Oregon Department of Revenue W 2 File Specfications Form

Understanding the Oregon W-2 File Specifications

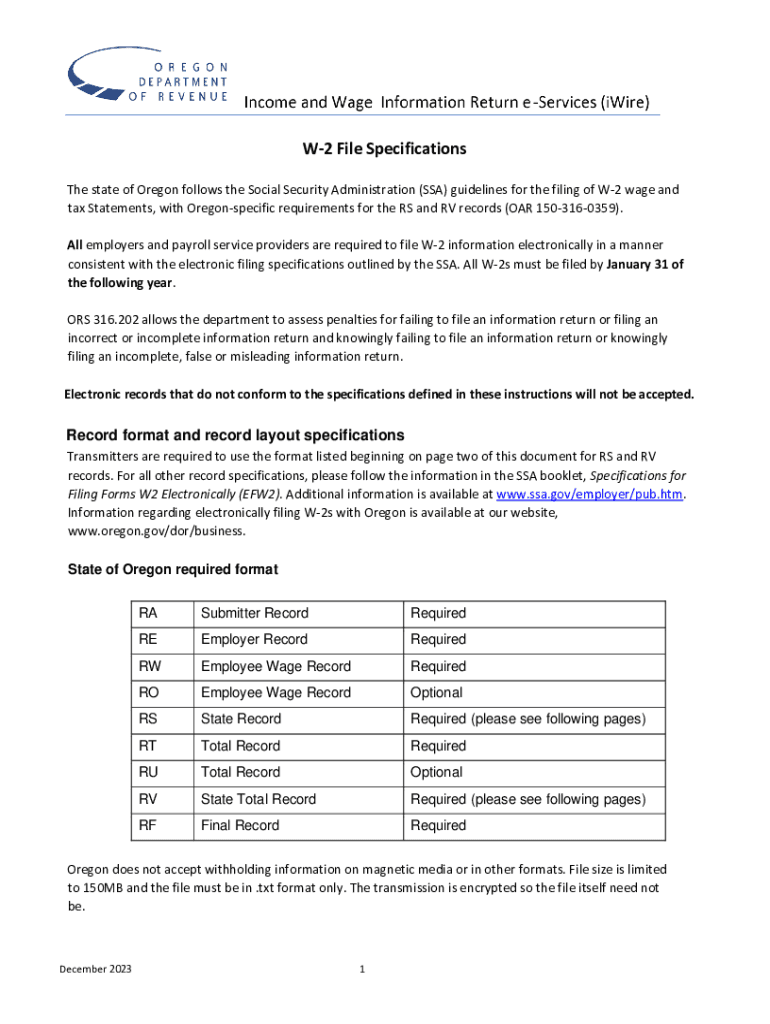

The Oregon W-2 file specifications outline the requirements for employers when reporting wage information to the Oregon Department of Revenue. These specifications ensure that all necessary data, such as employee wages, tax withholdings, and personal information, is accurately reported. This information is crucial for the state to process tax returns effectively and ensure compliance with state tax laws.

Employers must adhere to specific formatting rules, including character limits for each field and the overall structure of the file. These guidelines help maintain consistency and accuracy across all submissions, which is essential for both employers and the Department of Revenue.

Steps to Complete the Oregon W-2 File Specifications

Completing the Oregon W-2 file specifications involves several key steps:

- Gather employee information, including names, addresses, and Social Security numbers.

- Calculate total wages for each employee, including any bonuses or additional compensation.

- Determine the appropriate tax withholdings for state income tax and any local taxes.

- Format the data according to the Oregon W-2 specifications, ensuring compliance with character limits and field requirements.

- Review the completed file for accuracy before submission.

Filing Deadlines and Important Dates

Employers must be aware of specific deadlines related to the Oregon W-2 form. Typically, W-2 forms must be issued to employees by January 31 of the year following the tax year. Additionally, employers must submit the W-2 forms to the Oregon Department of Revenue by the same date. Missing these deadlines can result in penalties and interest charges, making timely filing essential.

Key Elements of the Oregon W-2 File Specifications

Key elements of the Oregon W-2 file specifications include:

- Employee Information: Accurate names, addresses, and Social Security numbers.

- Wage Data: Total wages, tips, and other compensation must be reported correctly.

- Tax Withholdings: Detailed reporting of state and local tax withholdings is required.

- File Format: The file must be in a specific electronic format, such as ASCII text or a compatible format accepted by the state.

Legal Use of the Oregon W-2 File Specifications

The Oregon W-2 file specifications are legally mandated for all employers operating in Oregon. Compliance with these specifications is essential not only for accurate reporting but also for avoiding legal issues with the state. Employers should ensure they are familiar with the specifications and maintain proper records to support their filings. Non-compliance can lead to penalties, including fines and increased scrutiny from tax authorities.

Form Submission Methods

Employers can submit the Oregon W-2 forms through various methods. The most common methods include:

- Online Submission: Employers can use the Oregon Department of Revenue's online portal to file W-2 forms electronically.

- Mail Submission: W-2 forms can be mailed directly to the Oregon Department of Revenue. It is important to ensure that the forms are properly completed and sent to the correct address.

- In-Person Submission: Employers may also deliver W-2 forms in person at designated Department of Revenue offices.

Quick guide on how to complete oregon department of revenue w 2 file specfications

Effortlessly prepare Oregon Department Of Revenue W 2 File Specfications on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without complications. Manage Oregon Department Of Revenue W 2 File Specfications on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Oregon Department Of Revenue W 2 File Specfications with ease

- Obtain Oregon Department Of Revenue W 2 File Specfications and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Produce your signature using the Sign tool, which takes only seconds and carries the same legal standing as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Oregon Department Of Revenue W 2 File Specfications to ensure seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon department of revenue w 2 file specfications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for Oregon W2 print using airSlate SignNow?

To use airSlate SignNow for Oregon W2 print, simply upload your W2 template, fill in the required details, and invite your employees to eSign. The platform ensures that all signatures are legally binding and securely stored. This makes it easier for you to manage compliance and keep track of your documents.

-

How much does airSlate SignNow cost for Oregon W2 print services?

airSlate SignNow offers flexible pricing plans tailored to different business needs, with rates starting from affordable monthly subscriptions. The cost for Oregon W2 print services depends on the volume of documents you need to process. You can easily find a plan that fits your budget while ensuring a smooth eSignature experience.

-

Can I customize my Oregon W2 forms in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Oregon W2 forms to meet your specific business requirements. You can add your company logo, modify fields, and adjust the layout to suit your needs. This flexibility ensures that your documents maintain a professional appearance.

-

Is airSlate SignNow compliant with Oregon's eSignature laws for W2 forms?

Absolutely! airSlate SignNow is fully compliant with Oregon's eSignature laws, making it a reliable choice for Oregon W2 print and eSigning. Your documents will meet all necessary legal standards, ensuring you are protected when managing sensitive information.

-

What features does airSlate SignNow provide for Oregon W2 print?

airSlate SignNow offers a range of features including easy document uploads, bulk sending, and secure eSigning for Oregon W2 print. Additionally, it includes tracking and reminders to ensure timely completion. These tools make managing your W2 printing and signing process efficient and straightforward.

-

Does airSlate SignNow integrate with accounting software for Oregon W2 print?

Yes, airSlate SignNow seamlessly integrates with various accounting software, enhancing the Oregon W2 print process. This integration allows for automatic population of W2 data, saving you time and reducing the potential for errors. Sync your systems for a more streamlined experience.

-

How does airSlate SignNow enhance the security of Oregon W2 prints?

Security is a top priority for airSlate SignNow, especially when handling sensitive information like Oregon W2 prints. The platform employs advanced encryption, secure cloud storage, and robust authentication methods to protect your documents. You can confidently manage your W2 forms without worrying about data bsignNowes.

Get more for Oregon Department Of Revenue W 2 File Specfications

Find out other Oregon Department Of Revenue W 2 File Specfications

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF