Form it 150 XAmended Resident Income Tax Returnshort Tax Ny

What is the Form IT 150 XAmended Resident Income Tax Return

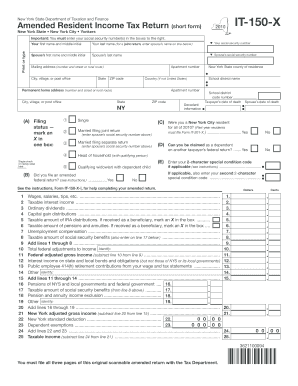

The Form IT 150 XAmended Resident Income Tax Return is a tax form used by residents of New York State to amend their previously filed income tax returns. This form allows taxpayers to correct errors or make changes to their original submissions, ensuring that their tax filings are accurate and up to date. It is essential for residents who need to report additional income, claim missed deductions, or correct filing status. By using this form, individuals can ensure compliance with state tax laws and avoid potential penalties.

How to use the Form IT 150 XAmended Resident Income Tax Return

Using the Form IT 150 XAmended Resident Income Tax Return involves several steps. First, gather all necessary documentation, including your original tax return and any supporting documents for the changes you wish to make. Next, fill out the form with accurate information, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submitting. It is important to retain a copy of the amended return and any accompanying documents for your records.

Steps to complete the Form IT 150 XAmended Resident Income Tax Return

To complete the Form IT 150 XAmended Resident Income Tax Return, follow these steps:

- Obtain the form from the New York State Department of Taxation and Finance website or a local tax office.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details about the original return.

- Clearly state the changes you are making, including any additional income or deductions.

- Calculate your new tax liability based on the amended information.

- Sign and date the form before submission.

Required Documents

When filing the Form IT 150 XAmended Resident Income Tax Return, it is important to include certain documents to support your amendments. These may include:

- A copy of the original tax return being amended.

- Any relevant documents that substantiate the changes, such as W-2 forms, 1099s, or receipts for deductions.

- Proof of payment for any additional taxes owed, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 150 XAmended Resident Income Tax Return align with New York State tax regulations. Generally, amended returns must be filed within three years of the original filing date or within two years of the date the tax was paid, whichever is later. It is important to stay informed about any changes to deadlines to avoid penalties and ensure timely processing of your amendments.

Penalties for Non-Compliance

Failure to file the Form IT 150 XAmended Resident Income Tax Return when required can lead to penalties imposed by the New York State Department of Taxation and Finance. These penalties may include fines for late filings, interest on unpaid taxes, and potential legal action for significant discrepancies. It is crucial to address any necessary amendments promptly to avoid these consequences.

Quick guide on how to complete form it 150 xamended resident income tax returnshort tax ny

Prepare [SKS] effortlessly on any device

Digital document management has become widely embraced by companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The simplest method to modify and eSign [SKS] without difficulty

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, daunting form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 150 xamended resident income tax returnshort tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny?

The Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny is a state tax form used by New York residents to amend their previously filed income tax returns. It allows taxpayers to correct errors or update information. Using airSlate SignNow simplifies the eSignature process for this form, ensuring it is completed quickly and accurately.

-

How can I use airSlate SignNow to file my Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny?

You can easily upload your Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny to airSlate SignNow and send it for electronic signatures. The platform’s intuitive interface guides you through each step, allowing you to adjust, share, and send the form with ease. Once finalized, you can submit it directly to the New York tax authorities.

-

Is airSlate SignNow a cost-effective solution for filing tax forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your tax documents, including the Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny. With flexible pricing plans and efficient features, you save time and money on document processing, making it an ideal choice for both individuals and businesses.

-

What features does airSlate SignNow provide for tax filings?

airSlate SignNow provides essential features like document upload, eSignature capabilities, and secure sharing options for tax forms such as Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny. Additionally, it includes tracking options to monitor the status of your documents and reminders for important deadlines.

-

Can I integrate airSlate SignNow with other applications while filing Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including cloud storage and accounting software. This allows you to easily access and manage your Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny alongside other important documents, enhancing your overall workflow and productivity.

-

What benefits does using airSlate SignNow provide for filing tax forms?

Using airSlate SignNow for filing tax forms like Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny enhances efficiency, accuracy, and security. The platform ensures that your sensitive information is protected while providing a straightforward process for obtaining signatures. This leads to faster turnaround times and fewer errors in your tax filings.

-

How does airSlate SignNow ensure the security of my personal tax information?

airSlate SignNow employs industry-standard encryption and secure servers to protect your personal tax information while using the platform. When filing your Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny, you can trust that all documents and data are handled with the utmost security and confidentiality, minimizing any risk of data bsignNowes.

Get more for Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny

Find out other Form IT 150 XAmended Resident Income Tax Returnshort Tax Ny

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word