ST 108 Indiana Department of Revenue Certificate of Form

What is the ST 108 Indiana Department Of Revenue Certificate Of

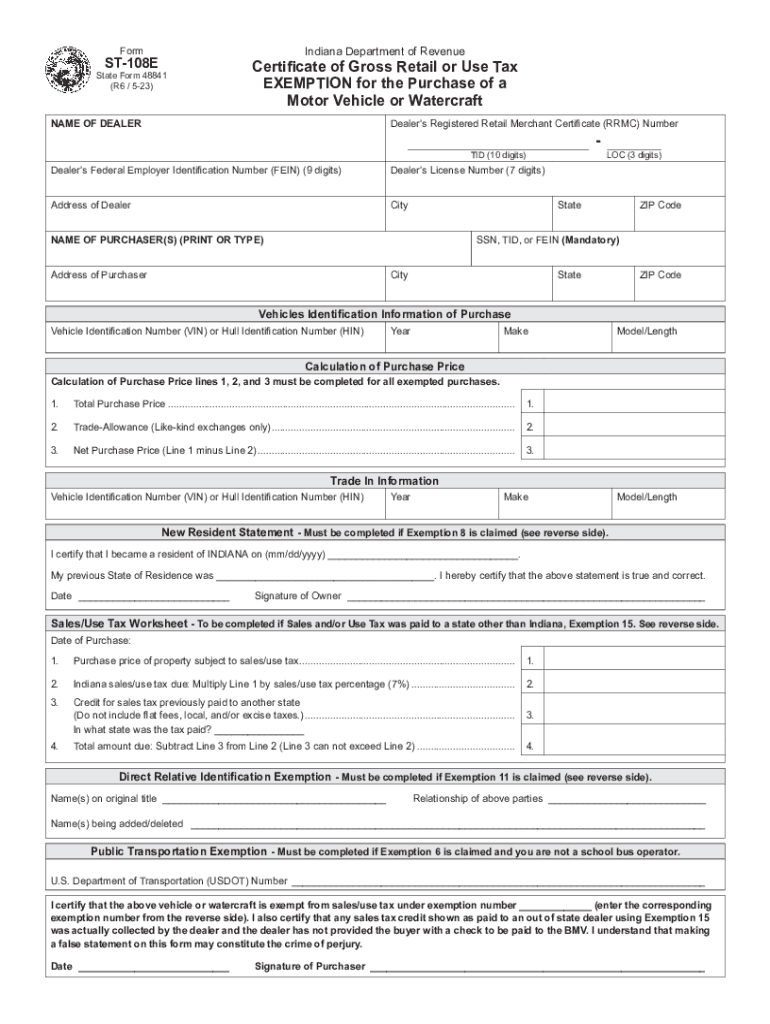

The ST 108 form, also known as the Indiana Department of Revenue Certificate of Exemption, is a crucial document used by businesses in Indiana to claim sales tax exemptions. This form allows eligible purchasers to make tax-exempt purchases for specific goods and services. The ST 108 is primarily utilized by organizations such as non-profits, government entities, and certain businesses that meet specific criteria set by the Indiana Department of Revenue.

How to use the ST 108 Indiana Department Of Revenue Certificate Of

To effectively use the ST 108 form, a purchaser must complete it accurately and present it to the seller at the time of purchase. The seller must retain the ST 108 form on file to validate the tax-exempt status of the transaction. It is essential to ensure that the form is filled out correctly, including the purchaser's name, address, and the reason for the exemption. Incorrect or incomplete forms may lead to tax liabilities for both the purchaser and the seller.

Steps to complete the ST 108 Indiana Department Of Revenue Certificate Of

Completing the ST 108 form involves several straightforward steps:

- Obtain the ST 108 form from the Indiana Department of Revenue website or authorized sources.

- Fill in the required information, including the name and address of the purchaser, the seller's name, and the specific reason for the exemption.

- Ensure that all information is accurate and complete to avoid issues later.

- Sign and date the form to validate it.

- Present the completed form to the seller at the time of purchase.

Legal use of the ST 108 Indiana Department Of Revenue Certificate Of

The legal use of the ST 108 form is governed by Indiana state law, which stipulates that only eligible entities may utilize this certificate for tax-exempt purchases. Misuse of the form, such as using it for ineligible purchases, can result in penalties, including back taxes and fines. It is crucial for both purchasers and sellers to understand the legal implications of using the ST 108 form to ensure compliance with state tax regulations.

Key elements of the ST 108 Indiana Department Of Revenue Certificate Of

The ST 108 form includes several key elements that must be accurately completed for it to be valid. These elements include:

- Purchaser Information: Name and address of the entity claiming the exemption.

- Seller Information: Name and address of the seller from whom goods or services are being purchased.

- Reason for Exemption: A clear explanation of the basis for the tax exemption.

- Signature: The form must be signed and dated by an authorized representative of the purchaser.

Examples of using the ST 108 Indiana Department Of Revenue Certificate Of

Examples of scenarios where the ST 108 form may be used include:

- A non-profit organization purchasing supplies for a charitable event.

- A government agency acquiring equipment for public use.

- A school purchasing educational materials for classroom instruction.

In each case, presenting the ST 108 form allows these entities to avoid paying sales tax on eligible purchases, thereby reducing overall costs.

Quick guide on how to complete st 108 indiana department of revenue certificate of

Accomplish ST 108 Indiana Department Of Revenue Certificate Of seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage ST 108 Indiana Department Of Revenue Certificate Of on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to modify and eSign ST 108 Indiana Department Of Revenue Certificate Of effortlessly

- Obtain ST 108 Indiana Department Of Revenue Certificate Of and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the data and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Alter and eSign ST 108 Indiana Department Of Revenue Certificate Of and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 108 indiana department of revenue certificate of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 108e state form 48841 and its purpose?

The st 108e state form 48841 is a tax form used in various states for specific tax reporting purposes. It serves to report sales and use taxes and is essential for businesses to maintain compliance with state tax regulations. Understanding this form can help you avoid penalties and streamline your tax processes.

-

How can airSlate SignNow help with completing the st 108e state form 48841?

airSlate SignNow simplifies the completion of the st 108e state form 48841 by providing a user-friendly platform for document management and eSignature solutions. You can easily fill out and send the form securely from any device, ensuring that you meet deadlines without hassle. This streamlined process can save you time and reduce errors.

-

Are there any costs associated with using airSlate SignNow for the st 108e state form 48841?

Yes, airSlate SignNow offers various pricing plans based on your needs, including options for businesses needing to complete documents like the st 108e state form 48841. These plans are cost-effective and designed to cater to different volumes of document processing. You can choose a plan that fits your budget and operational requirements.

-

Is it easy to integrate airSlate SignNow with other applications for the st 108e state form 48841?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to incorporate the st 108e state form 48841 into your existing workflows. This compatibility helps streamline your document processes and ensures that you can efficiently manage your compliance requirements alongside other business operations.

-

What are the benefits of using airSlate SignNow for eSigning the st 108e state form 48841?

Using airSlate SignNow for eSigning the st 108e state form 48841 offers several benefits, including enhanced security, reduced turnaround time, and easy tracking of signed documents. The electronic signature process is secure and verifiable, helping you maintain compliance with regulations while expediting approvals. As a result, you can manage your documentation more effectively.

-

Can I access and manage the st 108e state form 48841 on mobile devices?

Yes, airSlate SignNow provides mobile accessibility for managing the st 108e state form 48841. You can access all your documents, fill out forms, and obtain signatures from anywhere using your smartphone or tablet. This flexibility is ideal for businesses on the go, enabling efficient document management without being tied to a desk.

-

What features does airSlate SignNow offer for managing the st 108e state form 48841?

airSlate SignNow offers a range of features tailored for managing the st 108e state form 48841, including customizable templates, automated workflows, and secure storage. These features enhance your ability to keep your documents organized and accessible while ensuring you can easily share them with stakeholders. The platform is designed to improve your document efficiency.

Get more for ST 108 Indiana Department Of Revenue Certificate Of

Find out other ST 108 Indiana Department Of Revenue Certificate Of

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure