ST 809 Tax Ny Form

What is the ST 809 Tax Ny

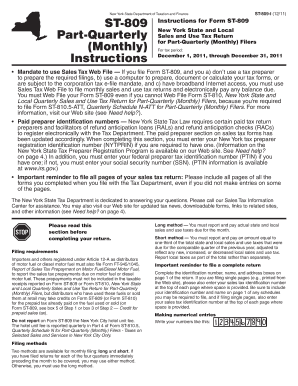

The ST 809 Tax Ny is a specific tax form used in New York State for the purpose of claiming a sales tax exemption. This form is primarily utilized by organizations and individuals who qualify for sales tax exemptions under certain circumstances, such as non-profit organizations, government entities, or specific types of purchases. Understanding the purpose and requirements of the ST 809 is essential for ensuring compliance with New York tax regulations.

How to use the ST 809 Tax Ny

Using the ST 809 Tax Ny involves several steps. First, individuals or organizations must determine their eligibility for a sales tax exemption. Once eligibility is established, the form should be filled out accurately, providing all necessary information, including the purchaser's details and the nature of the exemption. After completing the form, it must be presented to the seller at the time of purchase to ensure that sales tax is not charged. It is important to keep a copy of the form for record-keeping purposes.

Steps to complete the ST 809 Tax Ny

Completing the ST 809 Tax Ny requires careful attention to detail. Follow these steps:

- Gather necessary information, including the purchaser's name, address, and tax identification number.

- Identify the specific exemption category that applies to your situation.

- Fill out the form, ensuring all fields are completed accurately.

- Sign and date the form to certify its accuracy.

- Provide the completed form to the seller at the time of the transaction.

Legal use of the ST 809 Tax Ny

The ST 809 Tax Ny must be used in accordance with New York State tax laws. Only eligible purchasers may claim exemptions, and misuse of the form can lead to penalties. It is essential to understand the legal implications of using this form, including the requirement to maintain accurate records and the obligation to provide truthful information. Compliance with state regulations helps avoid potential audits or legal issues.

Filing Deadlines / Important Dates

While the ST 809 Tax Ny is primarily used at the point of sale, it is important to be aware of any relevant deadlines for filing related tax documents. Keeping track of these dates ensures that all tax obligations are met in a timely manner. For instance, organizations may need to file annual reports or renew their exemption status periodically, depending on their specific circumstances.

Required Documents

When using the ST 809 Tax Ny, certain documents may be required to support the exemption claim. These may include:

- Proof of the purchaser's tax-exempt status, such as a determination letter from the IRS for non-profit organizations.

- Documentation that details the nature of the purchase and how it qualifies for exemption.

- Any additional forms or identification numbers as requested by the seller.

Who Issues the Form

The ST 809 Tax Ny is issued by the New York State Department of Taxation and Finance. This agency is responsible for providing guidance on tax-related matters and ensuring compliance with state tax laws. For any questions or clarifications regarding the form, individuals can refer to the resources provided by this department.

Quick guide on how to complete st 809 tax ny

Effortlessly prepare [SKS] on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ST 809 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the st 809 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 809 Tax Ny form?

The ST 809 Tax Ny form is a document used in New York for sales tax exemption. It allows eligible organizations to make tax-exempt purchases. Understanding this form is essential for businesses looking to streamline their tax processes and comply with state regulations.

-

How can airSlate SignNow help me with ST 809 Tax Ny documentation?

airSlate SignNow simplifies the process of signing and managing ST 809 Tax Ny forms electronically. With our easy-to-use platform, you can quickly send, receive, and eSign documents while ensuring compliance and security. This improves your efficiency and helps you manage tax documents effectively.

-

Is there a cost associated with using airSlate SignNow for ST 809 Tax Ny?

airSlate SignNow offers competitive pricing for all its features, including those specific to ST 809 Tax Ny forms. You can choose from various plans that fit your business size and needs. This cost-effective solution enables you to manage your tax documents without breaking the bank.

-

What features does airSlate SignNow offer for managing ST 809 Tax Ny forms?

Our platform offers features like customizable templates, real-time tracking, and secure document storage specifically for the ST 809 Tax Ny form. Additionally, you can easily integrate with other business tools, enhancing your document workflow. These features make tax management seamless and efficient.

-

What are the benefits of using airSlate SignNow for ST 809 Tax Ny handling?

Using airSlate SignNow for ST 809 Tax Ny forms offers a range of benefits, including enhanced security, faster turnaround times, and increased productivity. By digitizing your documentation process, you reduce the risk of errors and ensure compliance with state tax regulations. This ultimately saves you time and money.

-

Can I integrate airSlate SignNow with other software for my ST 809 Tax Ny forms?

Yes, airSlate SignNow seamlessly integrates with various business applications to streamline your workflow for ST 809 Tax Ny forms. You can connect with tools like CRM systems, cloud storage, and productivity suites. These integrations help ensure that your document management processes are efficient and connected.

-

How does airSlate SignNow enhance the signing process for ST 809 Tax Ny documents?

airSlate SignNow enhances the signing process for ST 809 Tax Ny documents by providing a user-friendly interface for all parties involved. You can send documents for eSignature with just a few clicks, and signers can complete the process on any device. This convenience leads to quicker approvals and improved compliance.

Get more for ST 809 Tax Ny

Find out other ST 809 Tax Ny

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed