Form 01 925 Texas Timber Operations Sales and Use Tax

What is the Form 01 925 Texas Timber Operations Sales And Use Tax

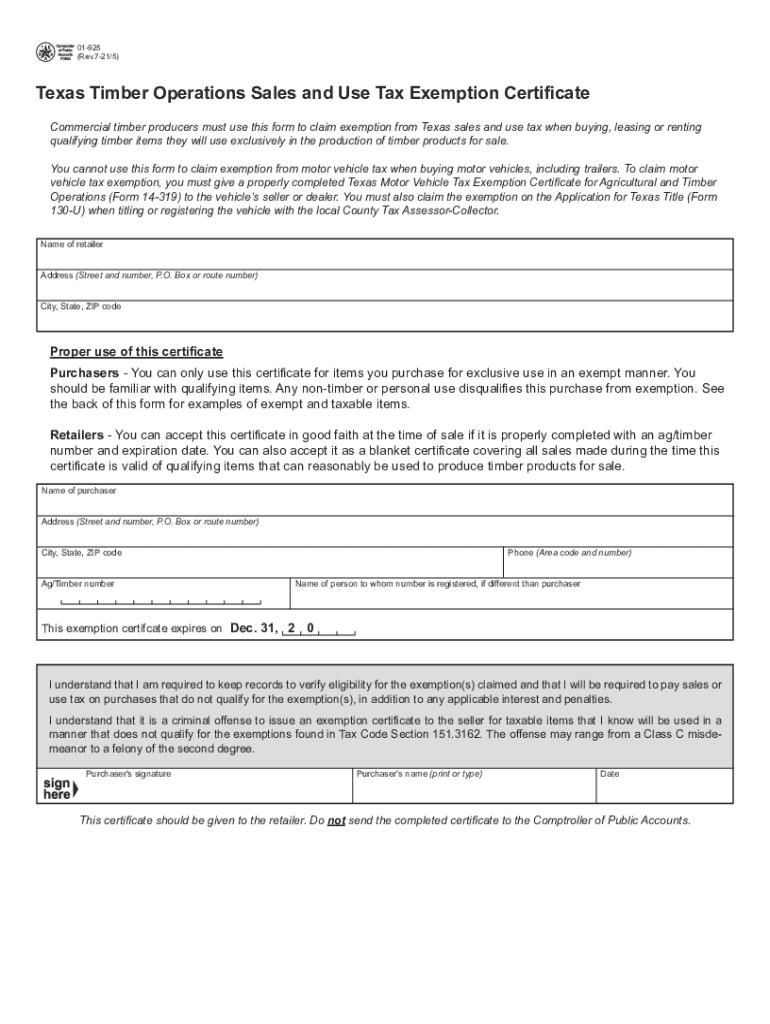

The Form 01 925 Texas Timber Operations Sales And Use Tax is a specific tax form used by businesses involved in timber operations within Texas. This form is essential for reporting and paying sales and use taxes related to timber sales, purchases, and operations. It helps ensure compliance with state tax regulations, allowing timber operators to accurately report their taxable activities and remit the appropriate taxes to the state.

How to use the Form 01 925 Texas Timber Operations Sales And Use Tax

To use the Form 01 925, businesses must first gather all necessary information regarding their timber operations, including sales and purchases made during the reporting period. The form requires details such as the total sales amount, any exemptions applicable, and the total tax due. Once completed, the form must be submitted to the appropriate state tax authority, along with any payments owed. Proper use of this form ensures that businesses remain compliant with Texas tax laws.

Steps to complete the Form 01 925 Texas Timber Operations Sales And Use Tax

Completing the Form 01 925 involves several key steps:

- Gather necessary documentation, including sales records and purchase invoices.

- Fill out the form with accurate details regarding sales and timber operations.

- Calculate the total sales tax due based on the reported figures.

- Review the form for accuracy and completeness.

- Submit the form and payment to the appropriate tax authority by the specified deadline.

Legal use of the Form 01 925 Texas Timber Operations Sales And Use Tax

The legal use of the Form 01 925 is governed by Texas tax laws, which outline the requirements for timber operations. Businesses must use this form to report sales and use taxes accurately to avoid penalties. Compliance with state regulations ensures that timber operations are conducted within the legal framework, protecting the business from potential audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 01 925 are typically set by the Texas Comptroller of Public Accounts. It is crucial for businesses to be aware of these deadlines to avoid late fees or penalties. Generally, the form is due on a quarterly basis, but specific dates may vary based on the reporting period. Staying informed about these important dates ensures timely compliance with tax obligations.

Required Documents

When completing the Form 01 925, businesses must have several documents ready, including:

- Sales records detailing all timber sales during the reporting period.

- Invoices for any timber purchases that may be subject to tax.

- Documentation supporting any claimed exemptions or deductions.

Having these documents organized and accessible will facilitate accurate and efficient completion of the form.

Quick guide on how to complete form 01 925 texas timber operations sales and use tax

Complete Form 01 925 Texas Timber Operations Sales And Use Tax seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Form 01 925 Texas Timber Operations Sales And Use Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form 01 925 Texas Timber Operations Sales And Use Tax effortlessly

- Obtain Form 01 925 Texas Timber Operations Sales And Use Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether via email, SMS, or invitation link, or download it directly to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you select. Edit and electronically sign Form 01 925 Texas Timber Operations Sales And Use Tax and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 01 925 texas timber operations sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 01 925 Texas Timber Operations Sales And Use Tax?

The Form 01 925 Texas Timber Operations Sales And Use Tax is a document used by businesses engaged in timber operations to report and pay sales and use taxes in Texas. It helps ensure compliance with state tax laws and simplifies the tax filing process for timber operators.

-

How can airSlate SignNow help me with the Form 01 925 Texas Timber Operations Sales And Use Tax?

airSlate SignNow provides a streamlined platform for digitally signing and sending the Form 01 925 Texas Timber Operations Sales And Use Tax. Our easy-to-use interface allows you to manage your documents efficiently, ensuring timely submission of your tax forms.

-

Is there a cost associated with using airSlate SignNow for the Form 01 925 Texas Timber Operations Sales And Use Tax?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans start at an affordable rate, providing a cost-effective solution for managing the Form 01 925 Texas Timber Operations Sales And Use Tax and other documents.

-

What features does airSlate SignNow offer for completing the Form 01 925 Texas Timber Operations Sales And Use Tax?

airSlate SignNow offers features such as templates for the Form 01 925 Texas Timber Operations Sales And Use Tax, customizable workflows, and real-time tracking of document status. These features help simplify the tax filing process and enhance overall productivity.

-

Can I integrate airSlate SignNow with other tools for managing Form 01 925 Texas Timber Operations Sales And Use Tax?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your Form 01 925 Texas Timber Operations Sales And Use Tax alongside your other business processes. This integration helps streamline operations and maintain consistency across platforms.

-

What are the benefits of using airSlate SignNow for the Form 01 925 Texas Timber Operations Sales And Use Tax?

Using airSlate SignNow for the Form 01 925 Texas Timber Operations Sales And Use Tax means faster document processing, reduced paperwork, and enhanced security. Our platform ensures that your tax forms are handled efficiently, so you can focus on other important aspects of your business.

-

How secure is my information when using airSlate SignNow for the Form 01 925 Texas Timber Operations Sales And Use Tax?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and compliance measures to protect your information while handling the Form 01 925 Texas Timber Operations Sales And Use Tax, giving you peace of mind regarding your data privacy.

Get more for Form 01 925 Texas Timber Operations Sales And Use Tax

- Constitution of a charitable incorporated organisation whose only voting members are its charity trustees a pdf print friendly form

- Bogo card order form 2013 cropmarks

- Weekly preschool planner form

- Uscis travel 2016 2019 form

- Sneakersnstuff returns eng site form

- Statement of non operation of form

- Maths class x sa ii mock test paper 02 for 2016 17doc form

- Employer requesting report reginfo form

Find out other Form 01 925 Texas Timber Operations Sales And Use Tax

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement