K 40SVR Property Tax Relief Claim for Seniors and Form

What is the K 40SVR Property Tax Relief Claim for Seniors?

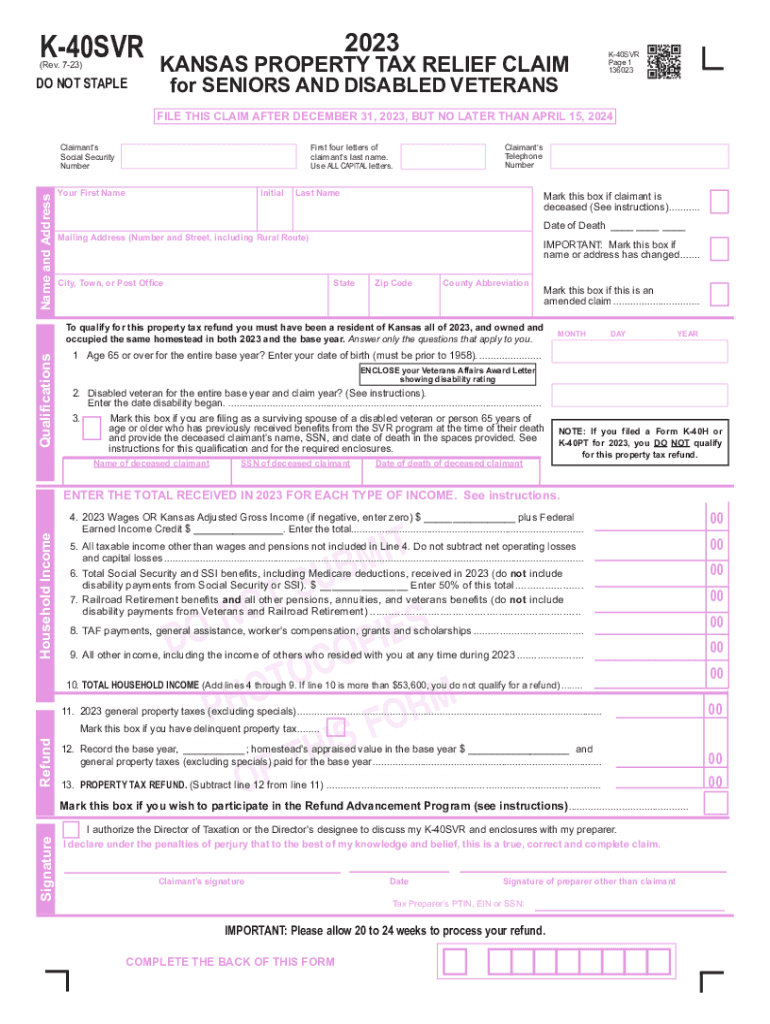

The K 40SVR form is a property tax relief claim specifically designed for seniors in Kansas. This form allows eligible senior citizens to apply for property tax relief, helping to ease the financial burden of property taxes on fixed incomes. The program aims to provide assistance to those who meet specific criteria, ensuring that seniors can remain in their homes without the stress of overwhelming property tax obligations.

Eligibility Criteria for the K 40SVR Property Tax Relief Claim

To qualify for the K 40SVR property tax relief claim, applicants must meet certain eligibility requirements. Generally, applicants must be at least sixty-five years old and have a total household income below a specified threshold. Additionally, the property for which the claim is being made must be the applicant's primary residence. It is important for applicants to review the specific income limits and other criteria set by the state to ensure they qualify for the relief program.

Steps to Complete the K 40SVR Property Tax Relief Claim

Completing the K 40SVR form involves several straightforward steps:

- Gather necessary documents, including proof of age, income statements, and property ownership records.

- Obtain the K 40SVR form from the Kansas Department of Revenue website or local tax office.

- Fill out the form accurately, providing all required information, including personal details and financial information.

- Attach any supporting documents as required by the form instructions.

- Submit the completed form by the designated deadline, either online, by mail, or in person at the local tax office.

Required Documents for the K 40SVR Property Tax Relief Claim

When applying for the K 40SVR property tax relief claim, certain documents are essential to support the application. These typically include:

- Proof of age, such as a birth certificate or driver's license.

- Income statements, including tax returns or Social Security benefit statements.

- Documentation of property ownership, such as a deed or property tax statement.

Having these documents ready can streamline the application process and help ensure that the claim is processed without delays.

Form Submission Methods for the K 40SVR Property Tax Relief Claim

The K 40SVR form can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission via the Kansas Department of Revenue's website, if available.

- Mailing the completed form and supporting documents to the appropriate tax office.

- In-person submission at local tax offices, where assistance may be available if needed.

Choosing the right submission method can depend on personal preferences and the urgency of the claim.

Important Filing Deadlines for the K 40SVR Property Tax Relief Claim

Filing deadlines for the K 40SVR property tax relief claim are crucial to ensure that applicants do not miss out on potential benefits. Typically, applications must be submitted by a specific date each year, often aligning with the property tax filing deadlines. It is advisable for applicants to check the Kansas Department of Revenue's website or contact local tax offices for the most current deadlines to avoid any issues with their claims.

Quick guide on how to complete k 40svr property tax relief claim for seniors and

Effortlessly complete K 40SVR Property Tax Relief Claim For Seniors And on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage K 40SVR Property Tax Relief Claim For Seniors And on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign K 40SVR Property Tax Relief Claim For Seniors And with ease

- Find K 40SVR Property Tax Relief Claim For Seniors And and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or obscure confidential information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put aside worries about lost or misplaced documents, cumbersome form navigation, or mistakes that require fresh copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign K 40SVR Property Tax Relief Claim For Seniors And and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 40svr property tax relief claim for seniors and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the k 40svr form and how can airSlate SignNow help with it?

The k 40svr form is a crucial document for tax reporting in Kansas. With airSlate SignNow, you can easily create, send, and eSign the k 40svr form securely from any device. This streamlines the submission process, ensuring compliance and saving your business valuable time.

-

Is there a cost involved in using airSlate SignNow for the k 40svr form?

Yes, airSlate SignNow offers different pricing plans that cater to various business needs. Depending on the size of your team and usage frequency for the k 40svr form, you can choose a plan that fits your budget. The solution remains cost-effective compared to traditional document handling methods.

-

What features does airSlate SignNow offer for managing the k 40svr form?

airSlate SignNow provides features such as drag-and-drop document creation, customizable templates, and secure eSigning specifically designed for forms like the k 40svr form. Additionally, you can track the status of your documents and set reminders for signatures, enhancing your efficiency.

-

How do I integrate airSlate SignNow with other software for handling the k 40svr form?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems to simplify your workflow when dealing with the k 40svr form. By connecting your tools, you can automatically manage documents and reduce manual data entry, improving your productivity.

-

Can I use airSlate SignNow to store completed k 40svr forms securely?

Absolutely! airSlate SignNow offers secure cloud storage for all your completed documents, including the k 40svr form. This ensures that your sensitive information remains protected and easily accessible whenever you need to reference or share it.

-

What are the benefits of eSigning the k 40svr form with airSlate SignNow?

Using airSlate SignNow for eSigning the k 40svr form allows you to expedite the signing process, reducing turnaround times signNowly. It enhances security through encryption and provides a legally binding signature, ensuring that your documents remain compliant with legal standards.

-

Is there customer support available for issues related to the k 40svr form?

Yes, airSlate SignNow offers robust customer support, including tutorials and live assistance to address any challenges you may encounter with the k 40svr form. Their team is dedicated to ensuring you maximize your experience and resolve queries promptly.

Get more for K 40SVR Property Tax Relief Claim For Seniors And

- 08302016 1 1702 in the district court of kansasjudicialcouncil form

- Real estate kansas probate notice publication form

- Rev 072016 ksjc 1 334 in the district court of county kansasjudicialcouncil form

- Juvenile cover sheet 120914 kansas judicial council kansasjudicialcouncil form

- Ks report condition ward form

- 5113 1 1741 in the district court of county kansas bb kansasjudicialcouncil form

- Revised 1013 prepared by filer s name sc filer s address filer s phone number filer s fax phone number filer s e mail address form

- Rev 072016 ksjc 1 367 in the district court of county kansasjudicialcouncil form

Find out other K 40SVR Property Tax Relief Claim For Seniors And

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy