Income Based Repayment General Information

What is the Income Based Repayment General Information

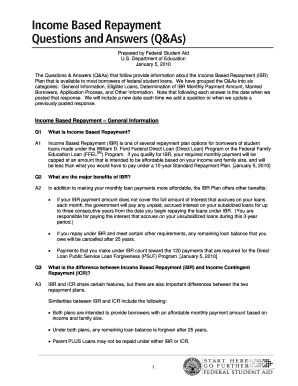

The Income Based Repayment (IBR) General Information provides essential details about a repayment plan designed to help borrowers manage their federal student loan payments based on their income and family size. This plan aims to make student loan repayment more affordable by capping monthly payments at a percentage of discretionary income. Under IBR, borrowers may qualify for forgiveness of any remaining loan balance after a specified period, typically 20 or 25 years, depending on when the loans were taken out.

Eligibility Criteria for Income Based Repayment

To qualify for the Income Based Repayment plan, borrowers must meet certain criteria. Primarily, the borrower must have a federal student loan, including Direct Loans and some Federal Family Education Loans (FFEL). The borrower's monthly payment amount is determined by their income, family size, and the total amount owed. It is important for borrowers to provide accurate income documentation, which may include recent pay stubs or tax returns, to ensure the correct payment calculation.

Steps to Complete the Income Based Repayment General Information

Completing the Income Based Repayment General Information involves several steps. First, borrowers should gather necessary documentation, such as proof of income and family size. Next, they can complete the Income Driven Repayment Plan Request form, which is available online or through their loan servicer. After submitting the form, borrowers should monitor their loan servicer's communications for confirmation and any additional requirements. It is advisable to keep copies of all submitted documents for personal records.

Required Documents for Income Based Repayment

When applying for Income Based Repayment, borrowers need to provide specific documents to support their application. These typically include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of family size, which may involve providing information about dependents.

- Loan information, including details about the types and amounts of loans held.

Having these documents ready can streamline the application process and facilitate accurate payment calculations.

Form Submission Methods for Income Based Repayment

Borrowers can submit their Income Based Repayment application through various methods. The most common options include:

- Online submission via the loan servicer's website, which is often the fastest method.

- Mailing a completed paper form to the loan servicer, ensuring it is sent to the correct address.

- In-person submission at the loan servicer's office, if applicable.

Each method has its own processing times, so borrowers should choose the one that best fits their needs.

Legal Use of the Income Based Repayment General Information

The Income Based Repayment General Information is governed by federal laws and regulations regarding student loans. Borrowers must adhere to the guidelines set forth by the U.S. Department of Education to ensure compliance. Misrepresentation of income or family size can lead to penalties, including the loss of eligibility for the IBR plan. It is crucial for borrowers to provide truthful and accurate information throughout the process.

Examples of Using the Income Based Repayment General Information

Understanding how to apply the Income Based Repayment General Information can be illustrated through various scenarios. For instance, a recent graduate with a low income may benefit significantly from this repayment plan, as their monthly payments would be reduced based on their earnings. Similarly, a borrower who has experienced a job loss may find relief through IBR, allowing them to maintain manageable payments while seeking new employment. These examples highlight the plan's flexibility and support for borrowers facing financial challenges.

Quick guide on how to complete income based repayment general information

Effortlessly Prepare [SKS] on Any Device

Online document organization has gained traction among enterprises and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary template and securely keep it online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents promptly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details thoroughly and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Income Based Repayment General Information

Create this form in 5 minutes!

How to create an eSignature for the income based repayment general information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Income Based Repayment and how does it work?

Income Based Repayment (IBR) is a federal repayment plan that helps borrowers manage their student loan payments based on their income and family size. The plan caps monthly payments at a percentage of the borrower’s discretionary income, making it more manageable compared to standard plans. For detailed Income Based Repayment General Information, borrowers can refer to federal student aid websites.

-

Who is eligible for Income Based Repayment?

Eligibility for Income Based Repayment generally includes borrowers with federal student loans who have a partial financial hardship. To qualify, your payments must be lower than what you would pay under a standard 10-year repayment plan. For comprehensive Income Based Repayment General Information, consult your loan servicer or the Federal Student Aid eligibility requirements.

-

How can I apply for Income Based Repayment?

To apply for Income Based Repayment, borrowers must fill out the Income-Driven Repayment Plan Request form, which can be completed online or submitted by mail. The application will require financial documents to determine the appropriate payment amount based on your income. For additional Income Based Repayment General Information, visit the Federal Student Aid website.

-

What are the benefits of choosing Income Based Repayment?

One of the key benefits of Income Based Repayment is that it provides financial relief by adjusting your monthly payment according to your income, which can prevent default. Additionally, any remaining balance may be forgiven after 20 or 25 years of qualifying payments. This makes understanding Income Based Repayment General Information essential for borrowers seeking an affordable repayment option.

-

How does Income Based Repayment affect my credit score?

Participating in Income Based Repayment itself does not directly affect your credit score; however, making on-time payments can positively influence your credit over time. It’s crucial to remain engaged and submit required documentation to maintain your payment plan. For thorough Income Based Repayment General Information, review your loan terms and monitor your credit report.

-

What if my income changes during the Income Based Repayment period?

If your income changes, you may submit a new application for Income Based Repayment to adjust your payment amount accordingly. This flexibility is one of the attractive features of IBR, allowing you to better align your financial obligations with your current circumstances. For further details on managing changes, consult the Income Based Repayment General Information resources available online.

-

Can I switch to a different repayment plan from Income Based Repayment?

Yes, borrowers can switch from Income Based Repayment to another repayment plan at any time, provided they meet the new plan's eligibility criteria. It’s important to consider that switching plans may change the terms of your loan and possibly your payment amount. Be sure to gather all necessary Income Based Repayment General Information before making a decision.

Get more for Income Based Repayment General Information

Find out other Income Based Repayment General Information

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract