Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return

What is Form 199?

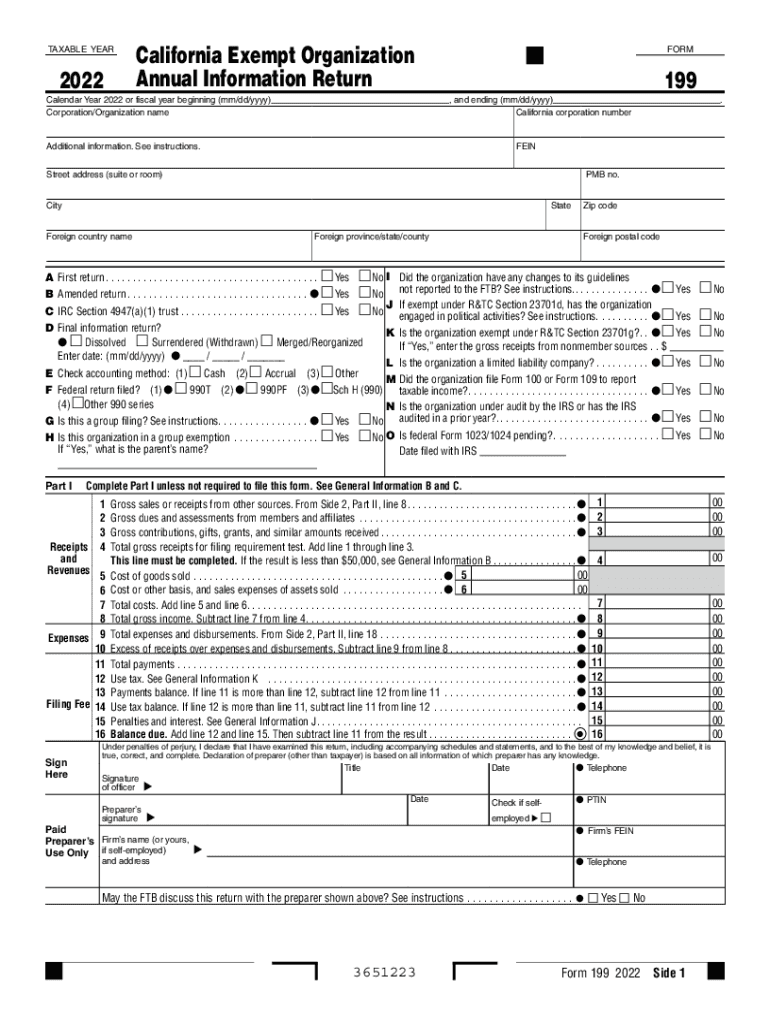

Form 199, officially known as the Exempt Organization Annual Information Return, is a crucial document for certain tax-exempt organizations in California. This form is designed to provide the Franchise Tax Board (FTB) with essential information about the organization’s financial activities, governance, and compliance with state regulations. Organizations that are required to file this form include those that are exempt under Internal Revenue Code Section 501(c)(3) and other similar designations.

How to Obtain Form 199

Obtaining Form 199 is straightforward. Organizations can access the form through the California Franchise Tax Board's official website. The form is available in PDF format, allowing for easy downloading and printing. Additionally, organizations may request a physical copy by contacting the FTB directly. It is important to ensure that the correct version of the form is used, particularly for the relevant tax year.

Steps to Complete Form 199

Completing Form 199 involves several key steps:

- Gather necessary financial records, including income statements and balance sheets.

- Provide detailed information about the organization’s mission, activities, and governance structure.

- Complete each section of the form accurately, ensuring all required fields are filled.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either electronically or via mail.

Legal Use of Form 199

Form 199 serves as a legal document that ensures compliance with California tax laws for exempt organizations. Filing this form is not only a legal requirement but also a means of maintaining transparency and accountability. Organizations that fail to file Form 199 may face penalties, including the potential loss of their tax-exempt status.

Key Elements of Form 199

Form 199 includes several critical components that organizations must address:

- Organization Information: Name, address, and tax identification number.

- Financial Data: Income, expenses, and net assets.

- Governance Details: Information about the board of directors and key personnel.

- Activities: Description of the organization’s programs and services.

Filing Deadlines for Form 199

Organizations must adhere to specific deadlines when filing Form 199. Typically, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form would be due by May 15 of the following year. It is essential to keep track of these deadlines to avoid penalties.

Quick guide on how to complete form 199 exempt organization annual information return form 199 exempt organization annual information return

Effortlessly Prepare Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an optimal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to generate, modify, and eSign your documents swiftly without any hold-ups. Manage Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Most Effective Method to Modify and eSign Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return with Ease

- Locate Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential parts of your documents or obscure confidential information using features that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign function, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Complete button to secure your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 199 exempt organization annual information return form 199 exempt organization annual information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the number 199?

airSlate SignNow is a powerful tool that empowers businesses to send and eSign documents efficiently. The integration of the number 199 often represents specific pricing tiers or features within our service offerings, highlighting our commitment to providing cost-effective solutions.

-

How much does airSlate SignNow cost in relation to the 199 pricing tier?

Our pricing for airSlate SignNow includes various tiers, with the 199 option offering exceptional value for businesses seeking comprehensive eSigning features. This tier includes advanced functionalities, ensuring efficient document management at a competitive price.

-

What features does airSlate SignNow include in the 199 pricing plan?

The 199 pricing plan for airSlate SignNow comes with essential features such as document templates, team collaboration, and unlimited eSignatures. These features are designed to streamline your workflow and enhance productivity across your organization.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow allows businesses to quickly send and eSign documents, signNowly reducing turnaround times. Specifically, the 199 pricing tier provides access to premium features that enhance accessibility and improve organizational efficiency.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing its functionality. This is especially useful at the 199 pricing tier, allowing seamless connectivity with platforms like Google Drive, Salesforce, and more to automate your workflows.

-

Is there a mobile app for airSlate SignNow related to the 199 plan?

Absolutely! The airSlate SignNow mobile app is available to all users, including those on the 199 pricing plan. This app facilitates on-the-go access to your documents, enabling signing and sending from anywhere, which is perfect for busy professionals.

-

How does airSlate SignNow ensure document security in the 199 tier?

Document security is a top priority for airSlate SignNow, especially for users on the 199 tier. We employ robust encryption protocols, two-factor authentication, and compliance with global security standards to ensure that your documents remain safe and secure.

Get more for Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return

Find out other Form 199 Exempt Organization Annual Information Return Form 199 Exempt Organization Annual Information Return

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament