FORM a 1 ALABAMA DEPARTMENT of REVENUE

Understanding the Alabama A 1 Form

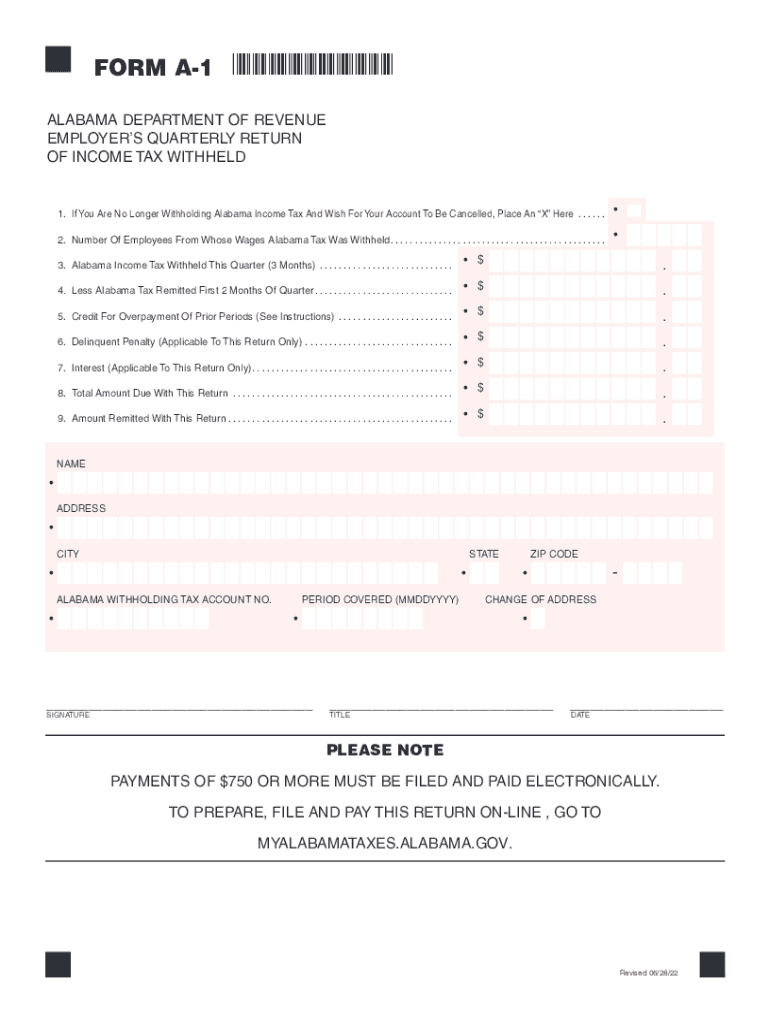

The Alabama A 1 form is a crucial document issued by the Alabama Department of Revenue. It is primarily used for reporting and remitting state income tax withheld from employees' wages. This form ensures that employers comply with state tax regulations and helps maintain accurate tax records. The Alabama A 1 form is essential for both businesses and employees, as it provides transparency in tax withholdings and contributes to the overall tax revenue of the state.

Steps to Complete the Alabama A 1 Form

Completing the Alabama A 1 form involves several key steps:

- Gather Required Information: Collect employee details, including names, Social Security numbers, and the amount of wages paid.

- Calculate Withholdings: Determine the total amount of state income tax to be withheld based on the employee's earnings and applicable tax rates.

- Fill Out the Form: Enter the gathered information accurately into the Alabama A 1 form, ensuring that all fields are completed as required.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to penalties or delays in processing.

- Submit the Form: File the completed form with the Alabama Department of Revenue by the designated deadline.

Legal Use of the Alabama A 1 Form

The Alabama A 1 form is legally mandated for employers in Alabama who withhold state income tax from their employees' wages. Proper use of this form ensures compliance with state tax laws and helps avoid penalties for non-compliance. Employers must submit this form regularly, typically on a monthly or quarterly basis, depending on their withholding amounts. Failure to file or inaccuracies in reporting can result in fines and legal repercussions.

Filing Deadlines for the Alabama A 1 Form

It is important for employers to be aware of the filing deadlines for the Alabama A 1 form. Generally, employers must submit the form by the end of the month following the end of the reporting period. For example, if the reporting period is January, the form must be filed by the last day of February. Staying on top of these deadlines is crucial to avoid late fees and ensure compliance with state regulations.

Form Submission Methods

The Alabama A 1 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Employers can file the form electronically through the Alabama Department of Revenue's online portal, which is often the fastest method.

- Mail Submission: The form can also be printed and mailed to the appropriate address provided by the Alabama Department of Revenue.

- In-Person Submission: Employers may choose to deliver the form in person at designated offices of the Alabama Department of Revenue.

Key Elements of the Alabama A 1 Form

When filling out the Alabama A 1 form, several key elements must be included to ensure its validity:

- Employer Information: This includes the name, address, and employer identification number.

- Employee Information: Names, Social Security numbers, and total wages paid to each employee must be reported.

- Withholding Amounts: The total amount of state income tax withheld during the reporting period should be clearly stated.

Quick guide on how to complete form a 1 alabama department of revenue

Complete FORM A 1 ALABAMA DEPARTMENT OF REVENUE with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage FORM A 1 ALABAMA DEPARTMENT OF REVENUE on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign FORM A 1 ALABAMA DEPARTMENT OF REVENUE without difficulty

- Find FORM A 1 ALABAMA DEPARTMENT OF REVENUE and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign FORM A 1 ALABAMA DEPARTMENT OF REVENUE while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form a 1 alabama department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama A 1 form and why do I need it?

The Alabama A 1 form is a crucial document used for various business and tax purposes in Alabama. By using airSlate SignNow, you can easily fill out, eSign, and send the Alabama A 1 form, ensuring compliance with local regulations while saving time.

-

How does airSlate SignNow simplify the process of filling out the Alabama A 1 form?

airSlate SignNow offers a user-friendly interface that allows you to complete the Alabama A 1 form quickly and efficiently. With features like templates and auto-fill options, you can eliminate the hassle of paperwork and focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for the Alabama A 1 form?

Yes, airSlate SignNow offers various pricing plans tailored to business needs, ensuring you get the best value for utilizing the Alabama A 1 form. You can choose a plan that offers flexible features to suit your budget and usage requirements.

-

What features does airSlate SignNow offer for the Alabama A 1 form?

airSlate SignNow provides essential features for the Alabama A 1 form, including eSigning, document sharing, and tracking. These features ensure your document is secure, and you can easily manage your paperwork from anywhere.

-

Can I integrate airSlate SignNow with other software while using the Alabama A 1 form?

Absolutely! airSlate SignNow integrates with various third-party applications, making it seamless to work on your Alabama A 1 form alongside your other tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Alabama A 1 form?

Using airSlate SignNow for the Alabama A 1 form offers numerous benefits, including time savings, reduced paper costs, and enhanced security. Additionally, the convenience of eSigning means you can finalize documents faster and more efficiently.

-

How secure is airSlate SignNow when handling the Alabama A 1 form?

airSlate SignNow prioritizes security, utilizing top-notch encryption to protect all documents, including the Alabama A 1 form. This commitment ensures that your sensitive information stays safe throughout the signing process.

Get more for FORM A 1 ALABAMA DEPARTMENT OF REVENUE

Find out other FORM A 1 ALABAMA DEPARTMENT OF REVENUE

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed