California Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

Understanding the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

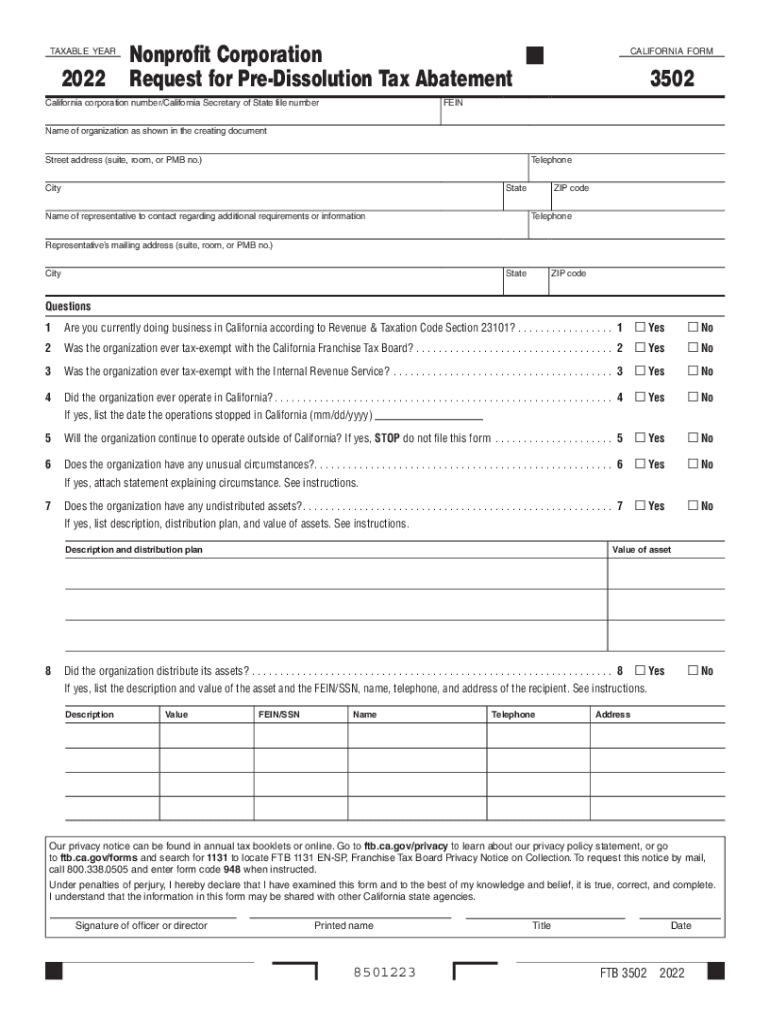

The California Form 3502 is a crucial document for nonprofit corporations seeking to request a pre-dissolution tax abatement. This form allows organizations to address tax liabilities before officially dissolving. By submitting this request, nonprofits can potentially reduce or eliminate outstanding tax obligations, ensuring a smoother transition during the dissolution process.

Steps to Complete the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Completing the California Form 3502 involves several key steps. First, gather all necessary information about your nonprofit, including its legal name, address, and tax identification number. Next, accurately fill out each section of the form, ensuring that all details are correct to avoid delays. It is essential to provide a clear explanation of why the abatement is being requested, along with any supporting documentation that may strengthen your case. Finally, review the form thoroughly before submission to ensure completeness and accuracy.

Eligibility Criteria for the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

To qualify for the pre-dissolution tax abatement, certain eligibility criteria must be met. The nonprofit corporation must be in good standing with the state of California and must have fulfilled all reporting requirements. Additionally, the organization should demonstrate that it has no remaining assets or that it has appropriately distributed its assets in accordance with state laws. Meeting these criteria is essential for a successful application.

Required Documents for the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

When submitting the California Form 3502, specific documents are typically required to support the request. These may include the nonprofit's articles of incorporation, financial statements, and any prior correspondence with tax authorities. It is advisable to include any additional documentation that can substantiate the claim for tax abatement, such as records of asset distribution or evidence of compliance with state regulations.

Filing Deadlines for the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Timely submission of the California Form 3502 is critical to ensure that the tax abatement request is processed efficiently. Generally, it is recommended to file the form at least thirty days prior to the intended dissolution date. This allows sufficient time for review and any necessary follow-up from tax authorities. Staying aware of specific deadlines can help avoid complications during the dissolution process.

Form Submission Methods for the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

The California Form 3502 can be submitted through various methods, depending on the preferences of the nonprofit organization. Options typically include mailing the completed form to the appropriate tax authority, submitting it in person at designated offices, or utilizing online submission platforms if available. Each method may have different processing times, so it is essential to choose the one that best suits the organization's needs.

Quick guide on how to complete california form 3502 nonprofit corporation request for pre dissolution tax abatement

Effortlessly Prepare California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without interruptions. Manage California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement effortlessly

- Locate California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight essential parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 3502 nonprofit corporation request for pre dissolution tax abatement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

The California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement is a form that allows nonprofits in California to request a tax abatement before dissolution. This form enables eligible organizations to avoid additional tax liability during the dissolution process by formally applying for tax relief.

-

How can airSlate SignNow help with the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

airSlate SignNow streamlines the process of completing and submitting the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. Our platform allows you to digitally fill out the form, obtain electronic signatures, and manage document workflows efficiently, ensuring compliance with California's requirements.

-

What are the pricing options for using airSlate SignNow for the California Form 3502?

airSlate SignNow offers various pricing plans suitable for organizations of all sizes looking to complete the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. We provide competitive pricing that includes features like eSigning, document management, and customer support, ensuring you get the best value for your needs.

-

Is airSlate SignNow compliant with California regulations for eSigning forms like the California Form 3502?

Yes, airSlate SignNow is fully compliant with California regulations concerning electronic signatures. This compliance ensures that any submission of the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement via our platform is valid and legally binding.

-

What benefits does airSlate SignNow offer for completing the California Form 3502?

Using airSlate SignNow to complete the California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement offers numerous benefits, including time savings, increased accuracy, and reduced paperwork. Our intuitive interface guides users through the form, while secure eSigning features streamline the approval process.

-

Can I integrate airSlate SignNow with other tools to manage my California Form 3502 submissions?

Absolutely! airSlate SignNow integrates seamlessly with various productivity tools and cloud storage services. This integration capability allows you to efficiently manage your California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement submissions alongside other business processes.

-

How secure is airSlate SignNow when handling sensitive forms like the California Form 3502?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols to safeguard your data, ensuring that your California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and any associated documents are protected. Regular security audits also help maintain a secure environment.

Get more for California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

- Optional forms and endorsements 120109

- Federal cobra election form health net

- Treatment authorization form r dickinson college dickinson

- Form 4506 t rev september 2015 request for transcript of tax return eou

- 2015 16 dependent verification worksheet furman university furman form

- Internship handbook canisius college canisius form

- Application for dce intern concordia university cui form

- Clearwater christian college transcript request form cedarville

Find out other California Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation