Indiana Property Tax Benefits State Form 51781 R14

Understanding the Indiana Property Tax Benefits State Form 51781

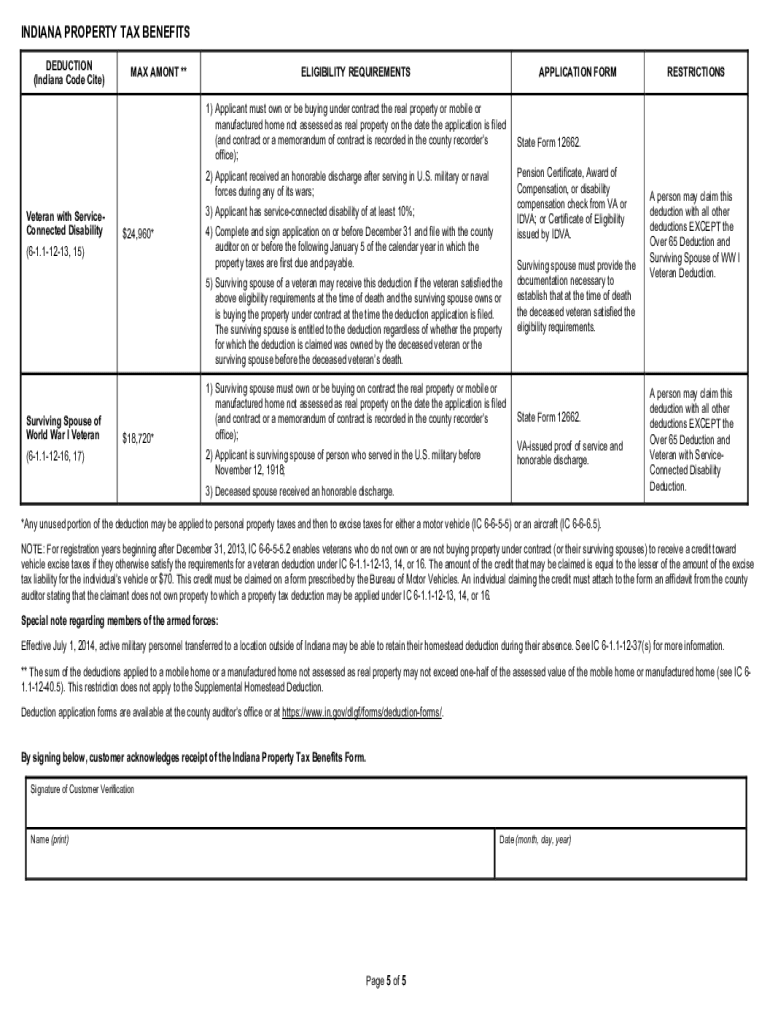

The Indiana Property Tax Benefits State Form 51781 is designed for residents seeking to apply for property tax benefits in Indiana. This form allows eligible homeowners to claim various deductions and exemptions, which can significantly reduce their property tax burden. It is essential to understand the specific benefits available under this form, including the homestead exemption and other property tax relief options that may apply based on individual circumstances.

Steps to Complete the Indiana Property Tax Benefits State Form 51781

Completing the Indiana Property Tax Benefits State Form 51781 involves several key steps:

- Gather necessary documentation, including proof of residency, property ownership, and any relevant income information.

- Fill out the form accurately, ensuring all sections are completed. Pay special attention to eligibility criteria and required signatures.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the appropriate local county office by the specified deadline to ensure consideration for the current tax year.

Eligibility Criteria for the Indiana Property Tax Benefits State Form 51781

To qualify for the benefits associated with the Indiana Property Tax Benefits State Form 51781, applicants must meet specific eligibility requirements. Generally, these criteria include:

- Ownership of the property for which benefits are being claimed.

- Residency in Indiana, with the property serving as the applicant's primary residence.

- Meeting certain income thresholds, which may vary based on the type of benefit being claimed.

It is important to review the detailed eligibility guidelines provided with the form to ensure compliance.

How to Obtain the Indiana Property Tax Benefits State Form 51781

The Indiana Property Tax Benefits State Form 51781 can be obtained through several channels:

- Visit the official Indiana Department of Revenue website, where the form is available for download.

- Contact your local county assessor's office for a physical copy of the form.

- Check with local government offices or libraries that may have printed forms available for residents.

Form Submission Methods for the Indiana Property Tax Benefits State Form 51781

Once the Indiana Property Tax Benefits State Form 51781 is completed, it can be submitted in several ways:

- By mail: Send the completed form to the local county assessor's office.

- In-person: Deliver the form directly to the county office during business hours.

- Online: Some counties may offer electronic submission options through their official websites.

Key Elements of the Indiana Property Tax Benefits State Form 51781

When filling out the Indiana Property Tax Benefits State Form 51781, it is crucial to include key information, such as:

- Your name and contact information.

- Property address and details about the property.

- Income information, if applicable, to determine eligibility for certain benefits.

- Any additional documentation required to support your application.

Providing accurate and complete information will help facilitate the review process and ensure timely approval of benefits.

Quick guide on how to complete indiana property tax benefits state form 51781 r14

Prepare Indiana Property Tax Benefits State Form 51781 R14 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your paperwork quickly and efficiently. Handle Indiana Property Tax Benefits State Form 51781 R14 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Indiana Property Tax Benefits State Form 51781 R14 with ease

- Obtain Indiana Property Tax Benefits State Form 51781 R14 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Indiana Property Tax Benefits State Form 51781 R14 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana property tax benefits state form 51781 r14

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with tax Indiana documents?

airSlate SignNow is a powerful eSignature platform that simplifies the process of signing and sending documents electronically. With its user-friendly interface, it addresses the needs of businesses handling tax Indiana paperwork, ensuring quick and secure transactions.

-

How does airSlate SignNow comply with tax Indiana regulations?

airSlate SignNow adheres to all necessary compliance standards relevant to tax Indiana documentation. This means that all electronic signatures are legally binding and secure, giving users peace of mind when managing sensitive tax documents.

-

What pricing plans are available for airSlate SignNow in Indiana?

airSlate SignNow offers flexible pricing plans suitable for businesses in Indiana, allowing you to choose a package that fits your budget and needs. Each plan provides access to essential features that enhance the processing of tax Indiana documents, ensuring value for your investment.

-

What features does airSlate SignNow offer for managing tax Indiana documents?

airSlate SignNow provides a range of features, including document templates, customizable workflows, and advanced security measures, specifically designed for tax Indiana needs. These features streamline the document management process, making it easy to handle tax-related paperwork efficiently.

-

Can airSlate SignNow integrate with accounting software relevant to tax Indiana?

Yes, airSlate SignNow seamlessly integrates with many popular accounting software solutions. This integration allows businesses to connect their tax Indiana processes directly to their accounting systems, enhancing efficiency and accuracy in document handling.

-

What benefits does airSlate SignNow provide for businesses dealing with tax Indiana?

Using airSlate SignNow for tax Indiana services offers several benefits, including faster turnaround times, reduced paperwork, and improved document security. These advantages can signNowly enhance your business's efficiency and compliance in tax-related matters.

-

Is there a mobile app for airSlate SignNow to manage tax Indiana documents on the go?

Absolutely! airSlate SignNow has a mobile app that allows you to manage tax Indiana documents from anywhere. This feature ensures that you can sign, send, and receive important tax paperwork while on the move, maintaining productivity at all times.

Get more for Indiana Property Tax Benefits State Form 51781 R14

Find out other Indiana Property Tax Benefits State Form 51781 R14

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure