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 656 b offer in compromise instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an offer compromise ftb in?

An offer compromise ftb in is a tax settlement option provided by the Franchise Tax Board that allows individuals or businesses to settle their tax debts for less than they owe. It is designed for taxpayers who can't pay their full tax liability, making it an essential option for those struggling financially.

-

How does airSlate SignNow facilitate the offer compromise ftb in process?

airSlate SignNow streamlines the offer compromise ftb in process by providing a user-friendly platform to sign and send necessary documents electronically. This efficiency reduces processing time and ensures that all paperwork is completed accurately and securely.

-

What are the costs associated with submitting an offer compromise ftb in?

While airSlate SignNow has affordable pricing plans that support users in submitting various documents, the costs associated with an offer compromise ftb in can vary depending on your tax situation. It's important to consider consultation fees and any potential penalties or interest that might apply.

-

What features does airSlate SignNow offer for managing offer compromises?

airSlate SignNow provides several features that assist in managing offer compromises, including document templates, secure eSigning, and real-time tracking. These tools improve organization and ensure that all forms related to the offer compromise ftb in are handled efficiently.

-

What benefits can I expect from using airSlate SignNow for my offer compromise ftb in?

By using airSlate SignNow for your offer compromise ftb in, you can expect increased convenience through electronic signing, reduced paperwork errors, and faster processing times. Additionally, our platform enhances safety by ensuring that all transactions are encrypted and compliant with regulatory standards.

-

Is airSlate SignNow compliant with offer compromise ftb in requirements?

Yes, airSlate SignNow adheres to all necessary compliance measures for the offer compromise ftb in process. Our platform ensures that documents are created and signed in line with current legal standards, giving users peace of mind while navigating their tax settlements.

-

Can I integrate airSlate SignNow with other software while handling my offer compromise ftb in?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, enhancing your workflow while managing your offer compromise ftb in. This integration capability allows users to streamline documentation and communication processes effectively.

Get more for IRS Form 656 B, Offer In Compromise Instructions

- Unified medical declaration form

- Puppy deposit breceiptb form

- Workout contract form

- Atl security badgevehicle permit return form this

- Com firma reconhecida por notary public form

- Telekom malaysia berhad 128740 p form

- Sales authorization and cpni consent form verizon

- Usa hockey officials evaluation formofficial eval

Find out other IRS Form 656 B, Offer In Compromise Instructions

- Sign PDF for HR Online

- Sign PDF for HR Now

- Sign PDF for HR Later

- Sign PDF for HR Fast

- Sign PDF for HR Simple

- Sign PDF for HR Easy

- Sign Word for HR Computer

- Sign Word for HR Online

- Sign Word for HR Mobile

- Sign Word for HR Later

- Sign Word for HR Now

- Sign Word for HR Secure

- Sign Word for HR Free

- Sign Word for HR Fast

- Sign Word for HR Easy

- Sign Word for HR Simple

- Can I Sign Word for HR

- Sign Document for HR Online

- Sign Document for HR Now

- Sign Document for HR Later