Earned Income Tax Credit Wisconsin Legislative Documents Form

Understanding the Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a federal tax benefit designed to assist low to moderate-income working individuals and families, particularly those with children. The credit reduces the amount of tax owed and may also result in a refund. For the tax year, the credit amount varies based on income, filing status, and the number of qualifying children. It is essential to understand the eligibility criteria and how the credit can impact your overall tax situation.

Eligibility Criteria for the Earned Income Tax Credit

To qualify for the EITC, taxpayers must meet specific requirements. These include:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and the number of qualifying children.

- Being a U.S. citizen or resident alien for the entire tax year.

- Filing a federal tax return, even if no tax is owed.

It is important to review the latest IRS guidelines to ensure compliance with these criteria, as they can change annually.

Steps to Complete the Earned Income Tax Credit

Completing the EITC involves several straightforward steps:

- Gather all necessary documents, including W-2 forms and any other income statements.

- Determine your eligibility based on the income limits and number of qualifying children.

- Fill out the appropriate tax forms, ensuring to include the EITC section.

- Submit your tax return electronically or via mail before the filing deadline.

Using tax preparation software can simplify this process, as many programs automatically calculate the EITC for eligible taxpayers.

Required Documents for the Earned Income Tax Credit

To claim the EITC, you need to provide specific documentation, which may include:

- W-2 forms from all employers for the tax year.

- Proof of any self-employment income, such as 1099 forms.

- Social Security numbers for yourself and any qualifying children.

- Documentation of any other income sources, if applicable.

Having these documents ready can expedite the filing process and ensure accuracy in your tax return.

Filing Deadlines for the Earned Income Tax Credit

Taxpayers must be aware of important deadlines when filing for the EITC. Typically, the tax return filing deadline is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file your return on time to avoid penalties and ensure you receive your refund promptly.

IRS Guidelines for the Earned Income Tax Credit

The IRS provides comprehensive guidelines for claiming the EITC. These guidelines include detailed information on eligibility, calculation of the credit, and the necessary forms to complete. Taxpayers are encouraged to review these guidelines annually, as they can change based on legislative updates. Understanding these rules can help maximize your benefits and ensure compliance.

Quick guide on how to complete earned income tax credit wisconsin legislative documents

Effortlessly prepare Earned Income Tax Credit Wisconsin Legislative Documents on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Manage Earned Income Tax Credit Wisconsin Legislative Documents on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and electronically sign Earned Income Tax Credit Wisconsin Legislative Documents with ease

- Obtain Earned Income Tax Credit Wisconsin Legislative Documents and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and electronically sign Earned Income Tax Credit Wisconsin Legislative Documents to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the earned income tax credit wisconsin legislative documents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

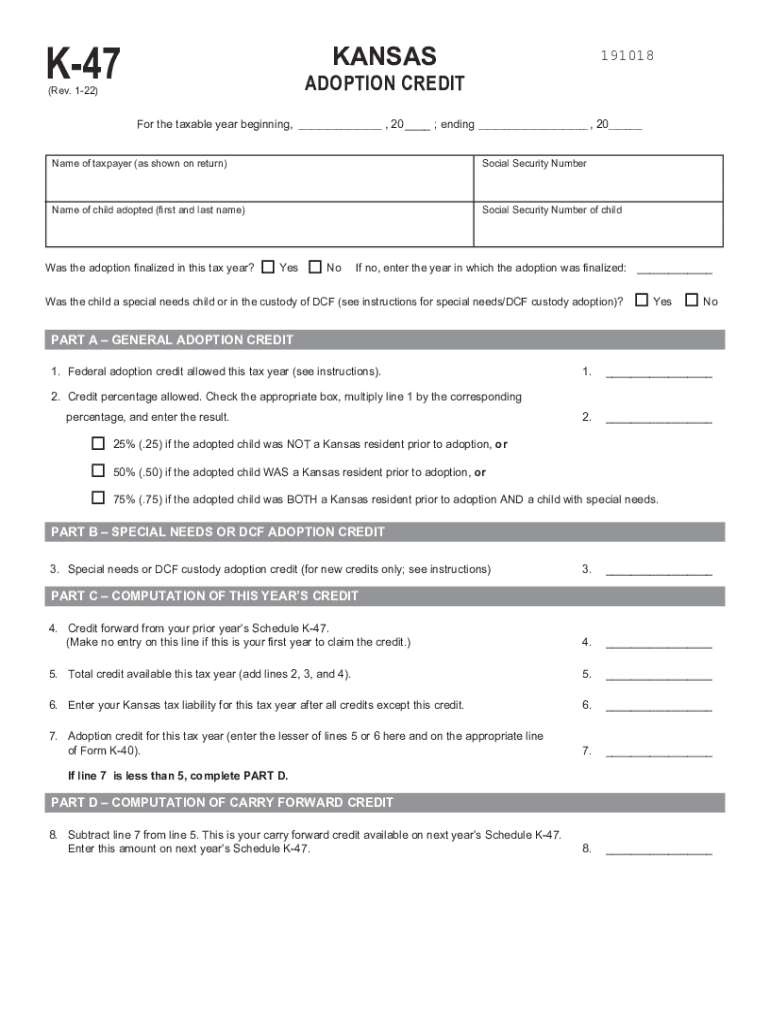

What is k47 in the context of airSlate SignNow?

K47 refers to a unique feature within the airSlate SignNow platform that enhances document management and eSignature capabilities. With k47, users can seamlessly send, sign, and manage documents in a user-friendly interface. This feature is designed to optimize workflow efficiency and ensure that all document transactions are secure and compliant.

-

How does the k47 feature improve my document workflow?

The k47 feature simplifies the document workflow by providing intuitive tools for creating, sending, and tracking signatures. It automates various steps in the process, allowing you to focus on more important tasks. By using k47, you can signNowly reduce turnaround times and improve overall productivity.

-

What are the pricing plans for airSlate SignNow with k47?

airSlate SignNow offers competitive pricing plans that include access to the k47 feature. Prices vary based on the number of users and features selected, making it easy to find a plan that fits your budget. Additionally, benefits such as free trials may be available, allowing you to test k47 and ensure it meets your needs before committing.

-

Does k47 integrate with other software applications?

Yes, the k47 feature within airSlate SignNow integrates with a variety of popular software applications. This means you can connect it with your existing tools such as CRMs and project management platforms for a seamless experience. With these integrations, you can streamline operations and enhance overall workflow efficiency.

-

What benefits does k47 provide for businesses?

K47 provides numerous benefits for businesses, including improved efficiency, enhanced security, and cost savings. By utilizing k47, companies can expedite document processing and reduce the risk of errors. This ultimately leads to better client satisfaction and a more streamlined operation.

-

Can I customize my document templates using k47?

Absolutely! K47 allows users to create and customize document templates to fit their specific needs. This feature ensures that every document sent for eSigning is tailored to your business requirements, improving the professionalism and effectiveness of your communications.

-

Is support available for problems related to k47?

Yes, airSlate SignNow provides dedicated support for issues related to the k47 feature. Users can access a rich knowledge base, chat support, and email assistance for any inquiries. Our team is committed to ensuring you have a smooth experience while using k47.

Get more for Earned Income Tax Credit Wisconsin Legislative Documents

- Decherd parkland neuro trauma award form

- Simply prior authorization form for medication

- Group 84542 new york university dental form

- Dekalb medical doctors note form

- Silverback care management form

- Lifeline telephone bapplicationb brib cox communications form

- Click here to add photo form

- U s bank add person to checking account form

Find out other Earned Income Tax Credit Wisconsin Legislative Documents

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP