MW5, Withholding Tax DepositPayment Voucher Form

What is the Minnesota MW5 Form?

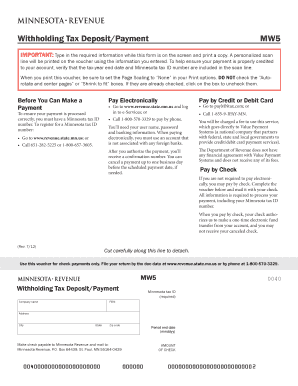

The Minnesota MW5 form, officially known as the Withholding Tax Deposit Payment Voucher, is a crucial document for businesses operating in Minnesota. This form is utilized to report and remit state withholding taxes that employers withhold from their employees' wages. It ensures that the appropriate amounts are submitted to the Minnesota Department of Revenue, helping to maintain compliance with state tax laws.

The MW5 form is particularly important for employers who have employees subject to Minnesota income tax withholding. By using this form, businesses can streamline their tax payment process, ensuring timely and accurate submissions.

How to Use the Minnesota MW5 Form

Using the Minnesota MW5 form involves several straightforward steps. First, employers must gather the necessary information, including the total amount of withholding tax due for the reporting period. Next, the form should be filled out with accurate details, including the employer's name, address, and tax identification number.

Once completed, the MW5 form can be submitted along with the payment to the Minnesota Department of Revenue. Employers have the option to submit the form and payment online or via mail, depending on their preference and the specific requirements for their business.

Steps to Complete the Minnesota MW5 Form

Completing the Minnesota MW5 form requires careful attention to detail. Here are the essential steps:

- Gather your business information, including your tax identification number.

- Calculate the total withholding tax amount due for the reporting period.

- Fill out the MW5 form with your business name, address, and the calculated tax amount.

- Review the form for accuracy to avoid any errors that could lead to penalties.

- Submit the completed form along with your payment to the Minnesota Department of Revenue.

Key Elements of the Minnesota MW5 Form

The Minnesota MW5 form includes several key elements that are essential for proper completion:

- Employer Information: This section requires the employer's name, address, and tax identification number.

- Payment Amount: Employers must indicate the total amount of withholding tax being remitted.

- Reporting Period: It is important to specify the period for which the withholding tax is being reported.

- Signature: The form must be signed by an authorized representative of the business.

Filing Deadlines for the Minnesota MW5 Form

Timely filing of the Minnesota MW5 form is essential to avoid penalties. The filing deadlines depend on the frequency of your tax payments, which can be monthly, quarterly, or annually. Generally, employers must submit the MW5 form and payment by the due date specified by the Minnesota Department of Revenue for each reporting period.

It is advisable for employers to keep track of these deadlines to ensure compliance and avoid any unnecessary fines or interest charges.

Form Submission Methods for the Minnesota MW5

The Minnesota MW5 form can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online Submission: Employers can submit the MW5 form and payment electronically through the Minnesota Department of Revenue's online portal.

- Mail Submission: Alternatively, the form can be printed and mailed along with the payment to the appropriate address provided by the Department of Revenue.

- In-Person Submission: Employers may also choose to deliver the form and payment in person at designated Department of Revenue offices.

Quick guide on how to complete mw5 withholding tax depositpayment voucher

Complete MW5, Withholding Tax DepositPayment Voucher effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage MW5, Withholding Tax DepositPayment Voucher on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign MW5, Withholding Tax DepositPayment Voucher without hassle

- Obtain MW5, Withholding Tax DepositPayment Voucher and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal importance as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or inaccuracies that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign MW5, Withholding Tax DepositPayment Voucher to guarantee excellent communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw5 withholding tax depositpayment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota MW5 form?

The Minnesota MW5 form is a tax form used by residents in Minnesota to claim certain deductions and credits. This form is essential for ensuring accurate tax reporting and compliance. airSlate SignNow simplifies the process of completing the Minnesota MW5 form by allowing users to eSign and send documents securely.

-

How can I fill out the Minnesota MW5 form electronically?

You can fill out the Minnesota MW5 form electronically using airSlate SignNow's user-friendly platform. Our solution allows you to easily input your information, ensure it is accurate, and eSign the document hassle-free. This saves time compared to traditional paper methods and helps streamline the filing process.

-

Are there any costs associated with using the Minnesota MW5 form on airSlate SignNow?

airSlate SignNow offers cost-effective pricing plans that cater to different business needs. While there may be a subscription fee, many of our users find that the efficiencies gained from using our platform, including for the Minnesota MW5 form, ultimately save money and time. Check our pricing page for detailed options.

-

What features does airSlate SignNow provide for the Minnesota MW5 form?

airSlate SignNow offers a variety of features for completing the Minnesota MW5 form, including customizable templates, secure cloud storage, and easy eSignature options. Our platform helps you ensure compliance and accuracy in your tax documents, thus enhancing your workflow and productivity.

-

Can I integrate airSlate SignNow with other software while working on the Minnesota MW5 form?

Yes! airSlate SignNow integrates seamlessly with various applications, including CRM systems and document management platforms. This makes it easier to access and manage the Minnesota MW5 form alongside your other business tools, streamlining your processes and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Minnesota MW5 form?

Using airSlate SignNow for the Minnesota MW5 form provides several benefits, including faster processing times, improved document accuracy, and enhanced security. Our platform allows you to collaborate with team members and clients effortlessly, ensuring that all signatures and documents are handled swiftly and efficiently.

-

Is airSlate SignNow secure for handling sensitive documents like the Minnesota MW5 form?

Absolutely! airSlate SignNow takes security seriously, employing bank-level encryption and secure storage to protect your sensitive documents, including the Minnesota MW5 form. Our platform ensures that your data is safe and accessible only to authorized individuals, allowing you to carry out important tasks with confidence.

Get more for MW5, Withholding Tax DepositPayment Voucher

- Dirt bike bill of sale form

- Wild things exhibition call for artist submission form sweetwaterartcenter

- Pdf download data center handbook full books by hwaiyu geng form

- 20 c license 2016 2019 form

- Assateague pointe boat rv and personal watercraft storage form

- Personal emergency evacuation plans peeps form

- Little league baseball amp softball national facility survey littleleague form

- Brand penalty exception request patient information

Find out other MW5, Withholding Tax DepositPayment Voucher

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy