CDTFA 501 DG Government Entity Diesel Fuel Tax Return Form

What is the CDTFA 501 DG Government Entity Diesel Fuel Tax Return

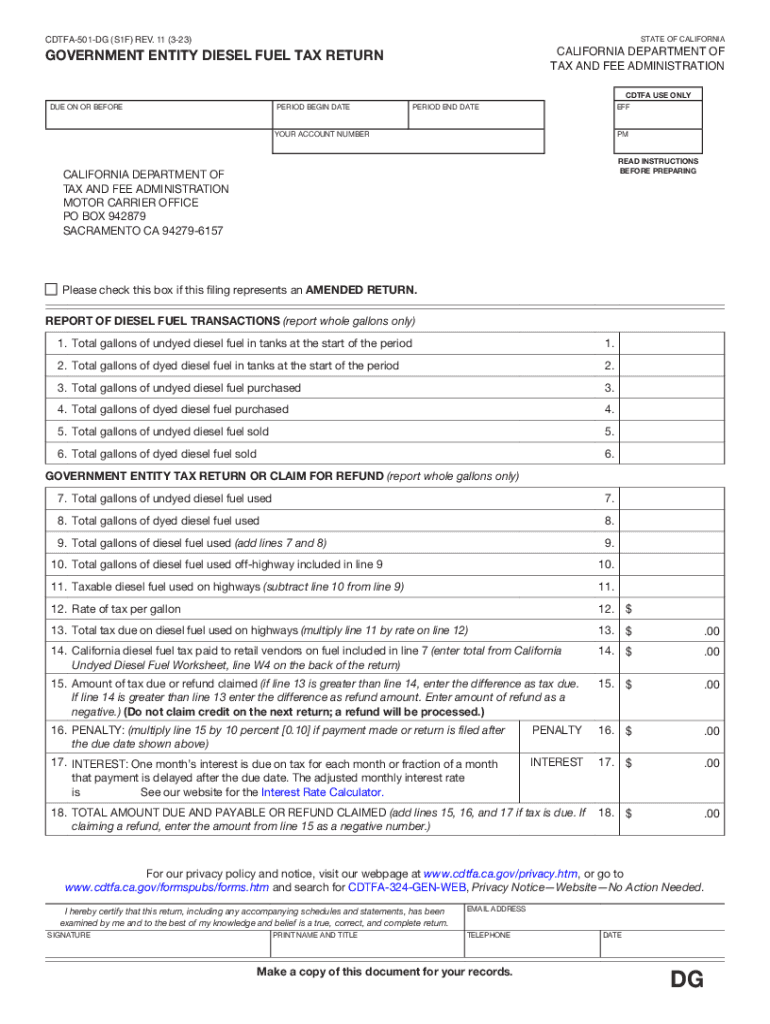

The CDTFA 501 DG Government Entity Diesel Fuel Tax Return is a specific form used by government entities in California to report and pay the diesel fuel tax. This form is essential for those entities that purchase diesel fuel for their operations and seek to claim a refund or exemption from the diesel fuel tax. Understanding this form is crucial for compliance with state tax regulations and for ensuring that government entities can effectively manage their fuel tax obligations.

How to use the CDTFA 501 DG Government Entity Diesel Fuel Tax Return

Using the CDTFA 501 DG involves several steps to ensure accurate reporting. First, gather all necessary information regarding diesel fuel purchases, including quantities and costs. Next, complete the form by entering the required details, such as the government entity's name, address, and tax identification number. After filling out the form, review it for accuracy before submission. This process helps maintain compliance and ensures that any potential refunds are processed efficiently.

Steps to complete the CDTFA 501 DG Government Entity Diesel Fuel Tax Return

Completing the CDTFA 501 DG requires careful attention to detail. The steps include:

- Collect documentation of diesel fuel purchases, including invoices and receipts.

- Fill in the entity's identifying information on the form.

- Report the total gallons of diesel fuel purchased during the reporting period.

- Calculate the total tax amount owed or the refund amount, based on the purchases.

- Sign and date the form to certify its accuracy.

Following these steps helps ensure that the form is completed correctly, minimizing the risk of errors that could lead to compliance issues.

Legal use of the CDTFA 501 DG Government Entity Diesel Fuel Tax Return

The CDTFA 501 DG is legally required for government entities that wish to report their diesel fuel purchases and seek tax refunds or exemptions. It is important to use this form in accordance with California tax laws to avoid penalties. Government entities must ensure that they meet eligibility criteria and adhere to filing deadlines to maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 501 DG are crucial for compliance. Government entities must submit the form on a quarterly basis, with specific due dates typically falling on the last day of the month following the end of the quarter. For example, the due date for the first quarter (January to March) is April 30. Entities should keep track of these dates to ensure timely submission and avoid late fees or penalties.

Required Documents

To complete the CDTFA 501 DG, several documents are necessary. These include:

- Invoices and receipts for diesel fuel purchases.

- Tax identification number for the government entity.

- Any previous tax returns that may be relevant for reference.

Having these documents readily available simplifies the completion of the form and ensures accurate reporting.

Quick guide on how to complete cdtfa 501 dg government entity diesel fuel tax return 439503397

Effortlessly prepare CDTFA 501 DG Government Entity Diesel Fuel Tax Return on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without complications. Manage CDTFA 501 DG Government Entity Diesel Fuel Tax Return on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign CDTFA 501 DG Government Entity Diesel Fuel Tax Return effortlessly

- Find CDTFA 501 DG Government Entity Diesel Fuel Tax Return and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign CDTFA 501 DG Government Entity Diesel Fuel Tax Return to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 501 dg government entity diesel fuel tax return 439503397

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form government diesel?

The form government diesel is designed to facilitate the processing and approval of diesel-related documentation within government sectors. It streamlines the submission process, ensuring compliance and improving efficiency for agencies handling diesel procurement.

-

How does airSlate SignNow help with the form government diesel?

airSlate SignNow simplifies the management of the form government diesel by providing an intuitive platform for eSigning and document management. With our solution, users can easily fill out, sign, and send the necessary forms, reducing the time and effort involved in traditional paper-based processes.

-

What are the pricing options for using airSlate SignNow with the form government diesel?

airSlate SignNow offers flexible pricing plans tailored for government organizations handling the form government diesel. Our cost-effective solutions ensure that you can access comprehensive features without compromising your budget, making it an ideal choice for public agencies.

-

Are there any specific features for the form government diesel in airSlate SignNow?

Yes, airSlate SignNow includes special features for managing the form government diesel, such as customizable templates, secure document storage, and automated workflows. These tools enhance the user experience and help ensure accuracy and compliance in all diesel-related transactions.

-

Can I integrate airSlate SignNow with other software for managing the form government diesel?

Absolutely! airSlate SignNow offers seamless integrations with various software tools commonly used by government agencies. This capability enhances the management of the form government diesel by allowing for better data flow and communication across platforms.

-

What benefits does airSlate SignNow provide for the form government diesel process?

Using airSlate SignNow for the form government diesel offers numerous benefits, including faster processing times, reduced paperwork, and improved tracking of document submissions. Ultimately, this leads to enhanced efficiency and transparency for government operations.

-

Is airSlate SignNow compliant with government regulations for handling the form government diesel?

Yes, airSlate SignNow is designed to meet the stringent compliance requirements associated with government documentation, including the form government diesel. Our platform adheres to industry standards for security and compliance, ensuring the integrity of your documents.

Get more for CDTFA 501 DG Government Entity Diesel Fuel Tax Return

- Form i 129 petition for a nonimmigrant worker 2011

- Form i 129 2014

- Form i90 2017 2019

- Www uscis i 90 2010 form

- Pdf icon click icon to download listed form auxiliary forms

- Than 24 hours national bureau of economic research nber form

- How to fill central bank of india form 2012 2019

- Pto 2038 2015 2019 form

Find out other CDTFA 501 DG Government Entity Diesel Fuel Tax Return

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple