Form 100S California S Corporation Franchise or Income Tax

What is the Form 100S California S Corporation Franchise Or Income Tax

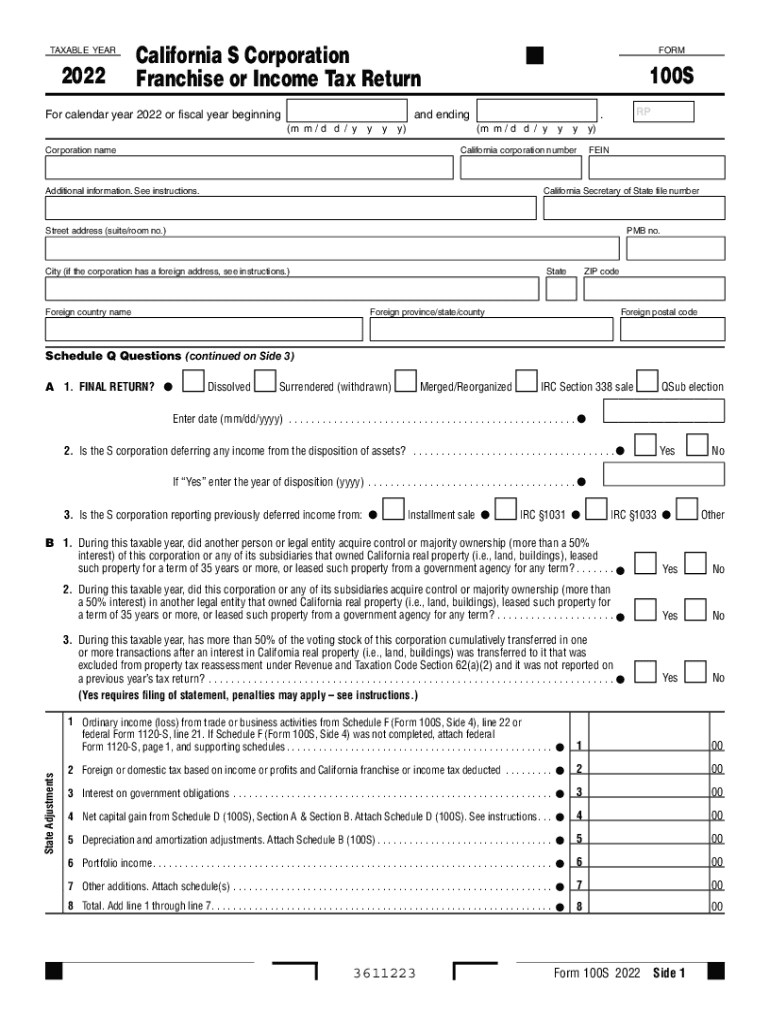

The Form 100S is a tax form used by S corporations in California to report their income, deductions, and other tax-related information. This form is specifically designed for S corporations that have elected to be taxed as pass-through entities, meaning the income is passed through to shareholders and taxed at the individual level. The California Franchise Tax Board (FTB) requires this form to assess the franchise tax owed by S corporations operating within the state. Understanding the purpose of Form 100S is essential for compliance and accurate tax reporting.

How to use the Form 100S California S Corporation Franchise Or Income Tax

Using Form 100S involves several steps to ensure accurate reporting of your S corporation's financial activities. Start by gathering all necessary financial documents, including income statements, balance sheets, and prior year tax returns. Next, fill out the form by providing details about your corporation's income, deductions, and credits. It is important to follow the instructions provided by the FTB carefully to avoid errors. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the requirements set by the FTB.

Steps to complete the Form 100S California S Corporation Franchise Or Income Tax

Completing Form 100S involves a systematic approach to ensure all information is accurate. Begin by entering your corporation's identifying information, including the name, address, and federal employer identification number (FEIN). Next, report your total income, which includes all revenue generated during the tax year. Deduct allowable expenses to arrive at your net income. Be sure to include any applicable credits and calculate the franchise tax owed. Finally, review the completed form for accuracy before submitting it to the FTB.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form 100S to avoid penalties. Generally, the form is due on the 15th day of the third month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by March 15. If additional time is needed, corporations can file for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failure to file Form 100S on time or providing inaccurate information can result in significant penalties. The California Franchise Tax Board imposes a penalty for late filing, which is usually a percentage of the unpaid tax. Additionally, if the form is not filed at all, the corporation may face a minimum franchise tax charge. It is essential for S corporations to stay compliant with filing requirements to avoid these financial repercussions.

Eligibility Criteria

To file Form 100S, a corporation must meet specific eligibility criteria. Primarily, the corporation must have elected to be treated as an S corporation for federal tax purposes. This includes having no more than one hundred shareholders, all of whom must be eligible individuals or certain trusts. Additionally, the corporation must meet the requirements set forth by the California Franchise Tax Board, including conducting business within California and adhering to state regulations.

Quick guide on how to complete form 100s california s corporation franchise or income tax

Complete Form 100S California S Corporation Franchise Or Income Tax effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without any holdups. Manage Form 100S California S Corporation Franchise Or Income Tax on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Form 100S California S Corporation Franchise Or Income Tax with ease

- Obtain Form 100S California S Corporation Franchise Or Income Tax and click on Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing additional copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 100S California S Corporation Franchise Or Income Tax and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100s california s corporation franchise or income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are form 100s and how can airSlate SignNow help with them?

Form 100s are essential documents used in various business processes. airSlate SignNow streamlines the process by allowing users to create, send, and electronically sign these forms efficiently. With its user-friendly interface, businesses can ensure compliance and improve turnaround times.

-

What features does airSlate SignNow offer for handling form 100s?

airSlate SignNow offers a range of features for form 100s, including customizable templates, real-time tracking, and automated reminders for signing. Additionally, users can integrate fields for easy data entry, making the completion of form 100s smooth and efficient.

-

Is airSlate SignNow a cost-effective solution for managing form 100s?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing form 100s. With various pricing plans available, businesses can choose a package that fits their budget while still accessing robust features to enhance their document workflows.

-

Can I integrate airSlate SignNow with other tools for managing form 100s?

Absolutely! airSlate SignNow offers seamless integrations with popular tools like Salesforce, Google Workspace, and more. This allows users to manage form 100s effectively within their existing workflows, improving productivity and collaboration across teams.

-

How does airSlate SignNow ensure the security of form 100s?

Security is a top priority at airSlate SignNow. All transactions involving form 100s are encrypted, and the platform complies with industry-leading security standards. Users can rest assured that their sensitive information remains protected throughout the signing process.

-

Can multiple users collaborate on form 100s using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 100s. Users can invite colleagues to review or sign documents, facilitating teamwork and ensuring that everyone involved in the process can contribute efficiently.

-

What benefits can businesses expect from using airSlate SignNow for form 100s?

Businesses using airSlate SignNow for form 100s can expect increased efficiency, faster processing times, and improved accuracy. The platform helps eliminate paper-based processes and reduces the risk of manual errors, leading to a more streamlined operation.

Get more for Form 100S California S Corporation Franchise Or Income Tax

- Application form for non resident indians nri union bank of india

- Form lb 0441 2013 2019

- Dcps dual certification bonus application and guidelines dcps dc form

- Cadet employment application louisiana state police lsp form

- Phoenix sales tax form

- 1093 proof of residency usps form

- Dentition analysis form

- Sec 44 worksheet trigonometric functions of any angle form

Find out other Form 100S California S Corporation Franchise Or Income Tax

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application